Article Text

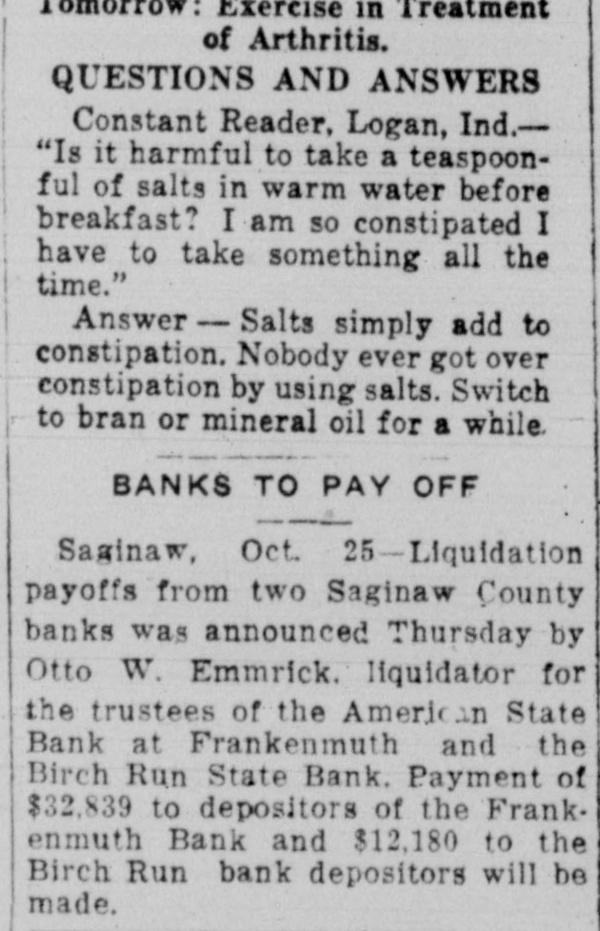

Exercise in Treatment of Arthritis. QUESTIONS AND ANSWERS Constant Reader, Logan, Ind."Is it harmful to take a teaspoonful of salts in warm water before breakfast? I am so constipated I have to take something all the time." Answer - - Salts simply add to constipation. Nobody ever got over constipation by using salts. Switch to bran or mineral oil for a while. BANKS TO PAY OFF Saginaw, Oct. 25-Liquidation payoffs from two Saginaw County banks was announced Thursday by Otto W. Emmrick. liquidator for the trustees of the American State Bank at Frankenmuth and the Birch Run State Bank. Payment of $32,839 to depositors of the Frankenmuth Bank and $12,180 to the Birch Run bank depositors will be made.