Click image to open full size in new tab

Article Text

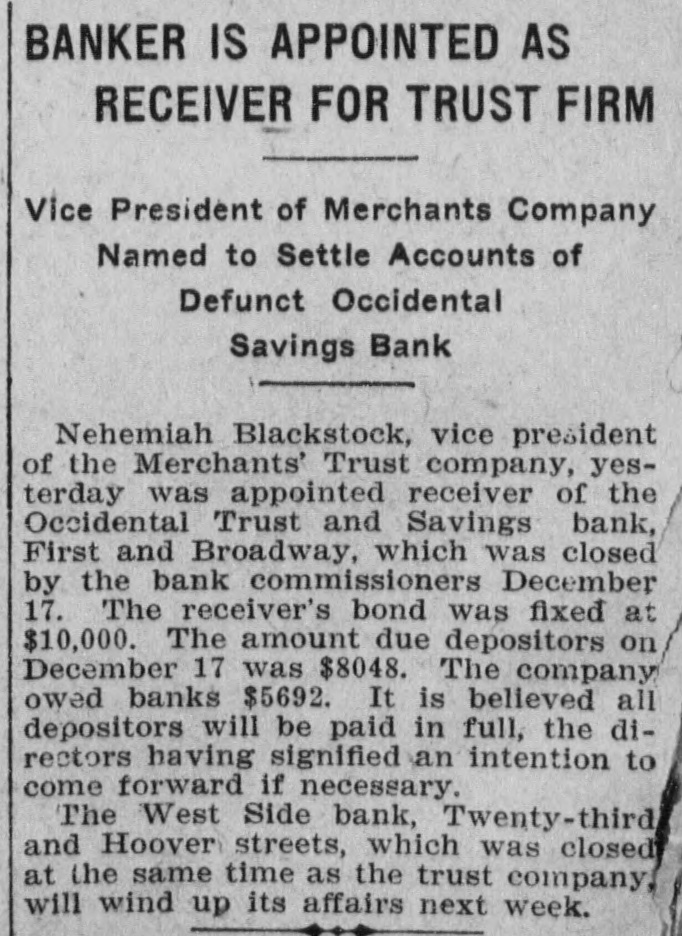

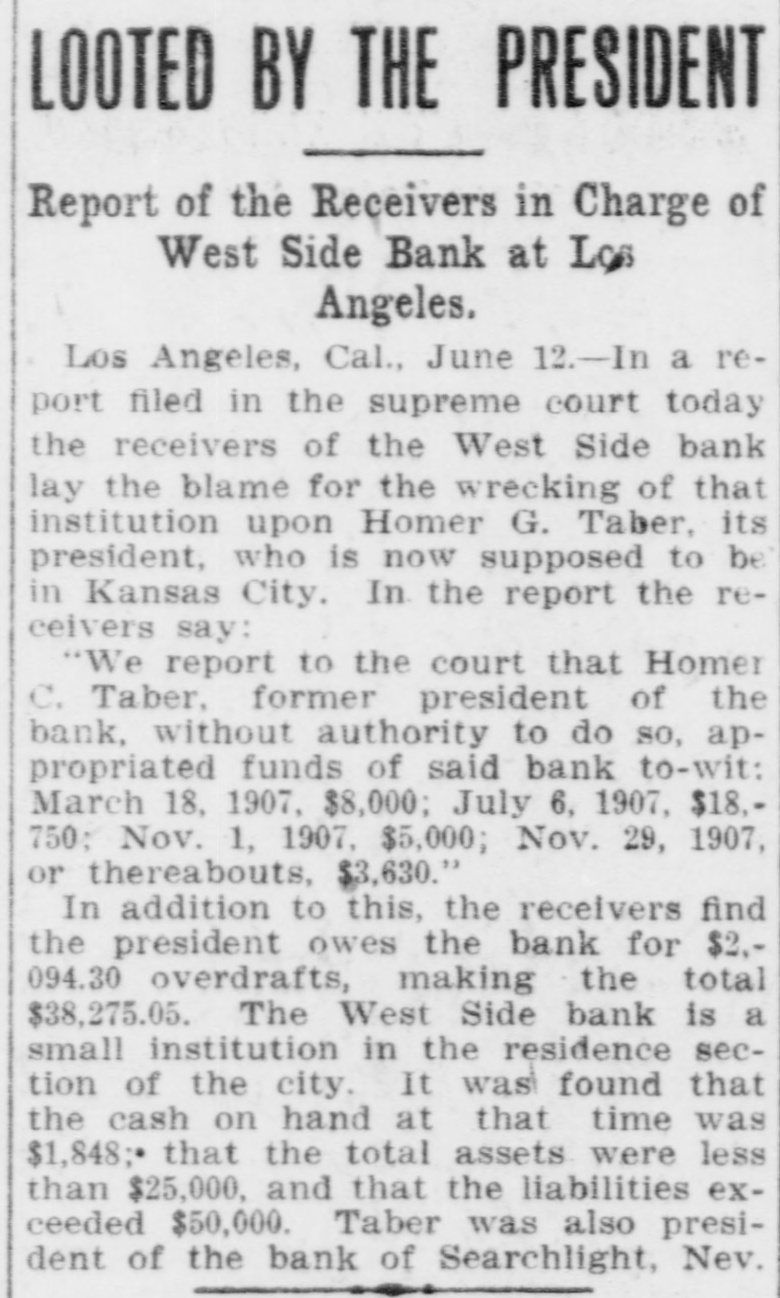

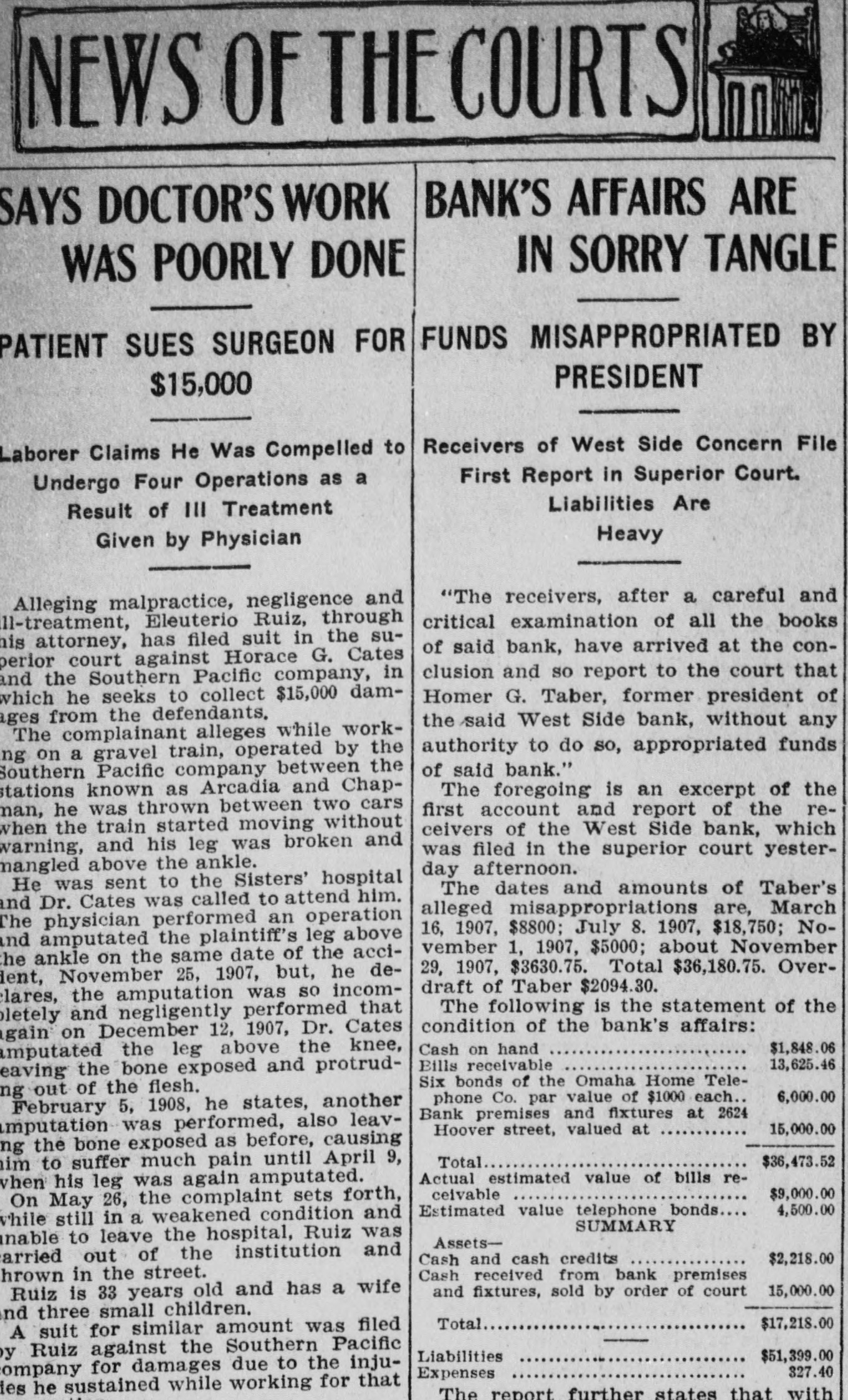

NEWS OF THE COURTS BANK'S AFFAIRS ARE SAYS DOCTOR'S WORK IN SORRY TANGLE WAS POORLY DONE FUNDS MISAPPROPRIATED BY PATIENT SUES SURGEON FOR PRESIDENT $15,000 Receivers of West Side Concern File Laborer Claims He Was Compelled to First Report in Superior Court. Undergo Four Operations as a Liabilities Are Result of III Treatment Heavy Given by Physician "The receivers, after a careful and Alleging malpractice, negligence and critical examination of all the books ll-treatment, Eleuterio Ruiz, through attorney, has filed suit in the suof said bank, have arrived at the conperior court against Horace G. Cates clusion and so report to the court that and the Southern Pacific company, in which he seeks to collect $15,000 damHomer G. Taber, former president of ages from the defendants. the said West Side bank, without any The complainant alleges while workauthority to do so, appropriated funds on a gravel