Article Text

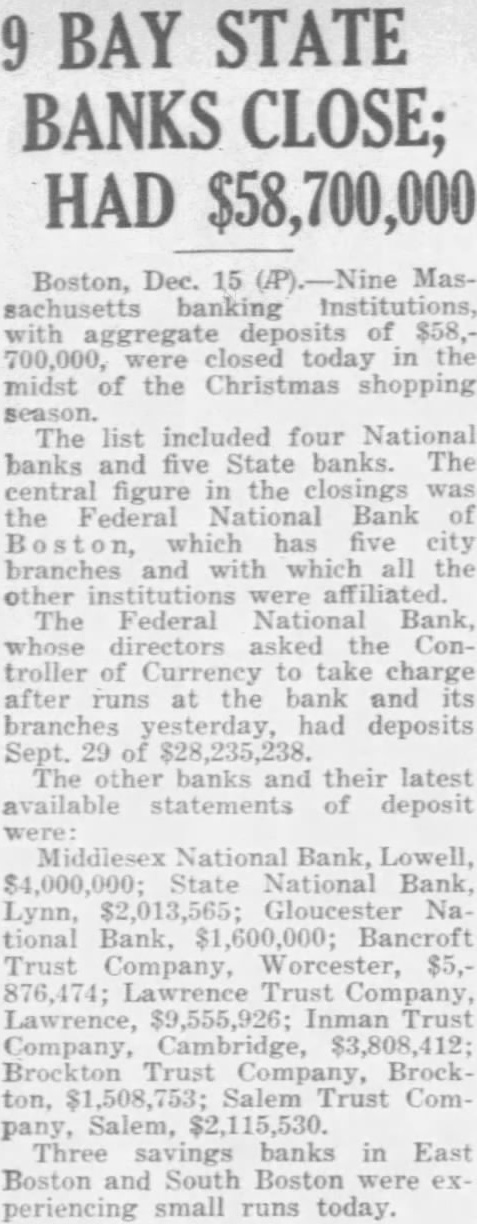

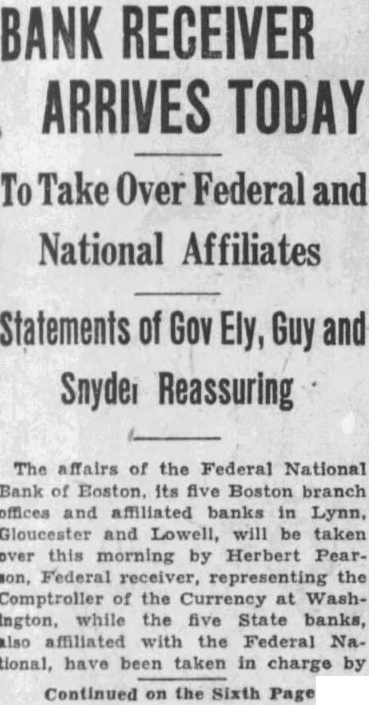

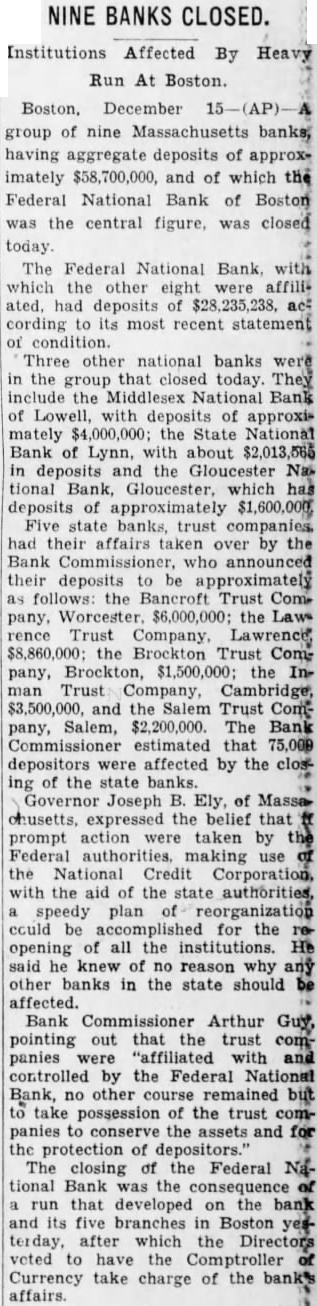

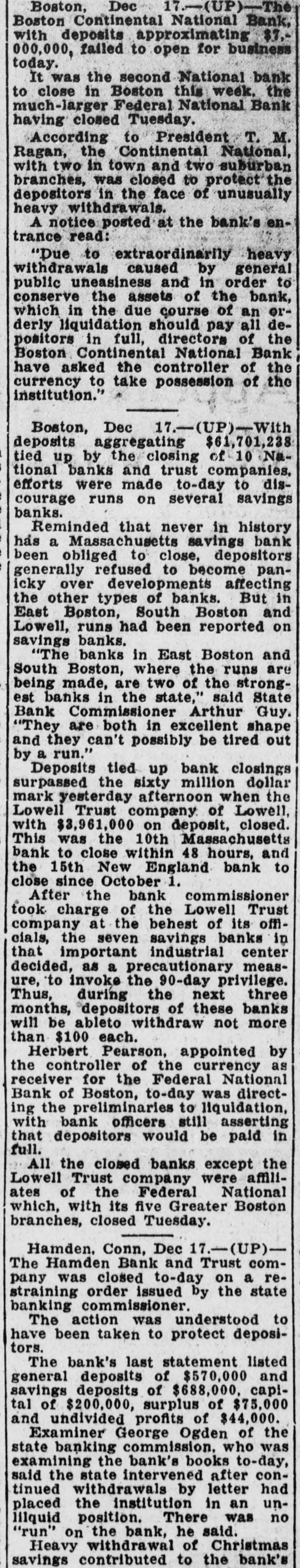

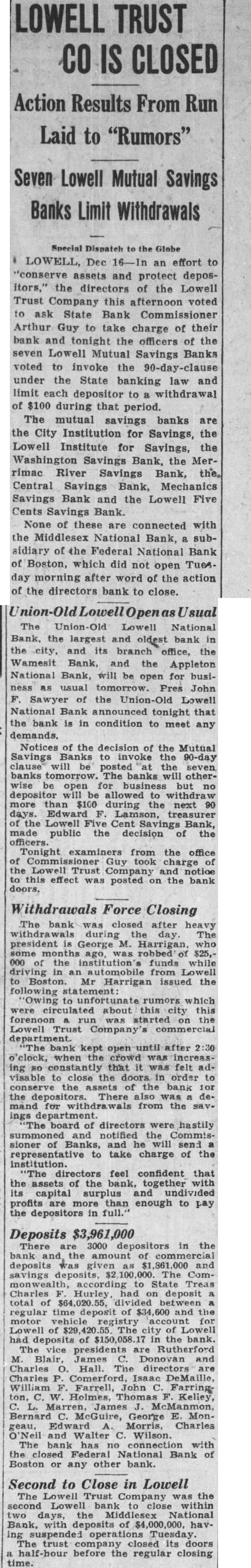

NATIONAL BOSTON AND AFFILIATES Aggregate Deposits of ConAffected cerns 000, According to Their Latest Statements. By the Associated Press.. BOSTON, Dec. Massachusetts banking houses with aggregate deposits of cording to their latest statements, were closed today. The list includes four National banks and five State banks. The central figure the Federal National Bank of which has five city branches and with which all the the other banks closed were affiliated. The Federal National Bank, whose directors voted to ask thhe Comptroller of Currency to take charge after runs at the bank and its branches yesterday, had deposits, Sept. 29, of $28,235,238. The other banks and their latest available statements of deposits follow: Middlesex National Bank, Lowell, State National Bank, Lynn, $2,013,565; Gloucester National Bank, Bancroft Trust Co., Worcester, $5,876,474; Lawrence Trust Co., Lawrence, Inman Trust Co., Cambridge, $3,Brockton Trust Co., Brockton, Salem Trust Co., Salem. $2,115,530. Gov. Ely, in statement, said that with proper measures, plan for the speedy reopening of the institutions could be arranged and further said had instructed Bank Commissioner Arthur Guy to proceed with that end in view. Three savings banks in East Boston and South Boston experienced small runs today. They are independent of the group affected by today's closings and officers sought to assure depositors that their funds were President Daniel Mulloney of the Federal National Bank expressed the opinion that with careful handling of resources. depositors in his bank would receive 100 cents the dollar. The Federal National member of the Boston Clearing House. It held State deposits of $729,889. National Bank at Marion, O., Closed: Ex-Cashier Missing. By the Associated Dec. B. Hane, president of the Marion National Bank, said apparent irregularities in the accounts of his son, H. W. Hane, former cashier, caused the closing of the bank today. The elder Hane issued statement that the directors had placed the bank in the hands of the Federal Comptroller of Currency and that national bank examiners were checking the records. nature and the amount of the apparent defalcations have not been determined.' the stateHane, cashier, in whose accounts the confusion in records has been found, resigned an officer of the bank last week. He left the city at that time and his not now known. The bank's deposits are listed