Article Text

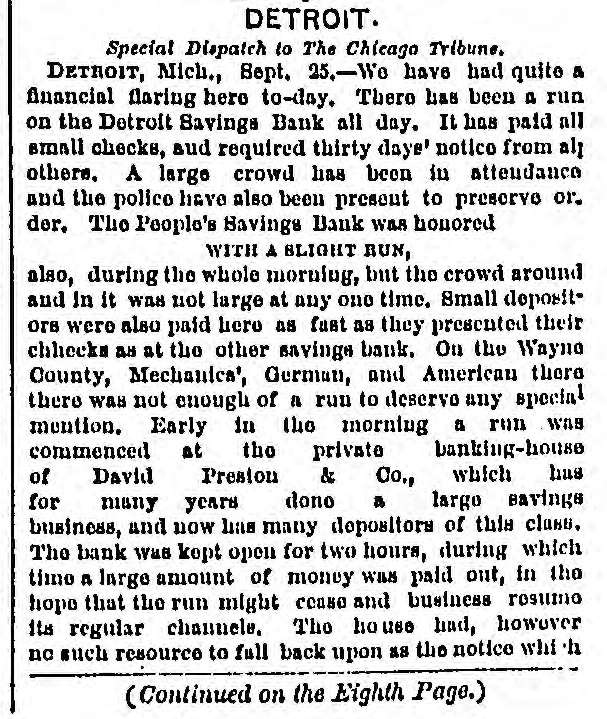

DETROIT. Special Dispatch to The Chicago Tribune. DETROIT, Mich., Sept. 25.-We have had quite & financial flaring here to-day. There has been a run on the Detroit Savings Bank all day. It has paid all small checks, aud required thirty daye' notico from all others. A large crowd has been in atteudance and the polico have also been present to preserve or. der. The People's Savings Bank was honored WITH A BLIGHT RUN, also, during the whole morning, but the crowd around and In it was not large at any one time. Small depositore were also paid here as fast as they presented their checks as at the other savings bank. On the Wayne County, Mechanica', German, and American there there was not enough of a run to deserve any special mention. Early in the morning a run was commenced at the private banking-house of David Preston & Co., which has for many years dono a largo savings business, and now has many depositors of this class. The bank was kept open for two hours, during which timo a large amount of money was paid out, in the hope that the run might cease and business resumo its regular channels. The ho use had, howover no such resource to full back upon as the notice whi h (Continued on the Eighth Page.)