Article Text

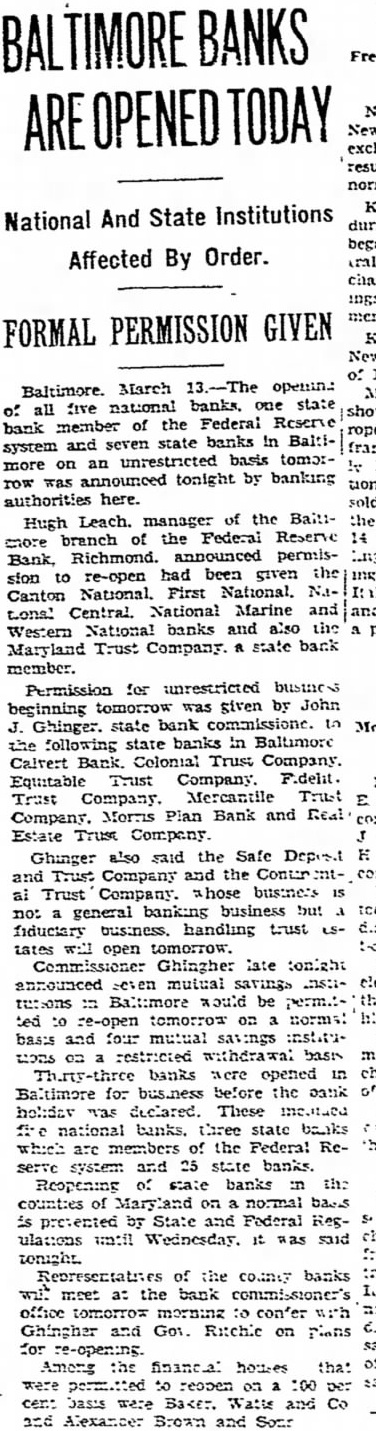

BALTIMORE BANKS TODAY National And State Institutions Affected By Order. PERMISSION GIVEN FORMAL o: all five national banks. one state bank member of the Federal Reserve system and seven state banks in Baltimore on an unrestricted basis tomo:row was announced tonight by banking authorities here. Hugh Leach. manager of the Bait:- the more branch of the Federal Reserve Bank, Richmond. announced permission to re-open had been given the Canton National. First National. N.ttonal Central. National Marine and Western National banks and also the Maryland Trust Company. state bank member. Permission for unrestricted business beginning was given by John J. Ghinger. state bank commissione. to the following state banks in Baltimore Calrert Bank Colonial Trust Company. Equitable Trust Company. F.delit. Trust Company. Mercantile Trust Company. Morris Plan Bank and Real Estate Trust Company Ghinger also said the Safe Deposit and Trust Company and the Conter mtai Trust Company. whose business is no: general banking business but fiductary business. handling trust tates open tomorrow. Commissioner Ghingher late tonight tutions = Baltimore would be permitted to re-open tomorrow on norms: his basis and four mutual savings institum. banks were opened in Baltimore for business before the bank holiday declared. These national three state banks which are members of the Federal Reserve system and 25 state banks. Reopening of state banks in the of Maryland on normal is presented by State and Federal Regulations until Wednesday. it was said Representatives of the county banks will meet at the bank commissioner's office tomorrow morning to Ghingher and Got. on for re-opening Among the financial houses that were to reopen on :00 per same. and Alexancer Brown and Son: