Article Text

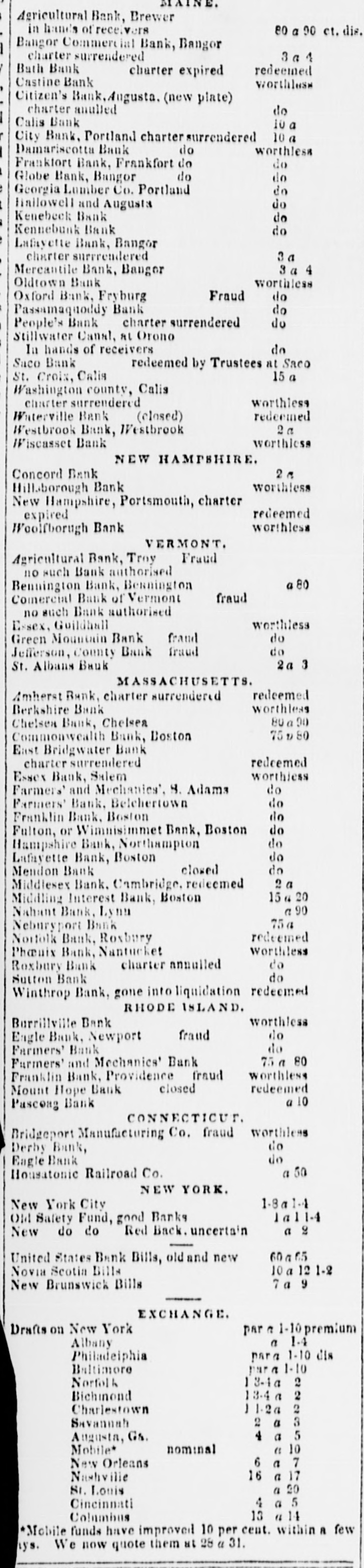

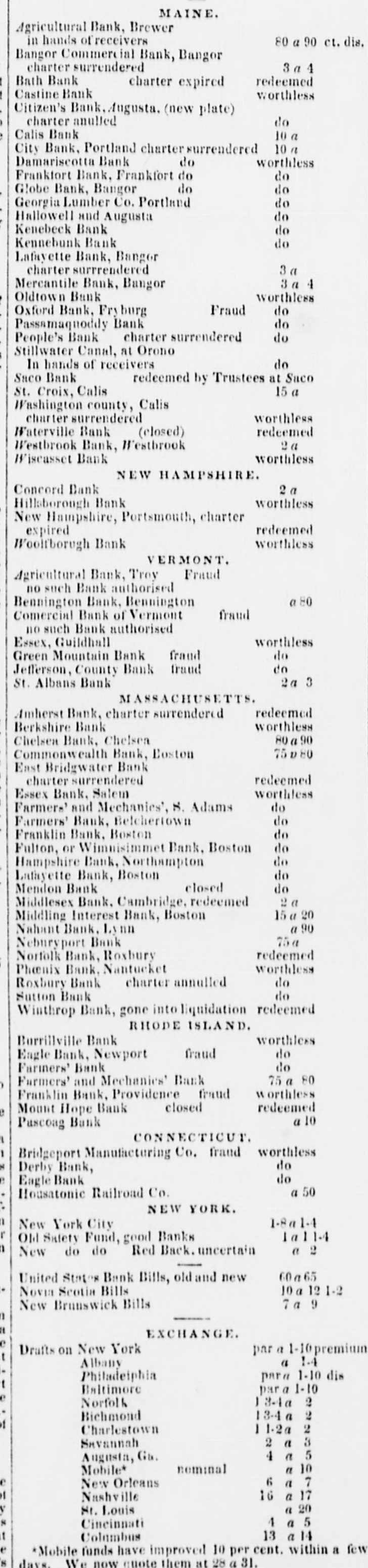

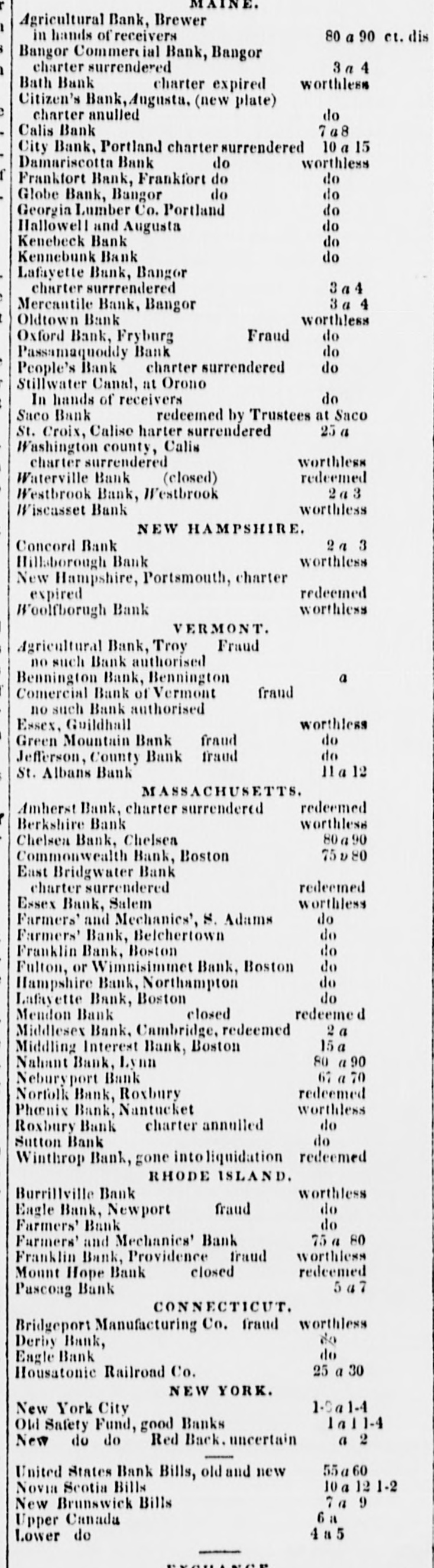

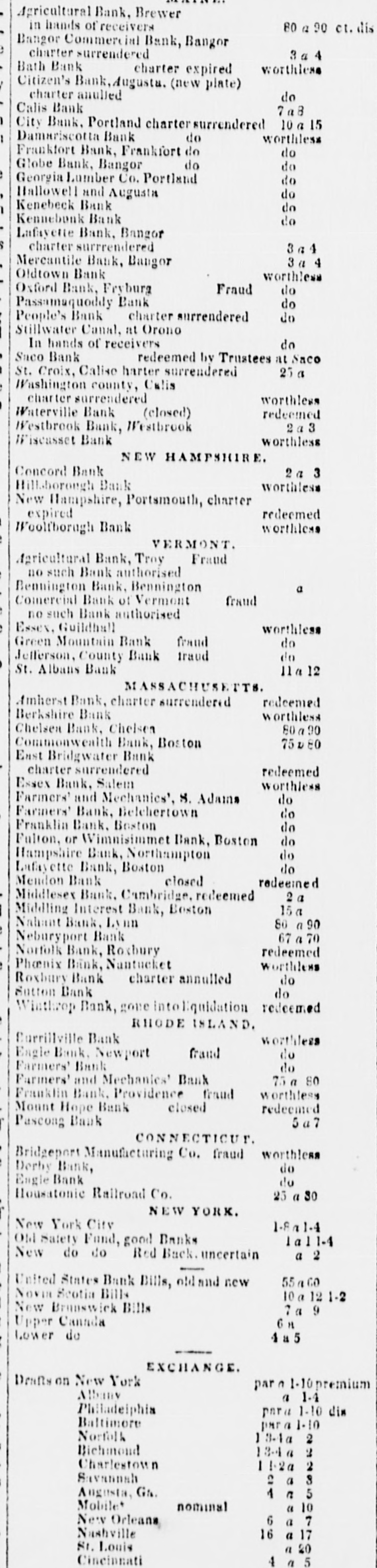

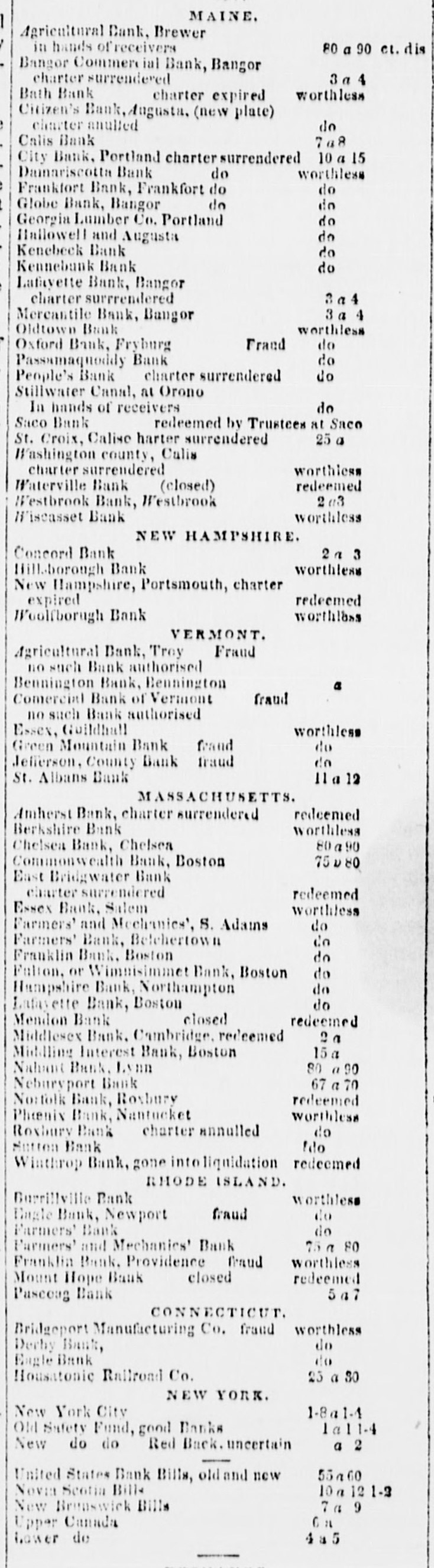

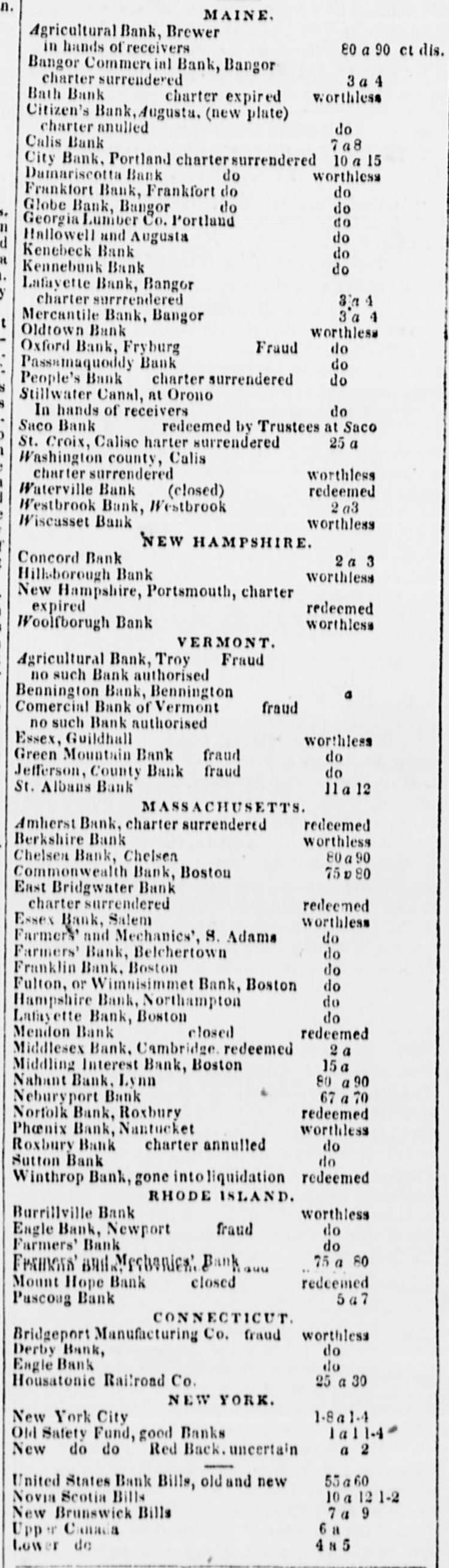

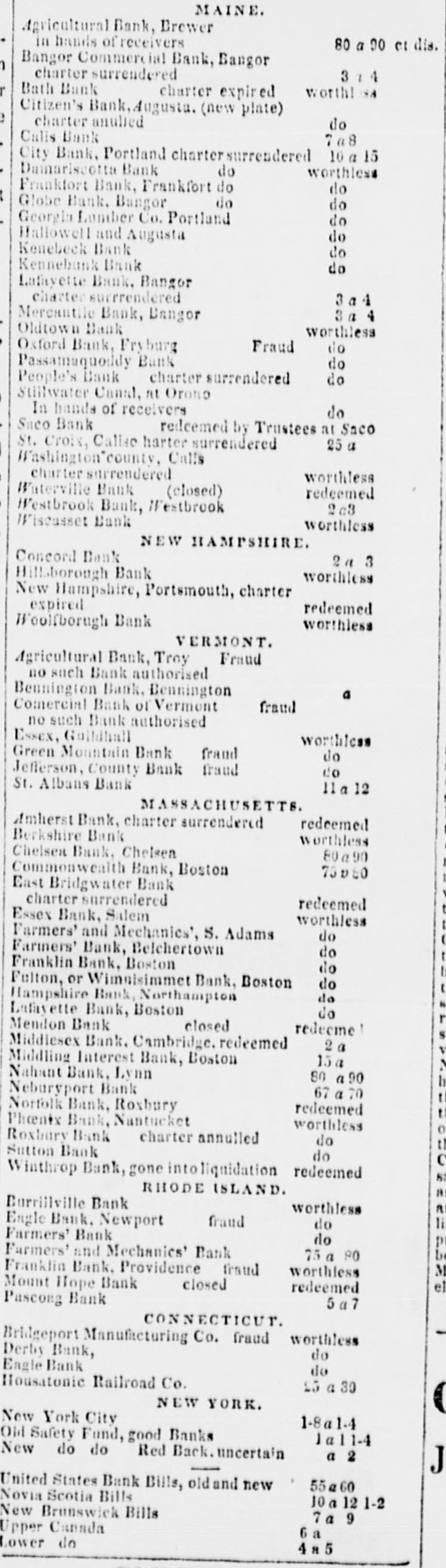

MAINE. Agricultural Bank, Brewer in lannes of receivers 80 a 90 ct. dis. Bangor Commercial int Bank, Bangor I charter surrendered 3a 4 Bath Bank / redeemed charter expired Castine Bank worthless Citizen's Bank. Augusta. (new plate) charter anulted do I Calis Bank 10 a ' 10 a City Bank. Portland charter surrendered do Damariscotta Bank worthless I do Frankfort Bank. Frankfort do 1 do do Globe Bank, Bangor e do Georgia Lumber Co. Portland do 1 Hailowell and Augusta Kenebeck Bank do Kennebunk Bank do Lafyyette