Article Text

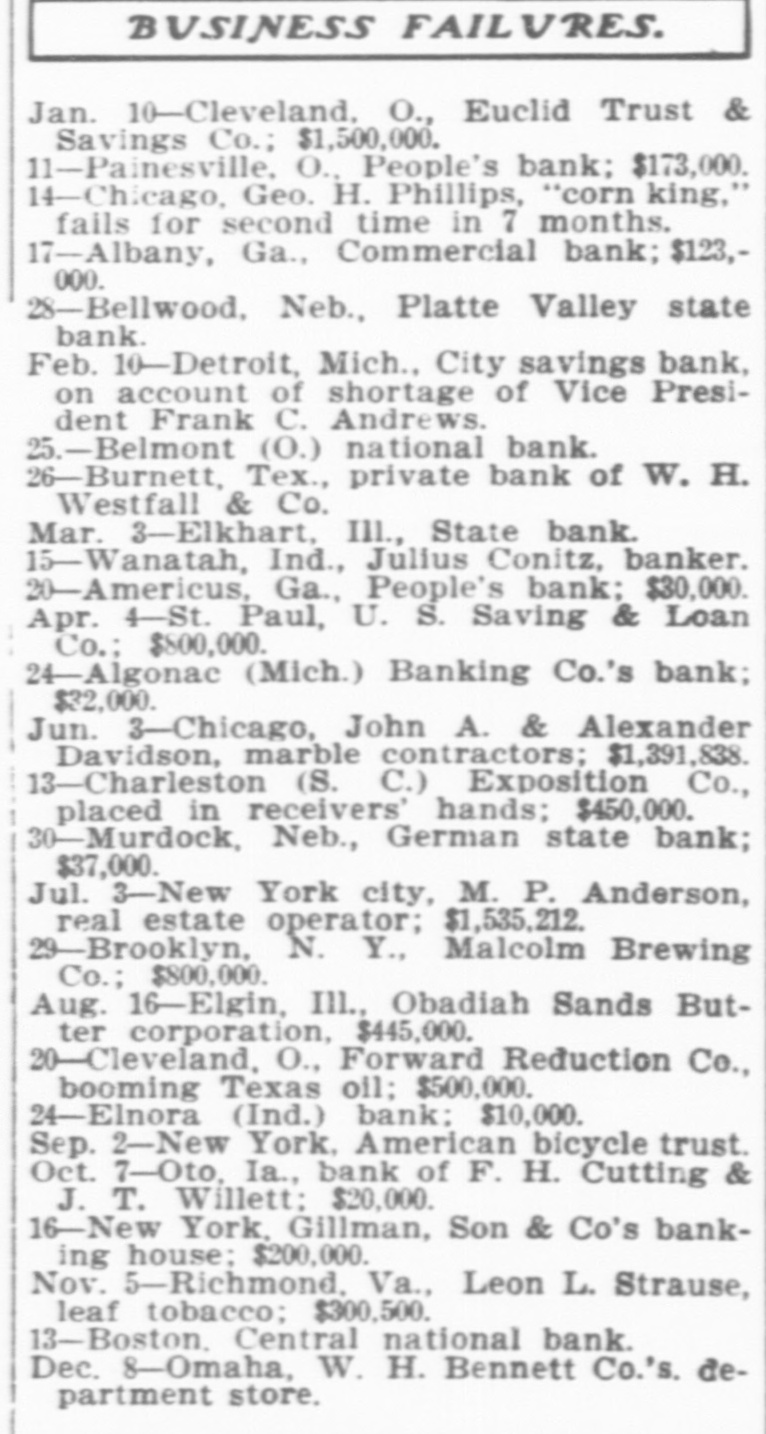

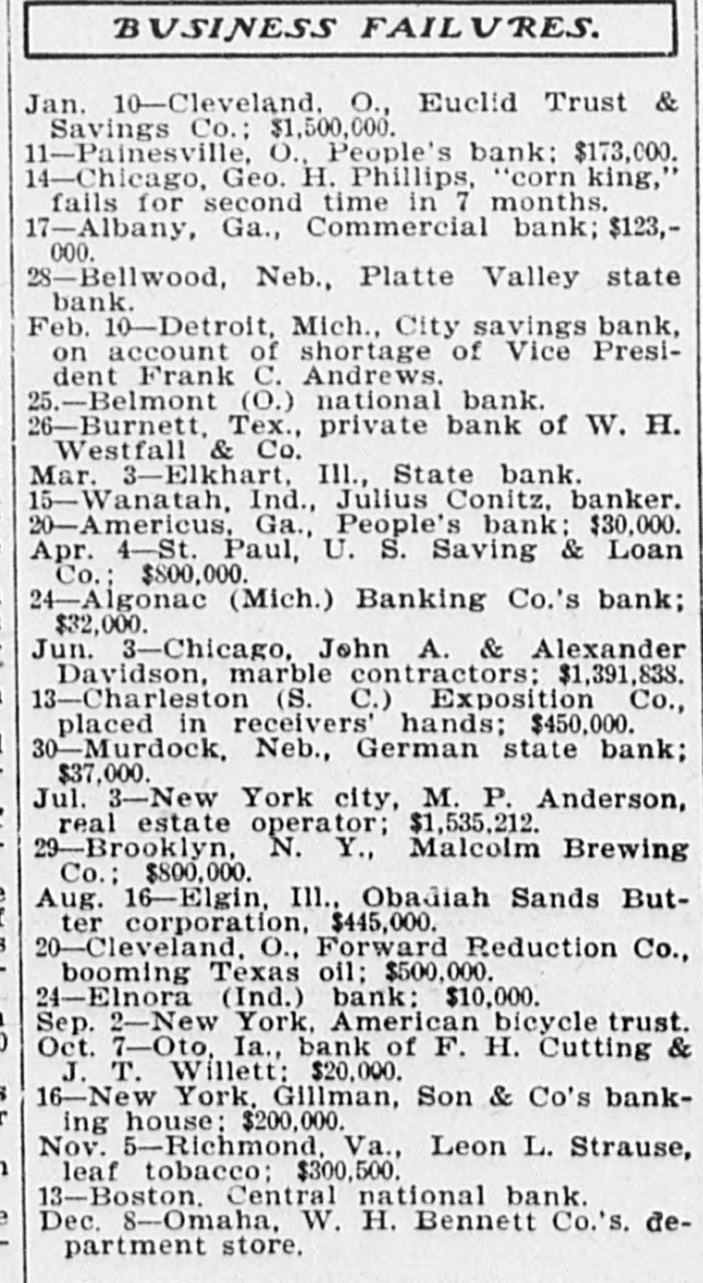

TUESDAY, Nov. 4, 1902. William T. Nelson of New York commits suicide; act caused by worry over friend's arrest. Coal arbitrators visit mines in the Hazleton region. "Jim Crow" car law goes into operation in New Orleans. Treasurer Roberts' annual report shows greatest cash balance in history of the country. Colombian government will renew negotiation of a canal treaty. Little Haverhill girl, supposed to have been abducted, claims to have been lost in Lawrence. Body of Ernest C. Mansfield, the Harvard student, found in Charles river. Alaskan natives dying by thousands from measles. Directors of Central national bank of Boston vote to wind up its business. S. T. Coy, a prominent paper manufacturer of Bellows' Falls, dead. Five hundred silversmiths go on strike in New York. Laura Biggar gives herself up to authorities at Freehold, N.J. Lebaudy brothers' new airship makes successful trial trip near Moisson, France. Dismissal of Grand Duke Paul Alexandrovitch from Russian army due to his marriage to Baroness Pistolkoff. Pennsylvania railroad promises 90minute runs between New York and Philadelphia. Wife of a New York real estate man, who is suing for divorce, charged with stealing husband's papers. Eleven Cuban children, destined for a Buddhist school in California, detained by immigration authorities in New York. Crown Prince of Siam arrives at Niagara Falls. Joseph Cloud was arrested at Brunswick, Me., charged with assaulting Mrs. John Griffin. He confessed. The