Article Text

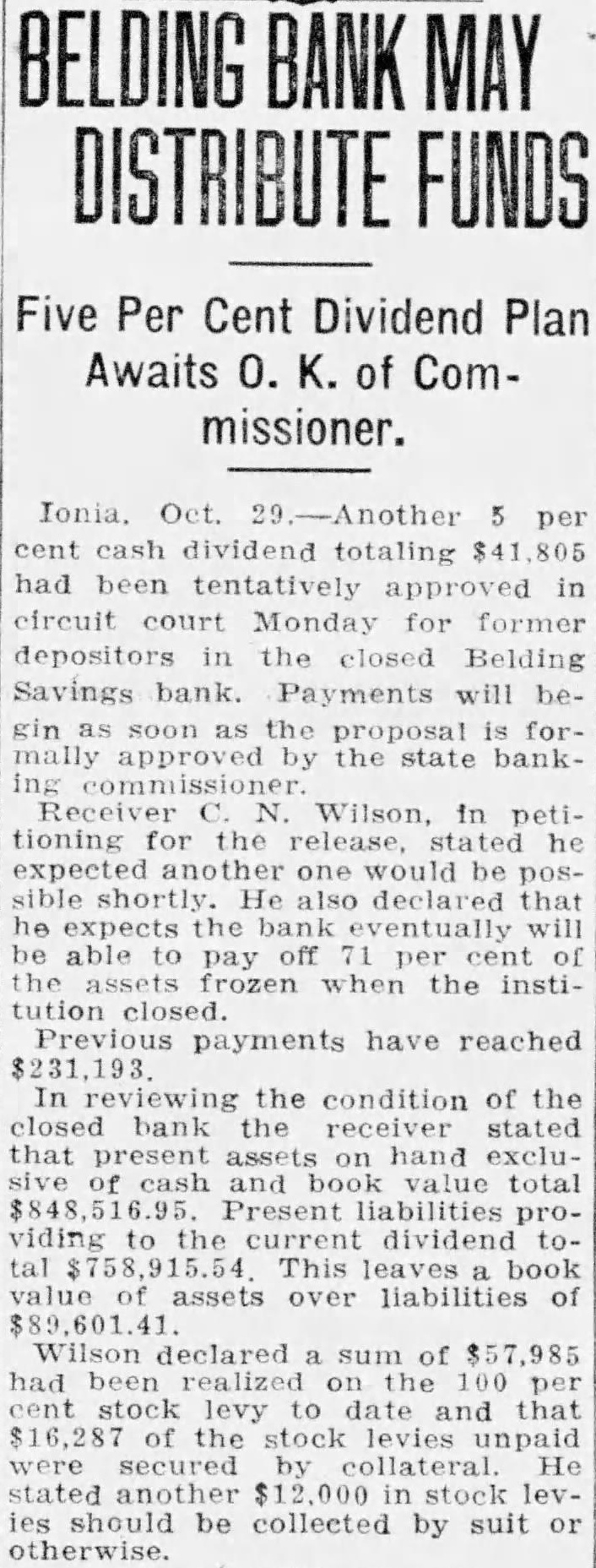

BELDING BANK DISTRIBUTE FUNDS Five Per Cent Dividend Plan Awaits 0. K. of Commissioner. Ionia. Oct. dividend 805 had been tentatively approved in circuit court Monday for former depositors closed Belding Savings bank. Payments will besoon the proposal formally approved the state bankWilson, in petitioning for the he be also that he expects the will able pay off assets frozen when the instipayments have reached In the condition of the closed bank stated that present hand excluof cash and book value Present tal This value assets liabilities of Wilson declared sum of had been realized the 100 levy and the were collateral stated stock levies should be collected by suit or otherwise.