Article Text

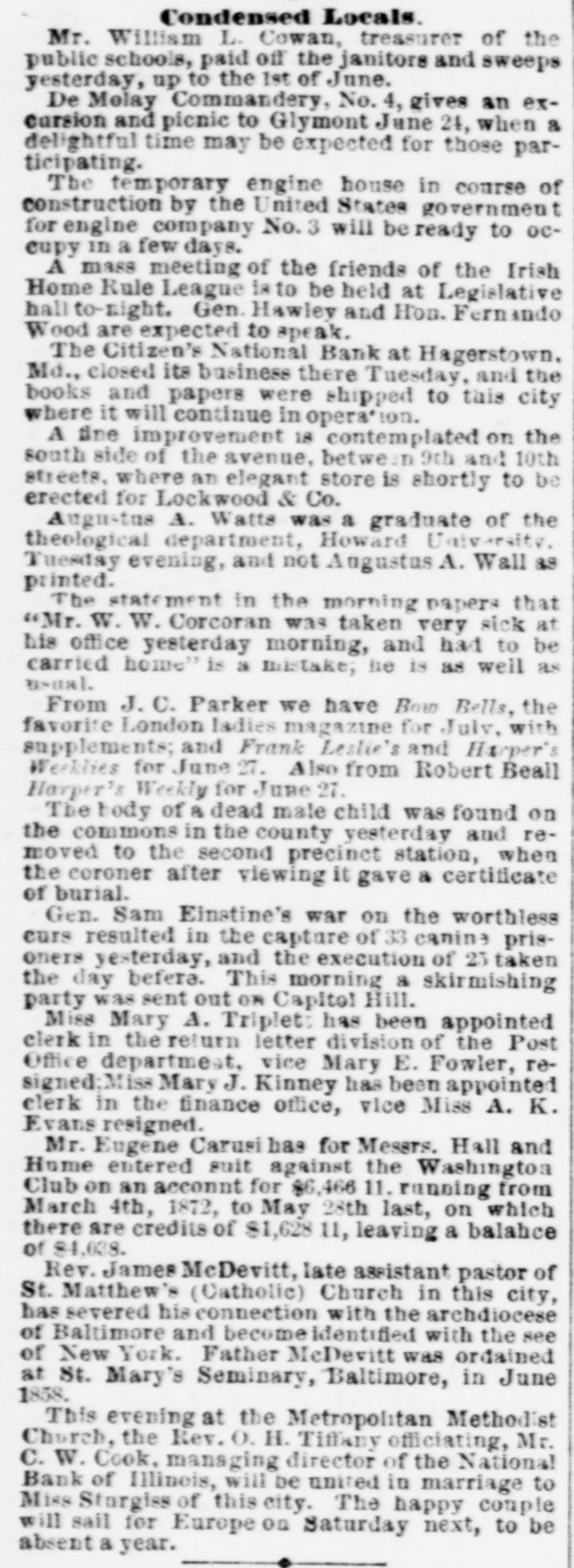

Condensed Locals. Mr. William L. Cowan, treasurer of the public schools, paid off the janitors and sweeps yesterday, up to the 1st of June. De Molay Commandery, No. 4, gives an excursion and picnic to Glymont June 24, when a delightful time may be expected for those participating. The temporary engine house in course of construction by the United States government t for engine company No. 3 will be ready to occupy in a few days. A mass meeting of the friends of the Irish Home Rule League is to be held at Legislative hall to-night. Gen. Hawley and Hon. Fernando Wood are expected to speak. The Citizen's National Bank at Hagerstown, Md., closed its business there Tuesday, and the books and papers were shipped to this city where it will continue in opera' 10n. A tine improvement 18 contemplated on the south side of the avenue, betwe 9th and 10th streets, where an elegant store is shortly to be erected for Lockwood & Co. Augustus A. Watts was a graduate of the theological department, Howard University, Tuesday evening, and not Augustus A. Wall as printed. The statement in the morning papers that "Mr. W. W. Corcoran was taken very sick at his office yesterday morning, and had to be carried home" is a mistake; he is as well as usual. From J. C. Parker we have Bow Bells, the favorite London ladies magazine for July, with supplements; and Frank Leslie's and Harper's Weeklies for June 27. Also from Robert Beall Harper's Weekly for June 27. The body of 8 dead male child was found on the commons in the county yesterday and removed to the second precinct station, when the coroner after viewing it gave & certificate of burial. Gen. Sam Einstine's war on the worthless curs resulted in the capture of 33 canine prisoners yesterday, and the execution of 25 taken the day befere. This morning a skirmishing party was sent out OR Capitol Hill. Miss Mary A. Triplet: has been appointed clerk in the return letter division of the Post Office department, vice Mary E. Fowler, resigned;Miss Mary J. Kinney has been appointed clerk in the finance office, vice Miss A. K. Evans resigned. Mr. Eugene Carusi has for Messrs. Hall and Hume entered suit against the Washington Club on an acconnt for $6,466 11. running from March 4th, 1872, to May 28th last, on which there are credits of $1,628 11, leaving a balance of $4,038. Rev. James McDevitt, late assistant pastor of St. Matthew's (Catholic) Church in this city, has severed his connection with the archdiocese of Baltimore and become identified with the see of New York. Father McDevitt was ordained at St. Mary's Seminary, Baltimore, in June 1858. This evening at the Metropolitan Methodist Church, the Rev. 0. H. Tiffany officiating, Mr. C. W. Cook, managing director of the National Bank of Illinois, will be united in marriage to Miss Storgies of this city. The happy couple will sail for Europe on Saturday next, to be absent a year.