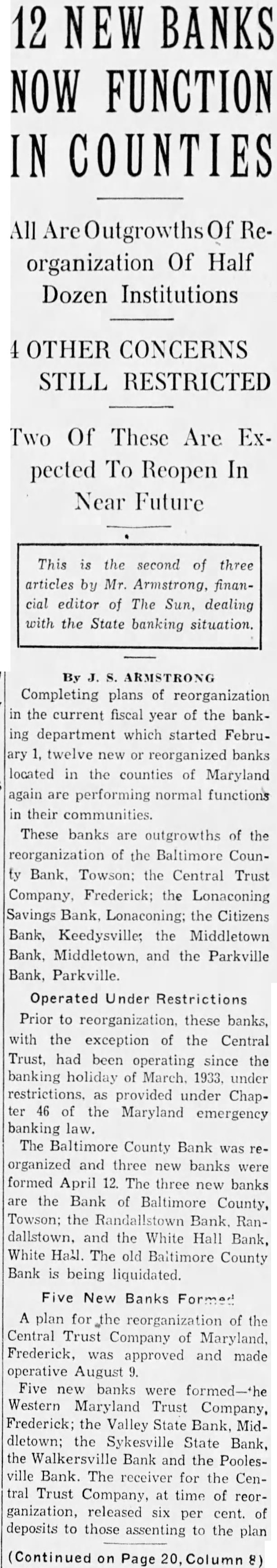

Article Text

NEW BANKS NOW FUNCTION COUNTIES organization Of Half Dozen Institutions OTHER CONCERNS STILL RESTRICTED Two Of These Are Expected To Reopen In Near Future This the second of three articles by Mr. Armstrong, financial editor of The Sun, dealing with the State banking situation. By Completing plans of reorganization the current fiscal year of the banking department which started February twelve reorganized banks located in the counties of Maryland again performing normal functions in their communities. These banks are outgrowths of the of the Baltimore County Bank, Towson: the Central Trust Company. Frederick: the Lonaconing Savings Bank. Lonaconing: the Citizens Bank, Keedysville; the Middletown Bank, Middletown, and the Parkville Parkville. Operated Under Restrictions Prior to reorganization. these banks, with the exception of the Central Trust, had been operating since the banking holiday March. 1933. under restrictions. provided under Chap46 of the Maryland emergency banking The Baltimore County Bank was reorganized and new banks were formed April 12. The three new banks are the Bank of Baltimore County, Towson; the Randallstown Bank, Randallstown. and the White Hall Bank, White Hall. The old Baltimore County Bank is being liquidated. Five New Banks Formed plan for reorganization of the Central Trust Company of Maryland, Frederick, was approved and made operative August Five banks were formed-the Western Maryland Trust Company, Frederick; Valley State Bank, Midthe Sykesville State Bank, the Walkersville Bank and the PoolesBank. The receiver for the Central Trust Company, time of reorganization, released six per cent. deposits to those assenting to the plan Continued on Page Column