Article Text

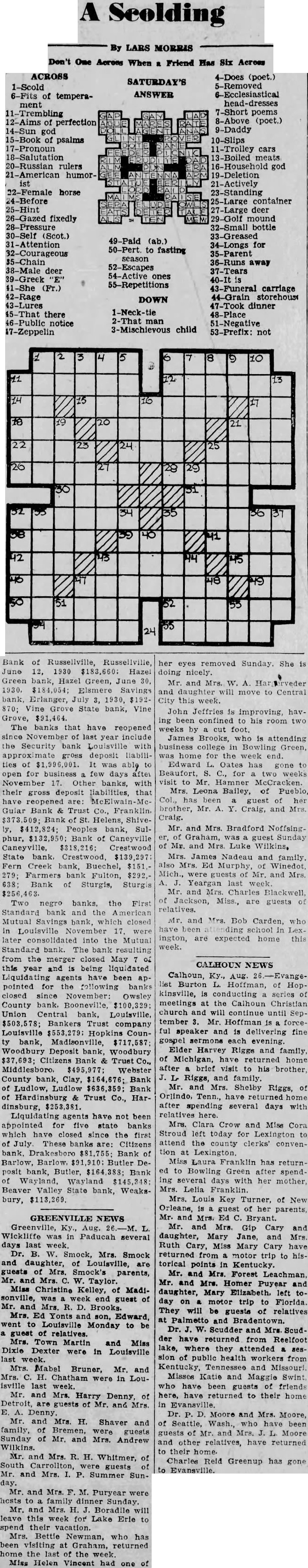

A Scolding

By LARS MORRIS Don't One Across When a Friend Has Six Across

ACROSS 1-Scold 6-Fits of temperament 11-Trembling 12-Aims of perfection 14-Sun god 15-Book of psalms 17-Pronoun 18-Salutation 20-Russian rulers 21-American humor-

22-Female horse 24-Before 25-Hint 26-Gazed fixedly 28-Pressure 30-Self (Scot.) 31-Attention 32-Courageous 38-Male deer 39-Greek "E" 41-She (Fr.) 42-Rage 43-Lures 45-That there 46-Public notice 17-Zeppelin

SATURDAY'S ANSWER

49-Paid (ab.) 50-Pert. to fasting season 52-Escapes 54-Active ones 55-Repetitions

DOWN

2-That man 3-Mischievous child

4-Does (poet.) 5-Removed 6-Ecclesiastical head-dresses 7-Short poems 8-Above (poet.) 9-Daddy 10-Slips 11-Trolley cars 13-Boiled meats 16-Household god 19-Deletion 21-Actively 23-Standing 25-Large container 27-Large deer 29-Golf mound 32-Small bottle 33-Greased 34-Longs for 35-Parent 36-Runs away 37-Tears 40-It is 43-Funeral carriage 44-Grain storehous 47-Took dinner 48-Place 51-Negative 53-Prefix: not