Bank, Bangor 3 a charter surrreadered 3 4 Mercantile Bank, Banger Oldtown Bank worthless Fraud do Oxford Bank, Fryburg do Passamaquoddy Bank do People's Bank charter surrendered Stillwater Canal, Al Orono do In hands of receivers Saco Bank redeemed by Trustees at Saco 15 a St. Croix, Calis Washington county, Calis worthless charter surrendered redeemed Waterville Bank (closed) 2 Westbrook Bank, Westbrook worthless Wiscasset Bank NEW HAMPSHIRE. 2 a Concord Bank worthless Hillaborough Bank New Hampshire, Portsmouth, charter redeemed expired worthless Woolfborugh Bank VERMONT. Agricultural Bank, Troy Fraud no such Bank authorised a 80 Bennington Bank, Bennington fraud Comercial Bank of Vermont no such Bank authorised worthless Essex, Goildhall do fraud Green Mountain Bank do Jefferson, County Bank fraud 2a 3 St. Albans Bauk MASSACHUSETTS. redeemed Amherst Bank, charter surrendered worthless Berkshire Bank 80 90 Chelsen Bank, Chelsea 75 80 Commonwealth Bank, Boston East Bridgwater Bank redeemed charter surrendered worthiess Essex Bank, Salem do Farmers' and Mechanics' 8. Adams do Farmers' Bank, Belchertown do Franklin Bank, Boston do Fulton, or Wimmisimmet Bank, Boston do Hampshire Bank, Northampton do Lafayette Bank, Boston closed do Mendon Bank Middlesex Bank. Cambridge redeemed 15 20 Middling Interest Bank, Boston 90 Natural Bank, Lynn 75 Neburyport Bank redeemed Norfolk Bank, Rosbury worthless Phanix Bank, Nantucket do Roxbury Bank charter annulled do Sutton Bank Winthrop Bank, gone into liquidation redeemed RHODE ISLAND. worthless Burrillville Bank do fraud Eagle Bank, Newport do Farmers' Bank 75 80 Farmers' and Mechanics' Bank worthless Franklin Bank, Providence fraud closed redeemed Mount Hope Bank a 10 Pascong Bank CONNECTICUT worthleas Bridgeport Manufacturing Co. fraud do Derby Bank, do Eagle Bank a 50 Housatonic Railroad Co. NEW YORK. 1-8 a l 4 New York City 1 a 1 1 - 4 OIL Safety Fund, good Banks a 2 New do do Red Back. uncertain 60 a 65 United States Bank Bills, old and new 10 12 1-2 Novia Scotia Bills 7a 9 New Brunswick Bills EXCHANGE Drafts on New York par a 1-10 premium 1.4 a Albany para 1-10 dis Philadeiphia par a 1-10 Bultimore 3-1a 2 Norfolk 13-4 a 2 Bichmond 1.2a 2 Charlestown 2 a 3 Savannah 4 a 5 Augusta, Gs. a 10 nominal Mobile* 6 a 7 New Orleans 16 a 17 Nashville a 20 St. Louis 4 a 5 Cincinnati 13 " 14 Columbus Mobile funds have improved 10 per cent. within A few hys. We now quote them at 28 " 31.