Article Text

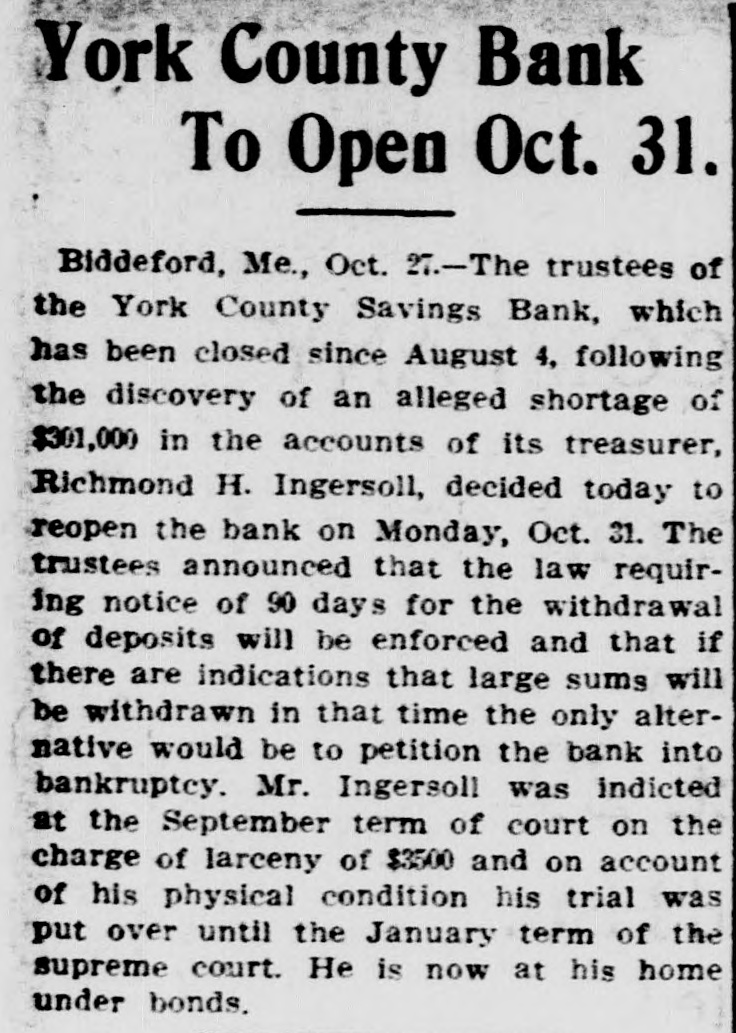

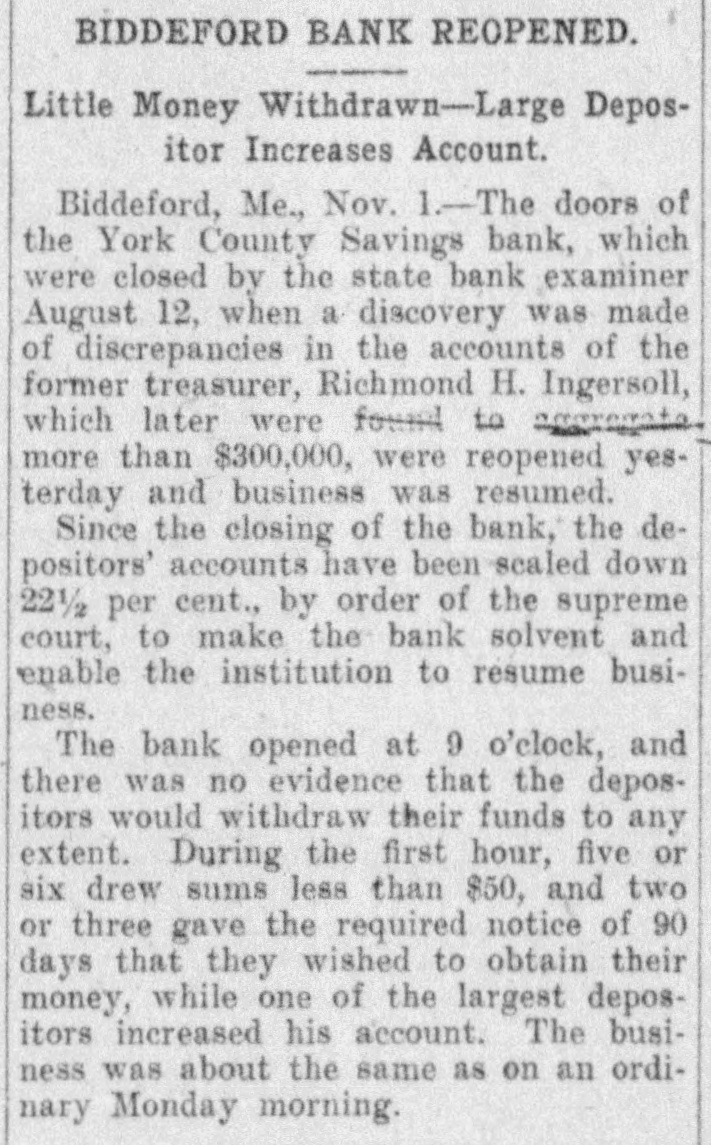

# SAVINGS BANK CLOSED Accounts Were Kept Falsely for Twenty-five Years. # THE TREASURER IS DYING Books Said to Have Been "Fixed" to Hide Bad Invest- ments-Shortage Not Known. Biddeford. Me., Aug. 13. Pride in the financial standing of the institution of which he had long been treasurer, and fear lest the announcement of poor investments in Western securities would hurt that standing, led Richmond H. Ingersoll to make false entries in the books of the York County Savings Bank a quarter of a century ago, and to continue the falsification through all the years without detection, each year getting deeper in the muddle of false figures. This is the explanation given by the treasurer following the closing of the doors of the bank yesterday after a discovery of a shortage in the funds had been made by a bank examiner. That Ingersoll himself did not profit by manipulation of the accounts was the belief to-night of bank officials. He had been treasurer of the bank for fifty years. For many years he had persistently declined to take a vacation. A month ago the directors of the bank voted to adopt a suggestion of the State Bank Examiner and advertise the accounts by number in a local paper, requesting depositors to compare them with the amounts with their pass books and report any discrepancies. The bank is in the hands of William B. Skelton, state bank examiner, who, with his assistant, Mr. Ellis, President C. H. Prescott and the trustees, has been examining the books for several days. The bank's doors were closed at 1 o'clock yesterday afternoon and a notice was posted to that effect. Notwithstanding the public had no suspicion that the accounts of the institution were in a tangled condition, Treasurer Ingersoll, in a letter which he left at the bank before he went to his home yesterday, admitted a discrepancy in his accounts, but did not explain the shortage. The officials of the bank are as yet unable to state the exact amount of the shortage, and it will probably be some time before its extent is known. President Prescott is one of the most highly respected citizens of Biddeford, and is prominent in public affairs. He has been president only since 1909. Treasurer Ingersoll is confined to his home seriously ill, having been