Article Text

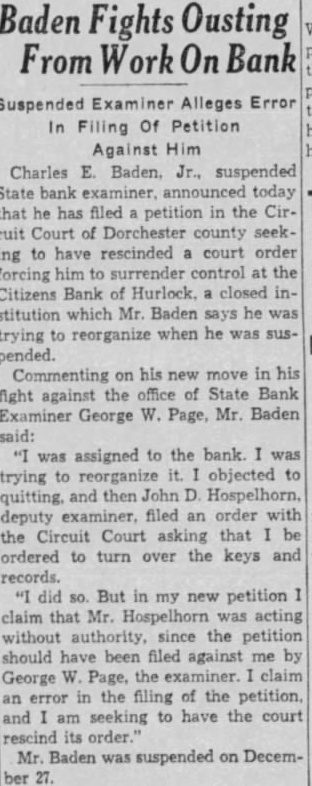

Baden Fights Ousting Suspended Examiner Alleges Error In Filing Of Petition Against Charles Baden. Jr., suspended State bank today that has filed petition in the cuit Court of Dorchester county seekto have rescinded court order forcing the Citizens Bank of Hurlock. closed stitution which Mr. Baden says he trying when he was pended. Commenting his new against the of State Bank George W. Page, Mr. Baden assigned to the trying reorganize objected deputy filed order the Circuit Court asking that ordered turn the keys and records. But petition that Mr. Hospelhorn was acting without authority, the petition should have filed against George Page, error the filing the petition, seeking to have the its Mr. Baden was suspended on Decem-