Article Text

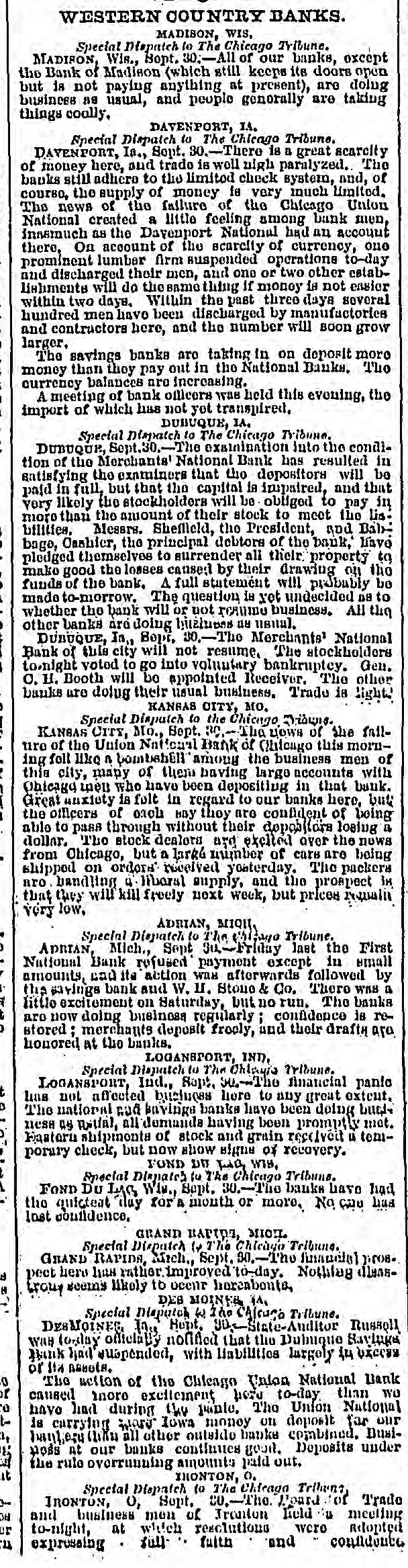

WESTERN COUNTRY BANKS. MADISON, WIS, Special Dispatch to The Chicago Tyliume. MADISON, Wis., Bopt. 30.-All of our banks, except the Bank of Madison (which still keeps its doors open but is not paying anything at present), are doing business as usual, and people genorally are taking things coally. DAVENPORT, IA. Special Dispatch to The Chicago Tribune. DAYENPORT, Ia., Sept. 30.-There is a great scarcity of money here, and trade is well nigh paralyzed. The banks still adhere to the limited check system, and, of courso, the supply of money la very much limited. The news of the failure of the Chicago Union National created a little feeling among bank men, innsmuch as the Dayenport National had an account there, On account of the scarcity of currency, our prominent lumber firm suspended operations to-day and discharged their men, and one or two other establiabments will do thesamo thing If money is not ensier within two days. Within the past three days several hundred men have been discharged by manufactories and contractors here, and the number will soon grow larger. The savings banks are taking in on deposit more money than they pay out in the National Banks. Tho currency balances are increasing. A meeting of bank officers was held this evening, the import of which has not yet transpired, DUBUQUE, IA, Special Dispatch to The Chicago Tribune. DUBUQUE, Sept.30.-The examination into the condition of the Merchants' National Bank has resulted in antisfying the examiners that the depositors will be paid in full, but that the capital in impaired, and that very likely the stockholders will be obliged to pay in more than the amount of their stock to meet the lis bilities. Messrs. Shefiield, the President, and Bab bage, Cashier, the principal debtors of the bank, Have pledged themselves to surrender all their property to make good the losses caused by their drawing on the funds of the bank. A full statement will probably be made to-morrow. The question is yet undecided as to whether the bank will or not require business. All the other banks ard doing bitéluens au usual. DUBUQUE, In, Bopt. 30,-The Merchante' National Bank of this city will not resume. The stockholders tonight voted to go into voluntary bankruptcy. Gen. O. 11. Booth will be appointed Receiver. The other banks are dolug their usual business. Trade is light KANGAS CITY, MO. Special Dispatch to the Chicago Discuss KANGAS CITY, Mo., Sept. 30. The LIOWS of the failuro of the Union National Bank of Chiloago this morning foll like n bombsbill among the business men of this city, many of them having largo accounts with Obleage tpen who have been depositing in that bank. Great unxiety is fult in regard to our banks here, but the officers of each bay they are confident of being able to pass through without their depositors loaing a dollar. The stock dealora are exclted over the nows from Chicago, but a larké number of care are being shipped on orders received yeaterday. The packers aro handling 4 liberal supply, and the prospect is that they will kill freely next week, but prices requality very low, ADRIAN, MIQII Special Dispatch to The Village Tribune. ADRIAN, Mich., Sept 31.-Friday last the First National Bank refused payment except in email amounts, and its action was afterwards followed by the savings bank and W. II. Stone & Co. There was a little excitement on Saturday, but no run. The bauka are now doing business regularly confidence is restored: merchants deposit freely, and their drafth ara honored at the banks. LOGANSTORT, IND, Special Dispatcle to The Ohlayia Iribune. LOGANSPORT, Ind., Rept. 344-The financial panic line not affected biletures here to any great extent, The national cod bavinge banks have been doing bud. HESH as Instal, all demanda having been promptly met. Fastorn shipments of stock and grain recover 11 temporary check, but now show signe or recovery. FOND DW HA WIB, Special Dispatch to The Chicago Tribuns. FOND Du LAB Wis., Sept. 30.-The banks have had the quicteat day for A month or more, No cau has lost confidence, GRAND HAPTON, MOIL Special Disputch (+ The Chicago Tribuns. GRAND RAPIDA, Mich., Sept. 30.-The financial 1:008 pect here lum rather improved 10-day. Nothing dianstrous seems likely to occur hereaboute, DEB MOINE& IA, Special Dispatch The Chicago Trilune. DESMOINES, In. Hept. JUL-State-Auditor Russell WITH today officially notified that the Dubuque Bayluga Bank had suspended, with liabilities largely 14 or 11a Assets. The action of the Chicago Union National Bank caused Inoro excitement have to-day than we have had during the plante. The Union National is carrying WAN Iowa money on deposit far our banle (11/11) all other outside banks combined. Dusinots at our banks continues good. Deposits under the rule overrunning amounts paid out. INONTON, o. Special Dispatch (o The Clienga Trillions IRONTON, o, Sept. 20.-The. Poard of Trade and business mon of Ironton hill u meeting to-night, at which resolutions were Rdopted and confidente faith full expressing