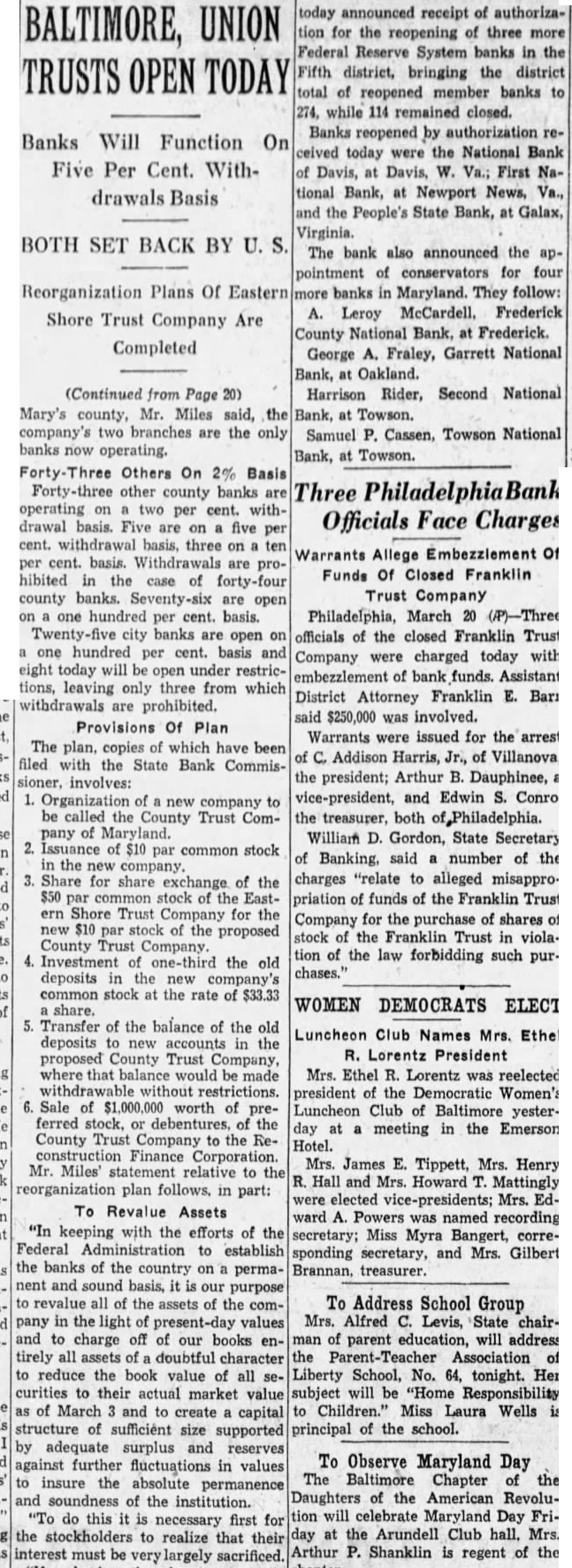

Article Text

BALTIMORE, UNION TRUSTS OPEN TODAY Banks Will Function On Five Per Cent. Withdrawals Basis BOTH SET BACK BY Reorganization Plans Of Eastern Shore Trust Company Are Completed today announced receipt of authorization for the reopening of three more Federal Reserve System banks in the Fifth district, bringing the district total of reopened member banks to 274, while 114 remained closed. Banks reopened by authorization received today were the National Bank of Davis, at Davis, W. Va.; First National Bank, at Newport News, Va., and the People's State Bank, at Galax, Virginia. The bank also announced the appointment of conservators for four banks Maryland. They follow: A. Leroy Frederick County National Bank, at Frederick. George A. Fraley, Garrett National Bank, Oakland. Harrison Rider, Second National Bank, at Towson. Samuel P. Cassen, Towson National Bank, Towson. (Continued from Page 20) Mary's county, Mr. Miles said, the company's branches are the only banks operating. Others On 2% Basis Forty-three other county banks are operating on two per cent. withdrawal basis. Five are on five per cent. basis, three on ten per cent. basis. Withdrawals are hibited the case of forty-four county banks. Seventy-six are open hundred per cent. basis. Twenty-five city banks are open on one hundred per cent. basis and eight today will open under restrictions, leaving only three from which withdrawals are prohibited. said $250,000 was involved. Provisions Of Plan Warrants were issued for the arrest The plan, copies which have been Addison Harris, Jr., of Villanova, filed with the State Bank Commisthe president; Arthur B. Dauphinee, sioner, involves: vice-president, and Edwin S. Conro, 1. Organization of new company to called the County Trust Com- the treasurer, both of Philadelphia. pany of Maryland. William D. Gordon, State Secretary Issuance of $10 par common stock of Banking, said number of the company. for share of the charges "relate to alleged misappro$50 par of the East- priation of funds of the Franklin Trust ern Trust for the Company for the purchase of shares new $10 of the proposed stock the Franklin Trust in violaCounty Trust Company. tion of the law forbidding such purInvestment one-third the old chases.' deposits in the new common stock the rate of $33.33 WOMEN DEMOCRATS ELECT share. Transfer of the balance of the old Luncheon Club Names Mrs. Ethel deposits the R. Lorentz President proposed County Trust Company, where that would Mrs. Ethel R. Lorentz was reelected without restrictions. president of the Democratic Women's Sale of $1,000,000 worth of pre- Luncheon Club of yesterferred stock, debentures, the day meeting in the Emerson County Trust Company the ReHotel. Finance Corporation. Mrs. James E. Tippett, Mrs. Henry Mr. Miles' relative to R. Hall and Mrs. Howard Mattingly reorganization plan follows, in part: elected Mrs. EdTo Revalue Assets ward A. named recording "In keeping with the efforts of the secretary; Miss Myra Bangert, correFederal to establish sponding secretary, and Mrs. Gilbert the banks of the country on perma- Brannan, treasurer. nent and our purpose all of the assets of the com- To Address School Group pany in light present-day values Mrs. Alfred Levis, State chairand charge off of our books en- parent education, will address tirely all assets doubtful character Parent-Teacher Association to reduce the book value of all Liberty School, 64, tonight. Her curities to their actual market value subject be "Home Responsibility as March and create capital to Children." Miss Laura Wells structure sufficient size supported principal of the school. by adequate surplus and reserves To Observe Maryland Day against further fluctuations in values The Baltimore Chapter the insure the absolute permanence and of the institution. Daughters of the American Revoluwill celebrate Maryland Day Fri"To do this is necessary first for the to realize that day at the Arundell Club hall. Mrs. must be largely sacrificed. Arthur P. Shanklin is regent of the