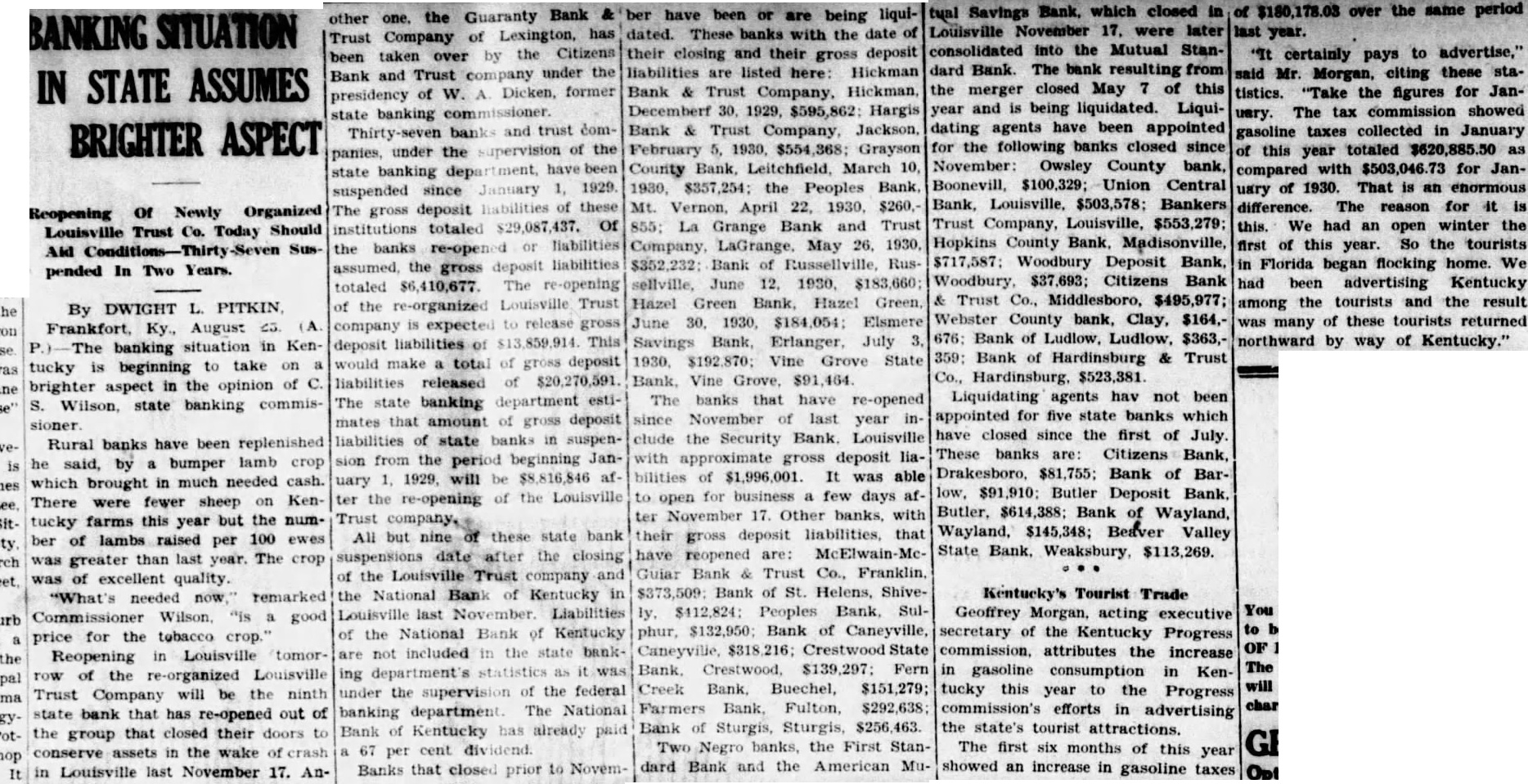

Bank of Russellville, Russellville, June 12, 1930 $183,660: Hazel Green bank, Hazel Green, June 30. 1930, $184,054; Elsmere Savings bank, Erlanger, July 3, 1930, $192870; Vine Grove State bank, Vine Grove, $91,464. The banks that have reopened since November of last year include the Security bank Louisville with approximate gross deposit liabilities of $1,996,001. It was able to open for business few days after November 17. Other banks, with their gross deposit liabilities, that have reopened are: McElwain-McGular Bank & Trust Co., Franklin. $373,509; Bank of St. Helens, Shively, $412,824; Peoples bank, Sulphur, $132,950; Bank of Caneyville Caneyville, $318,216; Crestwood State bank, Crestwood, $139,297 Fern Creek bank, Buechel, $151.279; Farmers bank Fulton, $292,638; Bank of Sturgis, Sturgis Two negro banks, the First Standard bank and the American Mutual Savings bank, which closed In Louisville November 17. were later consolidated into the Mutual Standard bank. The bank resulting from the merger closed May 04 this year and is being liquidated Liquidating agents have been appointed for the following banks closed since November: Owsley County bank. Booneville, $100,329: Union Central bank, Louisville, $503,578; Bankers Trust company Louisville $553,279: Hopkins County bank, Madisonville, $717,587 Woodbury Deposit bank, Woodbury $37,693; Citizens Bank & Trust Co., Middlesboro. $495,977; Webster County bank, Clay, $164,676; Bank of Ludlow, Ludlow $636,359; Bank of Hardinsburg & Trust Co., Hardinsburg, $253,381. Liquidating agents have not been appointed for five state banks which have closed since the first of July These banks are: Citizens bank, Drakesboro $81,755: Bank of Barlow, Barlow. $91,910: Butler Deposit bank, Butler, $164,388; Bank of Wayland, Wayland $145,348; Beaver Valley State bank, Weaksbury, $113,269.

