Article Text

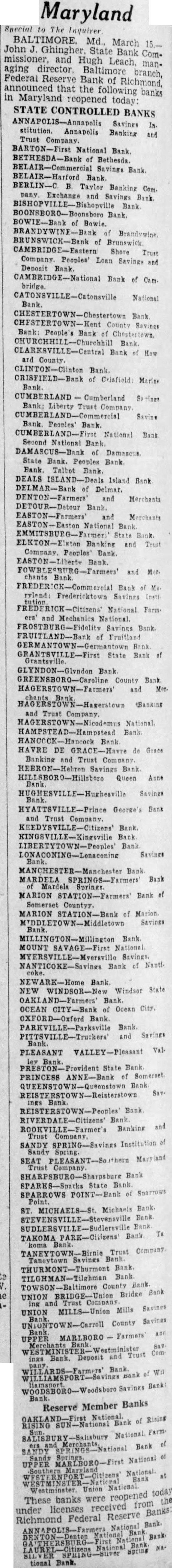

Maryland Special The BALTIMORE, Md., March John Ghingher State Bank Commissioner, and Hugh Leach, managing director. Baltimore branch, Federal Reserve Bank of Richmond, that the following banks in Maryland reopened today: STATE CONTROLLED BANKS Savings Annapolis Banking and Trust National Bank Savings Bank BELAIR-Harford Bank BERLIN-C. Taylor Banking Com Bank Bank BOWIE-Bank Bowie BRUNSWICK-Bank Brunswick Shore Trust Company. Peoples' Loan Savings and Deposit CAMBRIDGE-National Bank of Cam National Bank County Bank: People's Bank CLARKSVILLE-Central Bank of How CLINTON-Clinton Bank Crisfield Marine National Bank Second National Bank State Bank. Peoples Bank. Bank Bank. Island Bank and Merchants DETOUR-Detour EASTON-Farmers' and Merchants National Bank State Bank and Trust Bank CK-Commercial Bank of Ma National Farm and Mechanics Savings Bank FRUITLAND-Bank Fruitland Bank GRANTSVILLE-First State Bank of Bank Bank Trust National DE de Grace Banking and Trust Bank HILLSBORO-Hillsboro Queen Anne Savings HYATTSVILLE-Prince George's Bank and Company. Bank Bank Savings Bank MARDELA Bank MARION STATION-Farmers' Bank of Somerset MARION STATION-Bank Marion. Savings Bank SAVAGE-First WINDSOR-New Windsor State Bank OCEAN CITY-Bank Ocean City PITTSVILLE-Truckers' Savings PLEASANT VALLEY-Pleasant Val. State Bank PRINCESS Bank Bank Banking and SANDY SPRING-Savings Institution Maryland SEAT Bank SPARROWS POINT-Bank Sparrows ST. MICHAELS-St Michaels Bank Bank Bank Bank Ta PARK-Citizens Trust Company Bank Bank Bank UNION Mills UNIONTOWN-Carroll County Savings Bank Reserve Member Banks National Bank National UPPER Union today reopened These banks were the from licenses received Reserve Richmond Federal Bank Bank