1.

January 23, 1933

Imperial Valley Press

El Centro, CA

Click image to open full size in new tab

Article Text

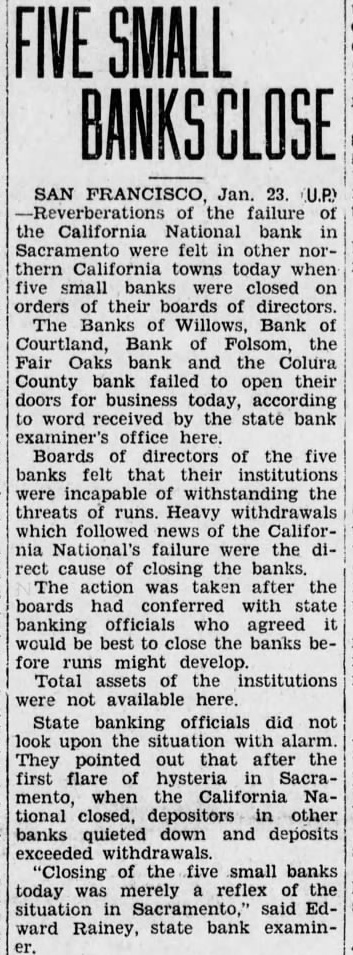

FIVE SMALL BANKS CLOSE SAN FRANCISCO, Jan. 23. U.P.) Reverberations of the failure of the California National bank in Sacramento were felt in other northern California towns today when five small banks were closed on orders of their boards of directors. The Banks of Willows, Bank of Courtland, Bank of Folsom, the Fair Oaks bank and the Colura County bank failed to open their doors for business today, according to word received by the state bank examiner's office here. Boards of directors of the five banks felt that their institutions were incapable of withstanding the threats of runs. Heavy withdrawals which followed news of the California National's failure were the direct cause of closing the banks. The action was taken after the boards had conferred with state banking officials who agreed it would be best to close the banks before runs might develop. Total assets of the institutions were not available here. State banking officials did not look upon the situation with alarm. They pointed out that after the first flare of hysteria in Sacramento, when the California National closed, depositors in other banks quieted down and deposits exceeded withdrawals. "Closing of the five small banks today was merely a reflex of the situation in Sacramento," said Edward Rainey, state bank examiner.

2.

January 23, 1933

Appeal-Democrat

Marysville, CA

Click image to open full size in new tab

Article Text

SAN Jan. 23, of the failure of the California National bank Sacramento were felt in other northern California towns today when five small banks were closed on orders of their boards of tors.

The Bank of Willows, the Colusa County Bank, Bank of Courtland, Bank of Folsom and the Fair Oaks bank failed to their open doors for business today, according to word received by the state bank examiner's office here. Heavy withdrawals which followed news the California National's failure the direct cause of closing of the banks. The action was taken after the boards had conferred state banking officials who agreed would best close banks before runs might develop. State banking officials did not look upon the situation with alarm. They pointed out that after the first flare of hysteria in Sacramento, when the California depositors in other banks quieted down and deposits exceeded withdrawals.

3.

January 23, 1933

Santa Maria Times

Santa Maria, CA

Click image to open full size in new tab

Article Text

More Close Doors

SAN Jan. Reverberations of the failure of the California National bank in Sacramento were felt in other northern California towns today when five small banks were closed on orders of their boards directors. The Bank of Willows, Bank of Courtland Bank Folsom. the Fair Oaks and the Colusa County bank failed to open their doors for business today. according to word received by the state bank examiner's office Boards directors of the five banks felt that their institutions were incapable of withstanding the threats of runs. Heavy withdrawwhich followed news of the California National's failure were the direct cause closing the banks. The action was taken after the boards had conferred with state banking officials who agreed would be best to close the banks beruns might develop.

4.

January 23, 1933

The Chico Enterprise

Chico, CA

Click image to open full size in new tab

Article Text

Five Banks in Valley Closed By Withdrawals

Ed Rainey. state superintendent of banks, announced today that five Sacramento Valley banks closed their doors today because of heavy withdrawals. due to closing of other banks in the district. The banks which failed to open for business today were the Bank of Courtland, the Colusa State Bank, the Bank of Folsom, the Bank of Willows and the Fair Oaks Bank. Saturday the California National Bank California Trust and Savings Bank of Sacramento among the oldest banking institutions of the state, closed their doors. Bank officers at Willows blamed frozen assets added to heavy withdrawals. The bank was established in 1882. Of the five towns where banks closed today. only Willows and Colusa have further banking facilities. There is also in Willows the Bank of America branch and the First National Bank of Willows. In Colusa there remained, Rainey said, First Savings Bank. Rainey said closing of the banks was more protective measure to safeguard deposits. Ht said he did not regard the situation "critical" and after telephonic survey of the situation Sacramento said banking conditions theer were "favorable.'

