Article Text

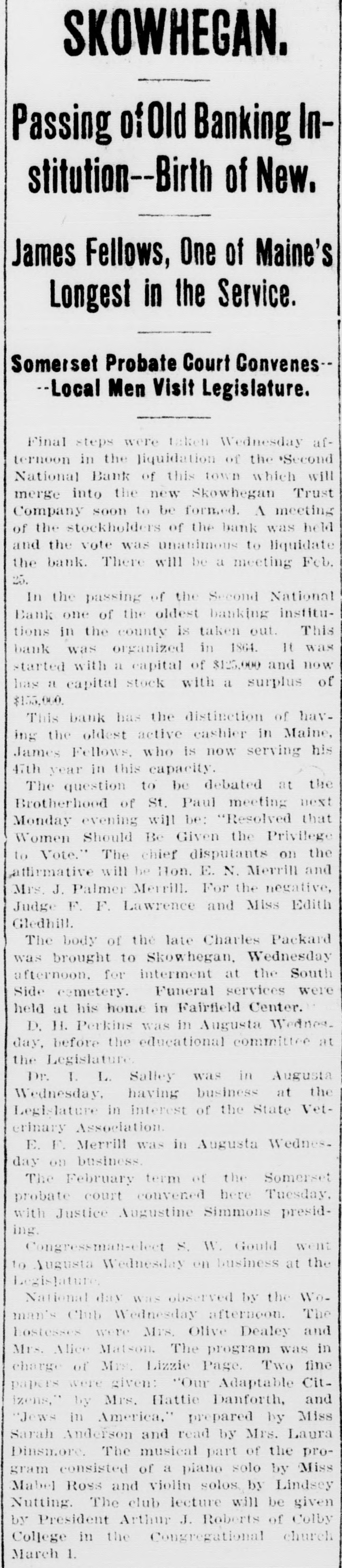

SKOWHEGAN. Passing ofOld Banking Institution--Birth of New. James Fellows, One of Maine's Longest in the Service. Somerset Probate Court Convenes -Local Men Visit Legislature. Final steps were taken Wednesday afternoon in the liquidation of the 'Second National Bank of this town which will merge into the new Skowhegan Trust Company soon to be formed. A meeting of the stockholders of the bank was held and the vote was unanimous to liquidate the bank. There will be it meeting Feb. 25. In the passing of the Second National Bank one of the oldest banking institutions in the county is taken out. This bank was organized in 1864. It was started with a capital of $125,000 and now has a capital stock with a surplus of $155,000. This bank has the distinction of having the oldest active cashier in Maine, James Fellows, who is now serving his 47th year in this capacity. The question to be debated at the Brotherhood of St. Paul meeting next Monday evening will be: "Resolved that Women Should Be Given the Privilege to Vote." The chief disputants on the affirmative will be Hon. E. N. Merrill and Mrs. J. Palmer Merrill. For the negative, Judge F. F. Lawrence and Miss Edith Gledhill. The body of the late Charles Packard was brought to Skowhegan. Wednesday afternoon. for interment at the South Side cemetery. Funeral services were held at his home in Fairfield Center. D. 11. Perkins was in Augusta Wednes. day, before the educational committee at the Legislature. Dr. 1. L. Salley was in Augusta Wednesday, having business at the Legislature in interest of the State Veterinary Association. E. F. Merrill was in Augusta Wednesday on business. The February term of the Somerset probate court convened here Tuesday, with Justice Augustine Simmons presiding. Congressman-elect S. W. Gould went to Augusta Wednesday on business at the Legislature, National day was observed by the Woman's Club Wednesday afternoon. The hostesses were Mrs. Olive Dealey and Mrs. Alice Matson. The program was in charge of Mrs. Lizzie Page. Two fine papers were given: "Our Adaptable Citizens," by Mrs. Hattie Danforth, and "Jews in America," prepared by Miss Sarah Anderson and read by Mrs. Laura Dinsmore. The musical part of the program consisted of a plano solo by Miss Mabel Ross and violin solos, by Lindsey Nutting. The club lecture will be given by President Arthur J. Roberts of Colby College in the Congregational church March 1.