Article Text

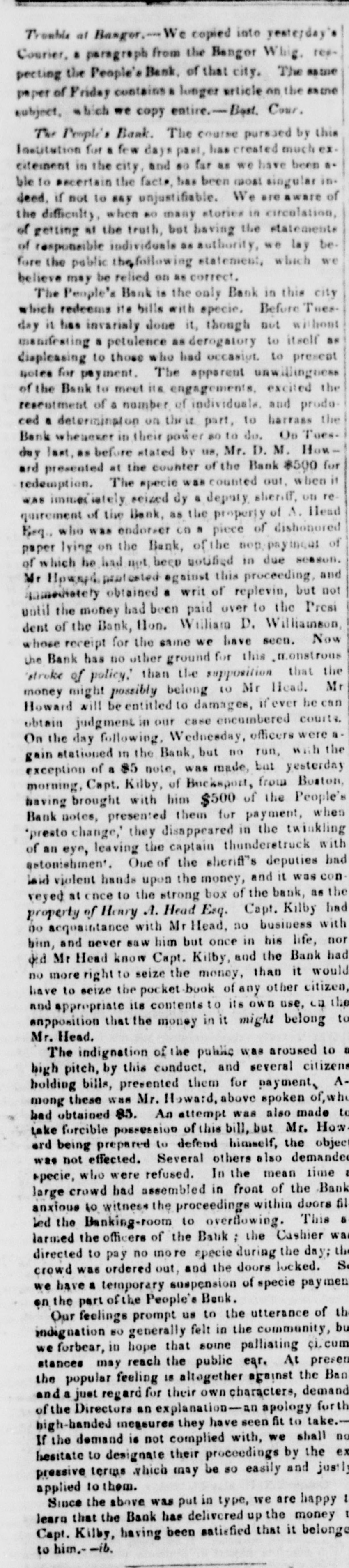

Trouble at Bangor.-We copied into yearerday's Courier, a paragraph from the Bangor Whig. refpecting the People's Bank, of that city. The same paper of Friday contains longer article on the as ne subject, which we copy entire.-Bqst. Cour. The People's Bank. The course pursued by this Institution for a few days past, has created much ex. citement in the city, and so far as we have been a. ble to secertain the fact# has been most singular in. deed. if not to say unjustifiable. We are aware of the difficulty when so many stories in circulation, of getting at the truth, but having the statements of responsible individuals as authority, we lay be. fore the public thefollowing statement, which we believe may be relied on as correct. The People's Bank is the only Bank in this city which redeems its bills with specie. Before Tues. day it has invarialy done it, though not without manifesting a petulence as derogatory to itself BR displeasing to those who had occasipt. to present notes for payment. The apparent unwillinguese of the Bank to meet its engagements. excited the resentment of a number of individuals. and produced a determination on thrit part, to harrass the Bank wheaexer in their power 80 to do. On Tues. day last, as before stated by us, Mr. D. M. Howard presented at the counter of the Bank $500 for The specie was counted out. when it reized dy a deputy on redemption. WAS immediately sheriff, of A. Head requirement of the Bank, as the property Beg. who was endorser CD a piece of dishonored lying on the Bank, of the nop. paying of he had not. been in paper of which notified this proceeding due season. and Mr Howned protested against immediately obtained a writ of replevin, but not had been paid over to the Presi the Hon. until dent of the money Bank, William D. Williamson Now whose receipt for the same we have seen. the Bank has no other ground for this monstrous than the supposition that the might possibly belong to Mr money stroke of policy." if Head. be can Mr Howard will be entitled to damages, ever obtain judgment in our case encumbered courts. following. Wednesday, officers were a in the Bank, but no run, On the gain stateous day but yesterday with the exception of a $5 note, was made, morning, Capt. Kilby, of Bucksport, from Boston, with him $500 of the People's them for having Bank notes, brought presented payment, the twinkling when *presto change," they disappeared in of an eye, leaving the captain thunderetruck with astonishment. One of the sheriff"s deputies had laid violent hands upon the money, and it was con veyed at once to the strong box of the bank, as the property of Herry A. Head Esq. Capt. Kilby had no acquaintance with Mr Head, no business with bin, and never saw him but once in his life, nor did Mr Head know Capt. Kilby, and the Bank had no more right to seize the money, than it would have to seize the pocket. book of any other citizen, and appropriate its contents to its own use, ca the apposition that the money in it might belong to Mr. Head. The indignation of the public was aroused to a high pitch, by this conduct, and several citizens holding bills, presented them for payment, A mong these was Mr. Howard, above spoken of, who had obtained 85. An attempt was also made to take forcible possession of this bill, but Mr. How ard being prepared to defend himself, the object was not effected. Several others also demanded specie, who were refused. In the mean time large crowd had assembled in front of the Bank anxious to witness the proceedings within doors fil led the Banking-room to overflowing. This a larmed the officers of the Bank the Cashier wa directed to pay no more specie during the day; the crowd was ordered out, and the doors locked. S we have a temporary suspension of specie payment the part of the People's Benk. Our feelings prompt us to the utterance of th indignation so generally felt in the community, bu we forbear, in hope that soine palliating ci.cum stances may reach the public ear. At presen the popular feeling is altogether against the Ban and a just regard for their own characters, demand of the Directors an explanation-an apology forth high-banded measures they have seen fit to take. If the demand is not complied with, we shall no hesitate to designate their proceedings by the ex pressive terms which may be so easily and justly applied to them. Since the above was put in type, we are happy 1 learn that the Bank has delivered up the money I Capt. Kilby, having been satisfied that it belonge to him.--ib.