According to reports received this afternoon, was the Colusa County Bank and not Colusa State Bank that closed its doors this morning following run.

5.

January 23, 1933

The Fresno Bee

Fresno, CA

Click image to open full size in new tab

Article Text

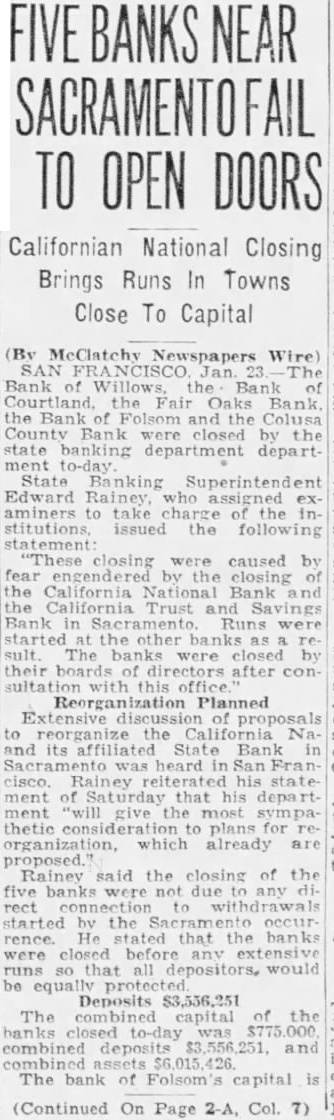

BANKS NEAR SACRAMENTO FAIL TO OPEN DOORS

Californian National Closing Brings Runs In Towns Close To Capital

(By Newspapers Wire) SAN Bank Willows, Bank Oaks Bank Colusa Bank closed by the state ment banking department departState Banking Superintendent Edward who assigned issued following statement: closing were caused engendered by the closing of California National Bank Trust Savings Bank Runs were started other The were their boards of directors after consultation Reorganization reorganize California Na. and its affiliated Bank in was heard San Francisco. Rainey reiterated his stateof Saturday that his ment thetic plans organization, which already proposed. Rainey said the closing of the five were any started by the occurrence. He stated that were closed before extensive runs that all depositors, would be equally Deposits $3,556,251 The capital the banks closed to-day combined deposits and combined The bank Folsom's capital (Continued On Page 2-A, Col. 7)

6.

January 23, 1933

Imperial Valley Press

El Centro, CA

Click image to open full size in new tab

Article Text

SAN Jan. U.P.) of the failure California National bank Sacramento were felt other northern California towns today when five closed orders their boards of directors. The Banks Willows, Bank Courtland, Bank Folsom, the Fair Oaks bank and Colura County bank failed to open their doors business today, according word received the state bank examiner's office here. Boards directors of five banks felt that their incapable of threats Heavy withdrawals which followed of the California National's failure cause closing the banks. The action taken the boards had conferred with state banking officials agreed would the banks fore might Total the institutions not available here. State banking officials did look upon with alarm. They pointed out that after the first Sacramento, when California National closed, depositors other banks quieted down and deposits exceeded withdrawals. "Closing of the five small banks today merely reflex the situation Sacramento,' ward Rainey, state bank examin-

7.