train, operated by the of said bank." Southern Pacific company between the stations known as Arcadia and ChapThe foregoing is an excerpt of the first account and report of the renan, he was thrown between two cars when the train started moving without ceivers of the West Side bank, which warning, and his leg was broken and was filed in the superior court yestermangled above the ankle. day afternoon. He was sent to the Sisters' hospital The dates and amounts of Taber's nd Dr. Cates was called to attend him. alleged misappropriations are, March The physician performed an operation 16, 1907, $8800; July 8. 1907, $18,750; Nond amputated the plaintiff's leg above vember 1, 1907, $5000; about November he ankle on the same date of the acci29, 1907, $3630.75. Total $36,180.75. Overlent, November 25, 1907, but, he dedraft of Taber $2094.30. lares, the amputation was SO incomThe following is the statement of the letely and negligently performed that condition of the bank's affairs: gain on December 12, 1907, Dr. Cates Cash on hand $1,848.06 imputated the leg above the knee, 13,625.46 Bills receivable eaving the bone exposed and protrudSix bonds of the Omaha Home Teleout of the flesh. 6,000.00 phone Co. par value of $1000 each February 5, 1908, he states, another Bank premises and fixtures at 2624 imputation was performed, also leav15,000.00 Hoover street, valued at the bone exposed as before, causing Total $36,473.52 to suffer much pain until April 9, Actual estimated value of bills revhen his leg was again amputated. ceivable $9,000.00 On May 26, the complaint sets forth, 4,500.00 Estimated value telephone bonds while still in a weakened condition and SUMMARY nable to leave the hospital, Ruiz was Assetsarried out of the institution and Cash and cash credits $2,218.00 Cash received from bank premises hrown in the street. 15,000.00 and fixtures, sold by order of court Ruiz is 33 years old and has a wife nd three small children. Total $17,218.00 A suit for similar amount was filed Ruiz against the Southern Pacific Liabilities $51,399.00 327.40 ompany for damages due to the injuExpenses he sustained while working for that The report further states that with