found in a critical condition Thursday afternoon. He was present in the bank Wednesday, during the first day of the examination, but made no statement then. In his letter he said that no part of the shortage is due to any use of the bank's funds for himself, but that it comes from a false method of bookkeeping adopted by him years ago to save the bank temporarily from losses made at that time through Western securities purchased before the present investment laws were enacted. The securities compartment of the vault was opened yesterday afternoon and those owned by the bank were found intact. It is hoped that the loss to depositors will nor be large, but its exact amount cannot be ascertained until the verification of the passbooks is completed. At one time the deposits exceeded $1,000,000. When Treasurer Ingersoll did not appear at the bank all day Thursday, the assistant treasurer, Henry H. Goodwin, called at his house. He found Ingersoll in an unconscious condition. Physicians said he had been accustomed to taking headache powders and that he probably had been affected by taking too many. Treasurer Ingersoll has been unconscious two days, and to-night is at the point of death. On Wednesday Ingersoll called on James Read, keeper of records and seal of a local lodge, and, giving him some lodge papers, said: "I'm going away on a vacation. Here are some books and papers the lodge will need while I am away." He said nothing further in reference to himself and Mr. Read thought nothing of the incident until to-day. Deposits of the bank, according to the last statement, amounted to $1,209,831, the reserve fund was $51,000 and there were undivided profits of $22,575. The estimated market value of resources above deposits, dividends and state tax is $100.402.27; the total liabilities are $1,283,408.63. Most of the depositors are mill workers in the Biddeford and Saco cotton mills, and their individual deposits are small. The other three savings banks are prepared to meet a run when they open Monday. In a statement issued to-night President Charles H. Prescott, of the York County Savings Bank, declares that no other bank or banking institution is in the least affected by its closing, and he urges depositors in other local banks to refrain from starting a run. Mr. Prescott has been president of the bank only about a year.