January 24, 1933

Pasadena Star-News

Pasadena, CA

Click image to open full size in new tab

Article Text

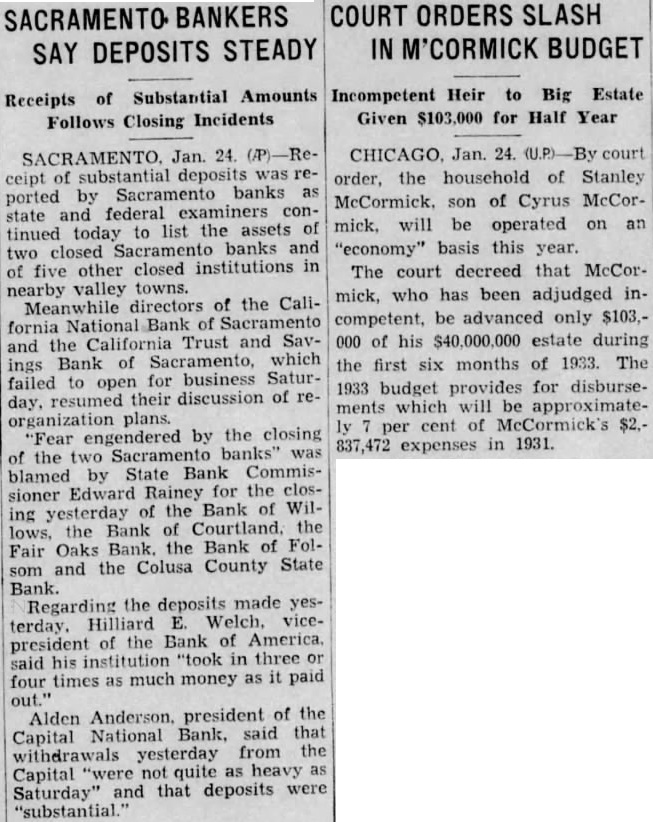

SACRAMENTO BANKERS SAY DEPOSITS STEADY

COURT ORDERS SLASH IN M'CORMICK BUDGET

Substantial Amounts Incompetent Heir to Big Estate Receipts of Follows Closing Incidents Given $103,000 for Half Year

SACRAMENTO. Jan. ceipt deposits Sacramento banks ported federal examiners constate and tinued today list the assets two closed Sacramento banks and of five other closed institutions in nearby valley towns. directors of the CallMeanwhile fornia National Bank of Sacramento California Trust and Savand the of Sacramento, which ings Bank business Saturfailed to open for day. resumed their discussion of organization plans. "Fear engendered by the closing the two Sacramento banks" was blamed State Bank Commisby sioner Edward Rainey for the closthe Bank of Wilyesterday of ing the lows, the Bank Bank of FolFair Oaks Bank. som and the Colusa County State Bank. Regarding the deposits made yesHilliard viceterday. of the Bank of America. president said his "took in three times much money it paid four as

Alden Anderson. president of the Capital National Bank, said that from the withdrawals yesterday Capital "were not quite as heavy and that deposits were

Jan. 24. order, the household of Stanley McCormick. son of Cyrus McCorwill be operated on "economy" basis this year. The court decreed that McCormick, who has been adjudged in competent, be advanced only $103.000 of his $40,000,000 estate during the first six months of 1933. The 1933 budget provides for disbursewhich be per cent of McCormick's $2,837,472 expenses in 1931.

8.

January 26, 1933

The Glenn Transcript

Willows, CA

Click image to open full size in new tab

Article Text

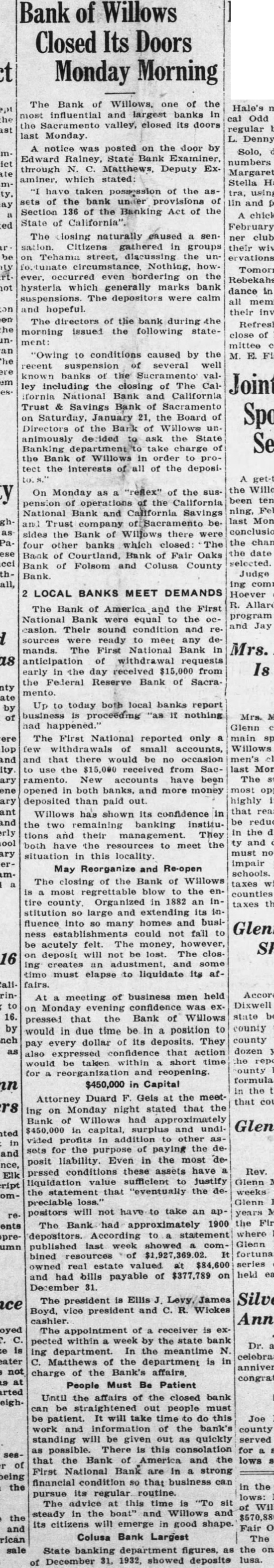

Bank of Willows Closed Its Doors Monday Morning

Bank of Willows, one of the influential and largest banks In the Sacramento valley, closed its doors last Monday. notice was posted on the door by Edward State Bank Examiner, through Deputy aminer, which stated: have taken of the sets of the bank under provisions Section 136 of the Banking Act of the State of California".

The closing naturally caused sation. Citizens gathered in groups Tehama street, discussing occurred even bordering on the hysteria which generally marks bank suspensions. The depositors were calm and hopeful. The directors of the bank the morning issued the following statement:

"Owing to conditions caused by the recent suspension several well banks the Sucramento valley including the closing of The Calfornia National Bank and California Trust Savings Bank of Sacramento Saturday, January 21, the Board of Directors the Bark of Willows un. animously decided ask the State Banking charge of the Bank of Willows order to tect the interests of the deposi-

On Monday as of the suspension operations the California National Bank and California Savings Trust company be. sides the Bank of Willows there were four other banks which closed: Bank of Courtland, Bank of Fair Oaks Bank of Folsom and Colusa County Bank.

