Article Text

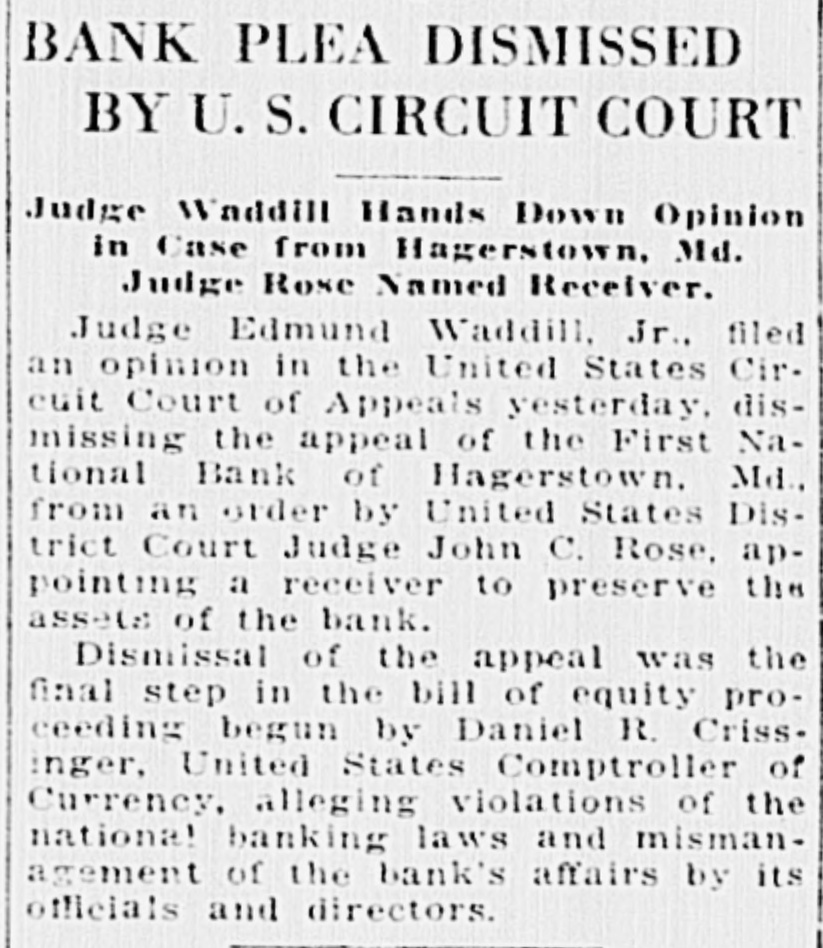

CAPITAL TRACTION NETS $98,097 FOR MONTH OF AUGUST July's Profits Amount to $113,984 and $102,147 Last Year. OU L OTHER LOCAL NOTES Hagerstown Bank's Charter Threatened in Suit Entered In Baltimore. Capital Traction lines operated at a net income of $95,007 during the month.of August, according to rereceived by the Public Utillties Commission for the period ports receipts yesterday. in question Total amounted to $433,698, while expenses totaled $335,601. These figures compare with $102.147 for the corresponding period one year ago, and with $113,984, which represents the net income for July of the present year. Bank May Lose Charter. A suit was entered in the United States Court at Baltimore yesterday by the United States attorney, in the name of the Comptroller of the Currency, to forfeit the charter of the First National Bank of Hagerstown, Md., for violations of the national banking laws. Pending a hearing of the case, the court appointed Robert D. Garrett as temporary receiver in order to conserve the assets of the bank in the interest of the depositors and stockholders. Acting Comptroller T. P. Kane stated that this bank has been a most persistent violator of the banking laws for the past several years. Its management not only deliberately ignored the intructions of the national bank examiners at each examiantion, but has openly defied the admonitions and warnings of the Comptroller until nothing remained for the Comptroller to to to for revocation the is Kane do but further of apply states bank's the that charter. court this only the second case in the history of the national banking system in which forfeiture proceedings have been instituted by the Comptroller for violations of law. In addition to the agricultural loan agencies previously announced by the War Finance Corporation, the following committee, with headquarters at Atlanta, has been appointed to receive applications from Sanks in its district for advances under the recently enacted Section 24 of the War Finance Corporation act, and to make recommendations as to these advances to the War Finance Corporation: Chairman. John K. Ottley; L. R. Adams, C. W. Skinner, Mills B. Lane, Augustus E. Young. W. F. Coachman, D. M. Lowry and T. L. Wilson. Personal. William D. Hoover, president of the National Savings and Trust Company, returned to his desk yesterday morning after an extended vacation spent in the mountains of West Virginia. Local Securities. Trading on the Washington Stock Exchange failed to emerge from the slump which has been prevalent for the past several days in yesterday's listless period. Washington Gas 5s showed considerable strength, $1.00. face value. selling at 82 and 821/4. Capital Traction 5s failed to change their position, $500 selling at 87% In the stock list 25 shares of Capital Traction sold at 86% Call money ruled at 7 per cent asked, with brokers bidding 5 1/2 per cent. .