Article Text

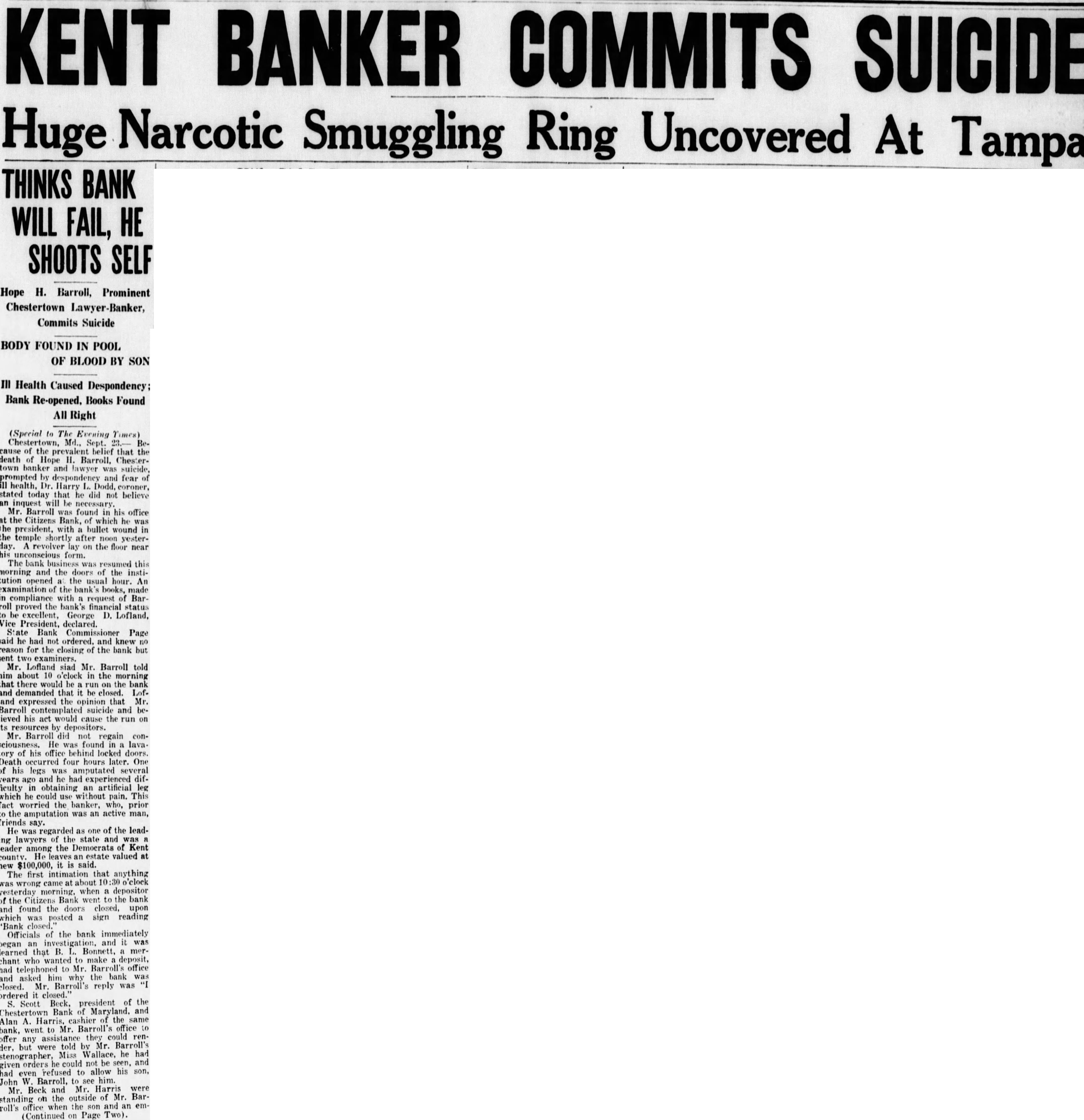

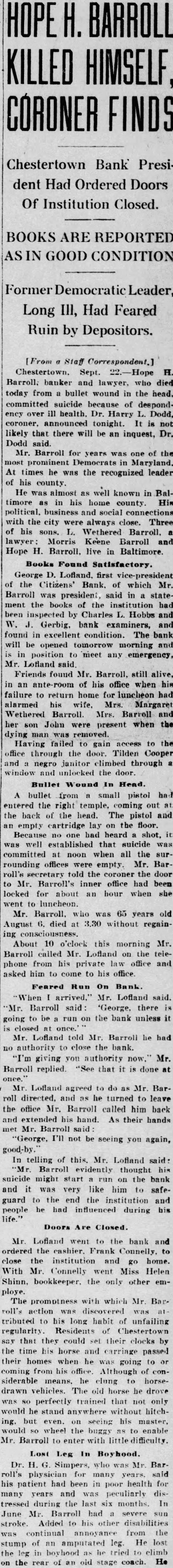

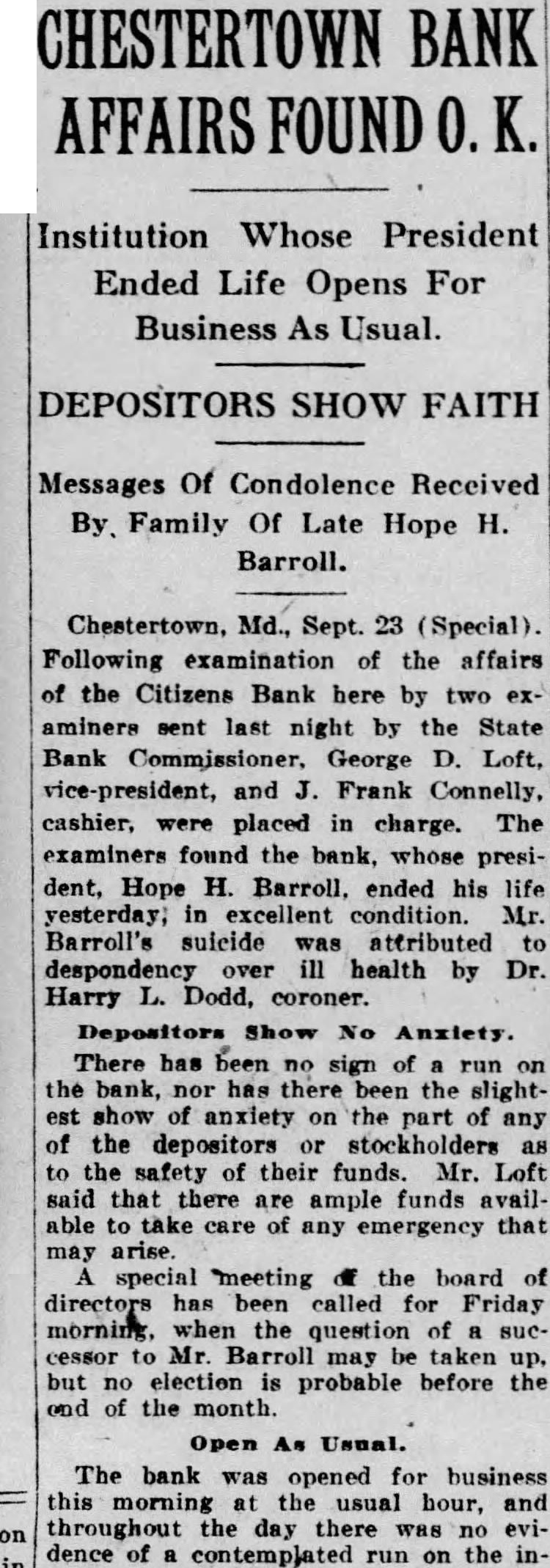

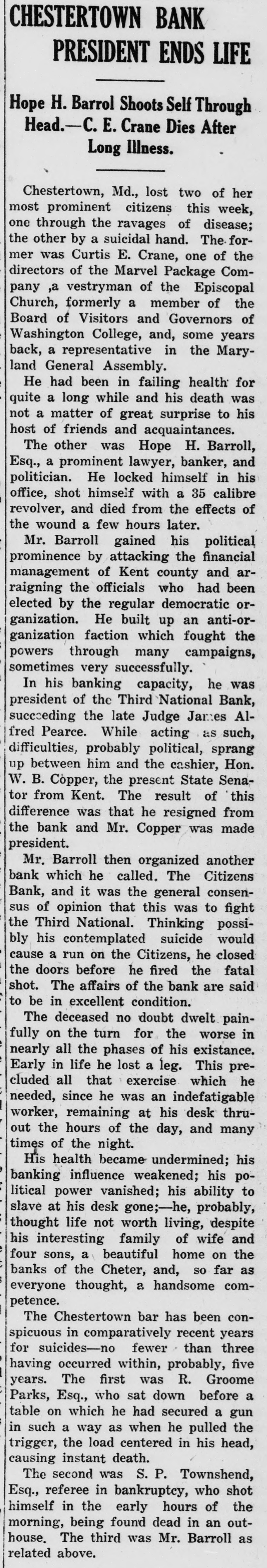

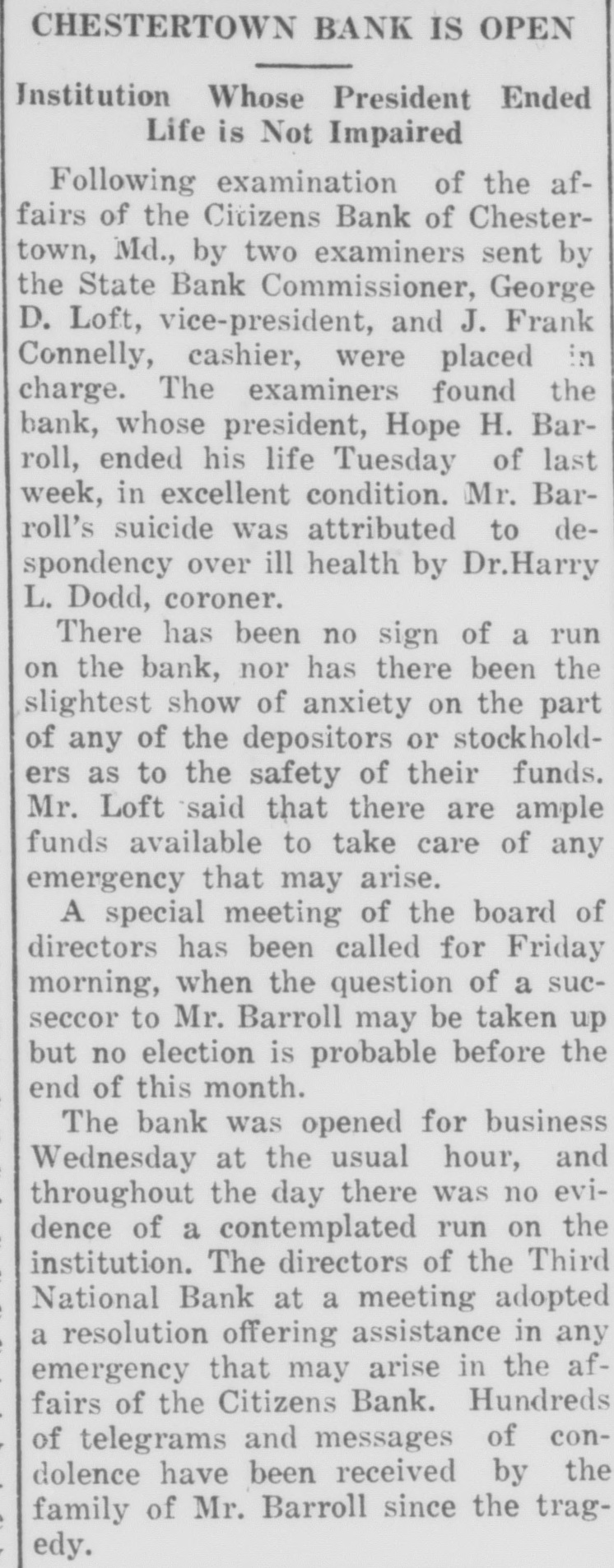

KENT BANKER COMMITS SUICIDE Huge Narcotic Smuggling Ring Uncovered At Tampa THINKS BANK WILL FAIL, HE SHOOTS SELF Hope H. Barroll, Prominent Chestertown Lawyer-Banker, Commits Suicide BODY FOUND IN POOL OF BLOOD BY SON III Health Caused Despondency; Bank Re-opened, Books Found All Right (Special to The Evening Times) Chestertown, Md., Sept. 23.- Because of the prevalent belief that the death of Hope H. Barroll, Chestertown banker and lawyer was suicide, prompted by despondency and fear of ill health, Dr. Harry L. Dodd, coroner, stated today that he did not believe an inquest will be necessary. Mr. Barroll was found in his office at the Citizens Bank, of which he was the president, with a bullet wound in the temple shortly after noon yesterday. revolver lay on the floor near his unconscious form. The bank business was resumed this