GREENVILLE NEWS Greenville, Ky., Aug. 26.-M. L. Wickliffe was in Paducah several days last week. Dr. B. W. Smock, Mrs. Smock and daughter, of Louisville, are guests of Mrs. Smock's parents, Mr. and Mrs. C. W. Taylor. Miss Christine Kelley, of Madisonville, was week end guest of Mr. and Mrs. R. D. Brooks. Mrs. Ed Yonts and son, Edward, went to Louisville Monday to be a guest of relatives. Mrs. Town Martin and Miss Dixie Dexter were in Louisville last week. Mrs. Mabel Bruner, Mr. and Mrs. C. H. Chatham were in Louisville last week. Mr. and Mrs. Harry Denny, of Detroit, are guests of Mr. and Mrs. E. A. Denny. Mr. and Mrs. H. Shaver and family, of Bremen, were guests Sunday of Mr. and Mrs. Andrew Wilkins. Mr. and Mrs. R. H. Whitmer, of South Carrollton, were guests of Mr. and Mrs. I. P. Summer Sunday. Mr. and Mrs. F. M. Puryear were hcsts to family dinner Sunday Mr. and Mrs. H. J. Boradile will leave this week for Lake Erie to spend their vacation. Mrs. Bettle Newman, who has been visiting at Graham, returned home the last of the week. Miss Helen Vincent had one of her eyes removed Sunday. She is doing nicely. Mr. and Mrs. W. A. Har erveder and daughter will move to Central City this week. John Jeffries is improving, having been confined to his room two weeks by cut foot. James Brooks, who is attending business college in Bowling Green, was home for the week end. Edward L. Oates has gone to Beaufort, S. C., for two weeks visit to Mr. Hamner McCracken. Mrs. Leona Bailey, of Pueblo, Col., has been a guest of her brother, Mr. A. Y. Craig, and Mrs. Craig. Mr. and Mrs. Bradford Noffsinger, of Graham, was guest Sunday of Mr. and Mrs Luke Wilkins, Mrs. James Nadeau and family. also Mrs. Ed Murphy, of Winedot, Mich., were guests of Mr. and Mrs. A. Yeargan last week. Mr. and Mrs. Charles Blackwell, of Jackson, Miss., are guests of relatives. Mr. and Mrs. Bob Carden, who have been inding school in Lexington, are expected home this week.

CALHOUN NEWS

Calhoun, Ky., Aug. 26.-Evangelist Burton L. Hoffman, of Hopkinsville, is conducting series of meetings at the Calhoun Christian church and will continue until September 3. Mr. Hoffman is forceful speaker and is delivering fine gospel sermons each evening. Elder Harvey Riggs and family, of Michigan, have returned home after brief visit to his brother, J. L Riggs, and family. Mr. and Mrs. Shelby Riggs, of Orlindo, Tenn., have returned home after spending several days with relatives here. Mrs. Clara Crow and Mise Cora Stroud left today for Lexington to attend the county clerks' convention at Lexington. Miss Laura Franklin has returned to Bowling Green after spendIng several days with her mother, Mrs. Lelia Franklin. Mrs. Louis Key Turner, of New Orleans, is a guest of her parents, Mr. and Mrs. Ed C. Bryant. Mr. and Mrs. Gip Cary and daughter, Mary Jane, and Mrs. Ruth Cary, Miss Mary Cary have returned from a motor trip to historical points in Kentucky. Mr. and Mrs. Forest Leachman, Mr. and Mrs. Homer Puyear and daughter, Mary Elizabeth. left today on motor trip to Florida. They will be guests of relatives at Palmetto and Bradentown. Dr. J. W. Scudder and Mrs. Scudder have returned from Reelfoot lake, where they attended a session of public health workers from Kentucky, Tennessee and Missouri. Misses Katie and Maggie Swint. who have been guests of friends here, have returned to their home in Evansville. Dr. P. D. Moore and Mrs. Moore, of Seattle, Wash., who have been guests of Mr. and Mrs. J. L. Moore and other relatives, have returned to their home. Charles Reid Greenup has gone to Evansville.