Article Text

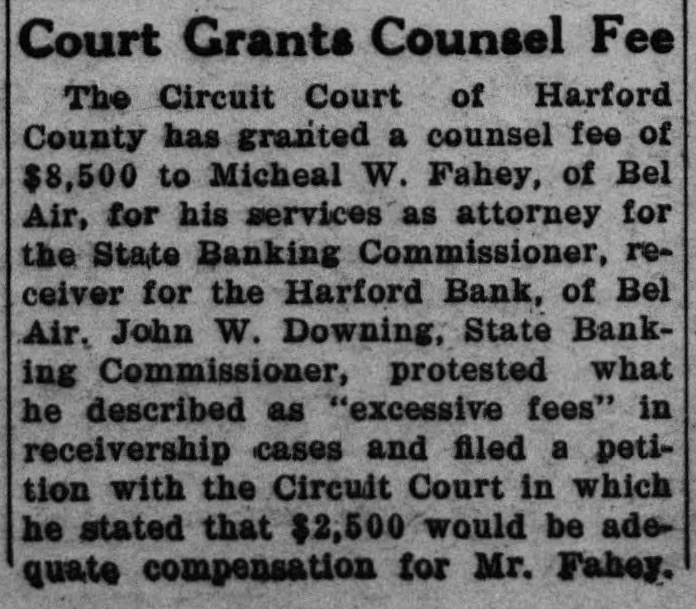

Court Grants Counsel Fee The Circuit Court of Harford County has granted a counsel fee of $8,500 to Micheal W. Fahey, of Bel Air, for his services as attorney for the State Banking Commissioner, receiver for the Harford Bank, of Bel Air. John W. Downing, State Banking Commissioner, protested what he described as "excessive fees" in receivership cases and filed a petition with the Circuit Court in which he stated that $2,500 would be adequate compensation for Mr. Fahey.