LOCAL BANKS MEET DEMANDS

The Bank of America and the First National Bank were equal the casion. Their sound condition and sources were ready to meet any demands. The First National Bank in anticipation of withdrawal requests early in day received $15,000 from the Federal Reserve Bank of Sacramento. Up to today both local banks report proceeding nothing had happened." The First National reported only withdrawals of small accounts, and that there would be no occasion to use the $15,000 received from Sacramento. New accounts have been opened both banks, and more money deposited than paid out. Willows has shown its confidence the two remaining banking institutions and their management. They both have the resources to meet the situation in this locality. May Reorganize and Re-open

The closing of the Bank of Willows most regrettable blow to the tire county. Organized in 1882 an stitution 80 large and extending its fluence into so many homes and busiestablishments could fall be acutely felt. The money, however, deposit will not lost. The closcreates and time must elapse to liquidate its affairs.

At meeting of business men held on Monday evening confidence that the Bank Willows pressed would due time be in position to in dollar of its deposits. They pay every also expressed confidence that action would be taken within short time for and reopening. $450,000 in Capital

Attorney Duard Geis at the meetthat ing on Monday night stated that the Bank Willows had approximately Glenn Rev. Glenn weeks Glenn 1900 the First where Glenn fortunate real estate valued $84,600 series owned on held Silver cashier. Dr. must this Joe work and information of the bank's county standing be given out as quickly served this consolation for the lows strong the lows: sit steady in the and Willows and $570,880; shape. Fair The the only lusa.

9.

January 26, 1933

The Glenn Transcript

Willows, CA

Click image to open full size in new tab

Article Text

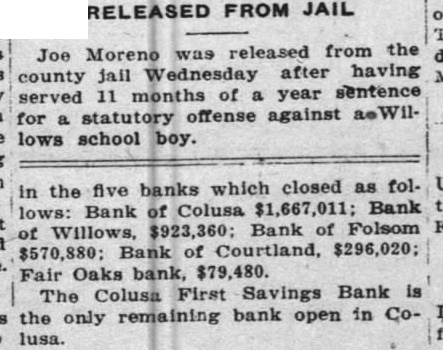

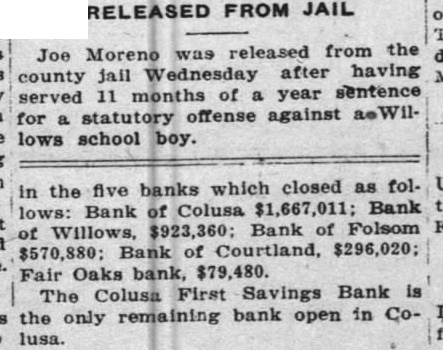

FROM JAIL released from the Moreno after having year sentence 11 months statutory offense against school boy. five banks which closed as Colusa $1,667,011; Bank Bank Willows, $923,360; Bank of Folsom Bank $296,020; Oaks bank, $79,480. Colusa First Savings Bank bank open in Co-

10.

January 31, 1933

Woodland Daily Democrat

Woodland, CA

Click image to open full size in new tab

Article Text

MAY REOPEN COLUSA BANK

(By Valley News Alliance) COLUSA Reorganization of the Colusa County Bank and a statement to depositors will be made in a few days, it was reported Monday. Business leaders are confident that the county's oldest banking institution will be reopened shortly.

11.

February 15, 1933

Woodland Daily Democrat

Woodland, CA

Click image to open full size in new tab

Article Text

AZEVEDO NAMED BANK RECEIVER

Edward Rainey. State Superintendent of Banks, announced here Wednesday that he had appointed Joseph Azevedo of Sacramento receiver of the Colusa County Bank, which was taken over by Rainey's department recently. Azevedo was here with Rainey, the two officials planning to go to Colusa later in the day. George Walker, an examiner from the State Banking Department, will act in supervisorial capacity in handling the liquidation of the assets of the closed bank.

12.

February 16, 1933

The Glenn Transcript

Willows, CA

Click image to open full size in new tab

Article Text

Names Receiver For Colusa Bank

Joseph Azevedo of Sacramento was yesterday appointed by Edward A. Rainey, state superintendent of banks, as receiver for the Colusa County Bank.