Article Text

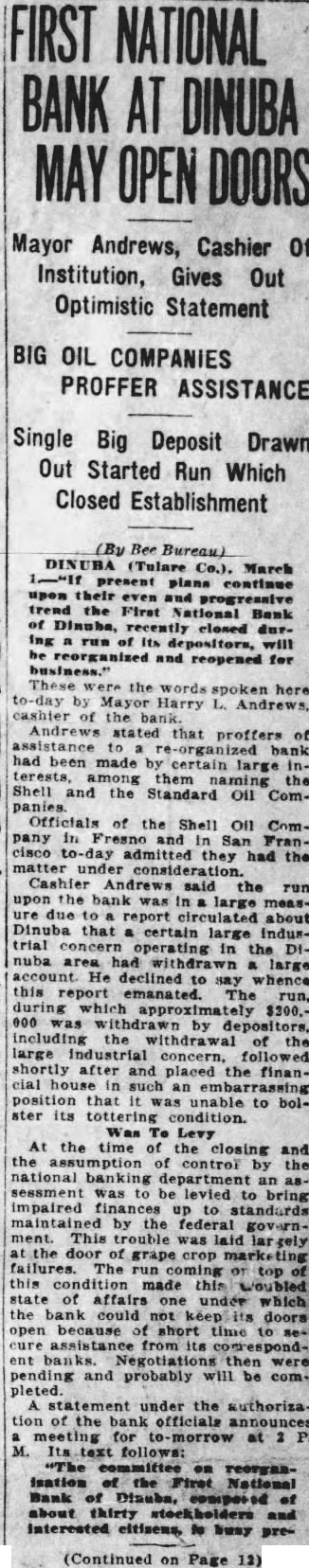

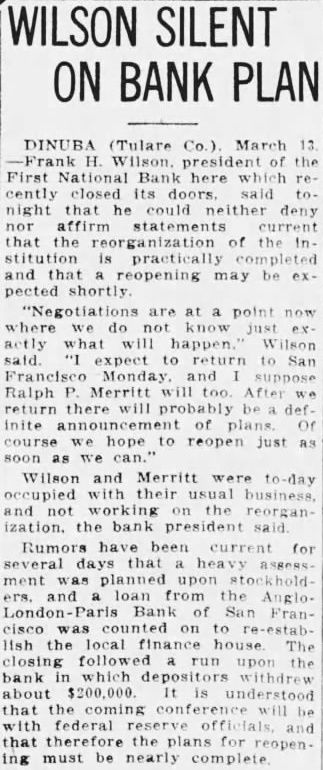

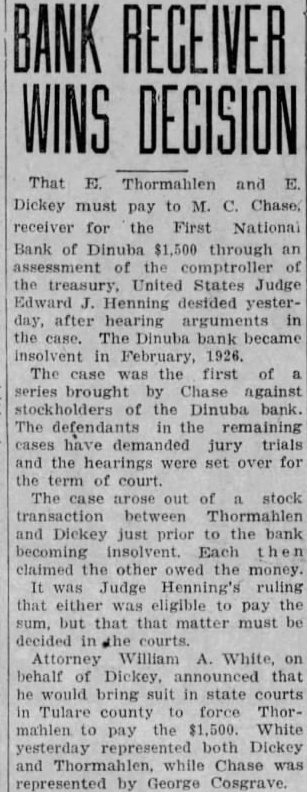

Bond Notes NEW YORK, Feb. (INS) A nationwide syndicate headed by Blair and Company of New York, BANK FAILURE today offered an issue of $40,000,000 Dominion of Canada ten-year 4½ per cent gold bonds, due Feb. 1, 1936, at 98% and Interest. This is The First National Bank at part of a $105,000,000 refunding op- Dinuba, Tulare county closed yeseration by the Dominion. terday and national bank * * aminer was placed in charge. Failure of the bank involves 167 The new issue of $4,000,000 City stockholders. It was capitalized of City, and 4% per cent for $200,000 and held deposits. bonds, dated Feb. 1, 1926, and due chiefly of farmers in the surroundAugust 1929, was offered by the ing country, of $750,000. First National Bank' of New York John E. Calkins. Governor of the and associates. The per cent Federal Reserve Bank, stated yesbonds are offered at 100 and interterday that the Federal Reserve est and the 4% per cent, bonds at Bank was in no way connected prices to yield 4.05 per cent. with or responsible for the failure. * Governor Calkins statement was Offering of $1,500,000 Seattle elicited by a statement made by Lighting Company 6 per cent sinkI. H. Newman, director of the First ing fund gold debenture bonds, due National at Dinuba, that its failure Feb. 1936, was made by A. was due in part to the refusal of Leach and Co. at 98 and accrued the Federal Reserve Bank to extend credit until next fall when * * Spitzer, Rorick and Co. distributed an issue of $50,000 City of Wauchula. Fla., 6 per cent improvement bonds. Harris, Forbes and Company in behalf of the syndicate which of. fered $15,000,000 German consolidated municipal per cent bonds announced that the issue has been oversubscribed and the books closed. Negotiations for $20,000,000 American loan to the Italian Public Utility Credit Institute have been completed. according to reports from the financial district today. Public offering of the bonds is expected to made later in the