aldermen of Fall River last night gave the Dartmouth and Westport Street Railway company the right to carry freight. Henry Brittin was held in $500 in Lewiston charged with the larceny of three barrels of whiskey and one barrel of brandy. While lighting the gas in a store window in Lowell the clothing of Miss Helen Priestly caught fire and she was probably fatally burned. The city council of Portland has passed a resolution favoring an abolishment of the lower branch and an increase of aldermen to three from each ward. The wholesale grocery firms of Chicago will have none of George B. Hanford's $500,000,000 grocery trust, for the formation of which a convention is called to meet in Detroit. John Hannan, the millionaire shoe manufacturer of New York, had a narrow escape from drowning at Narragansett Pier. As he was boarding a sailboat at the south pier dock he slipped and fell into the water. Although he was rescued at once, Mr. Hannan was speechless when taken aboard the boat. A 16-year-old hunter, David Fuller, was shot and instantly killed at Asqwith, Me., by Arthur Bagley. who fired into a clump of alders which were being shaken as if by a moving animal. Mark Fuller, his son, David, and Arthur Bagley of Henderson were hunting together. The stock of . O. Toby's store was extensively damaged by fire at Machiasport, Me. It was believed Mr. Toby sought death by burning with his property. Mr. Toby's store books were found outside the building, wrapped up and covered with his overcoat. Nothing else had been removed. He was not seen after leaving his home.