morning and the doors of the institution opened the usual hour. An examination of the bank's books, made in compliance with a request of Barroll proved the bank's financial status to be excellent, George D. Lofland, Vice President, declared. State Bank Commissioner Page said he had not ordered. and knew no reason for the closing of the bank but sent two examiners. Mr. Lofland siad Mr. Barroll told him about 10 o'clock in the morning that there would be a run on the bank and demanded that it be closed. Lofland expressed the opinion that Mr. Barroll contemplated suicide and believed his act would cause the run on its resources by depositors. Mr. Barroll did not regain consciousness. He was found in lavatory of his office behind locked doors. Death occurred four hours later. One of his legs was amputated several years ago and he had experienced difficulty in obtaining an artificial leg which he could use without pain. This fact worried the banker, who, prior to the amputation was an active man, friends say. He was regarded as one of the leading lawyers of the state and was leader among the Democrats of Kent county. He an estate valued at new $100,000, it is said. The first intimation that anything was wrong came at about 10:30 o'clock yesterday morning, when a depositor of the Citizens Bank went to the bank and found the doors closed, upon which was posted a sign reading "Bank closed.' Officials of the bank immediately began an investigation, and it was learned that B. L. Bonnett, a merchant who wanted to make a deposit, had telephoned to Mr. Barroll's office and asked why the bank was closed. Mr. Barroll's reply was "I ordered it closed." S. Scott Beck, president of the Chestertown Bank of Maryland. and Alan A. Harris, cashier of the same bank, went to Mr. Barroll's office to offer any assistance they could render, but were told by Mr. Barroll's stenographer, Miss Wallace, he had given orders he could not be seen, and had even refused to allow his son, John W. Barroll, to see him. Mr. Beck and Mr. Harris were standing on the outside of Mr. Barroll's office when the son and an em(Continued on Page Two).