Click image to open full size in new tab

Article Text

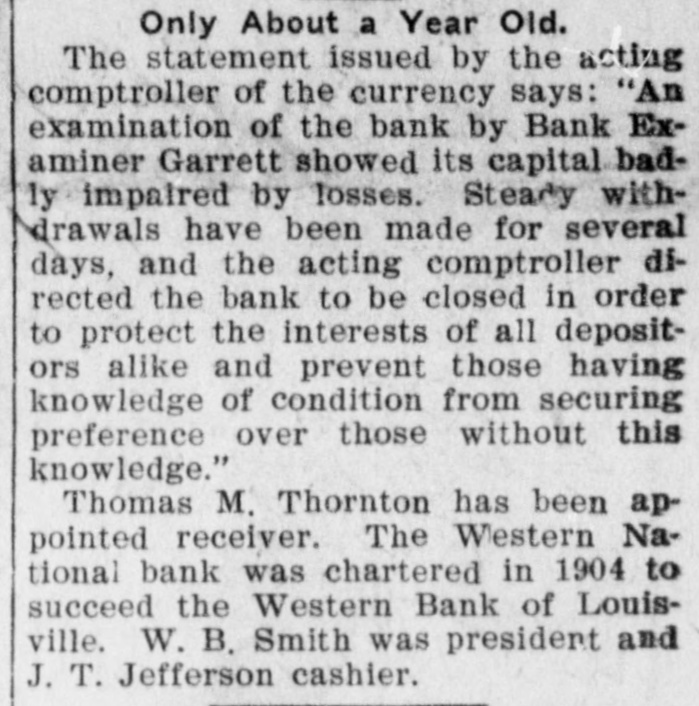

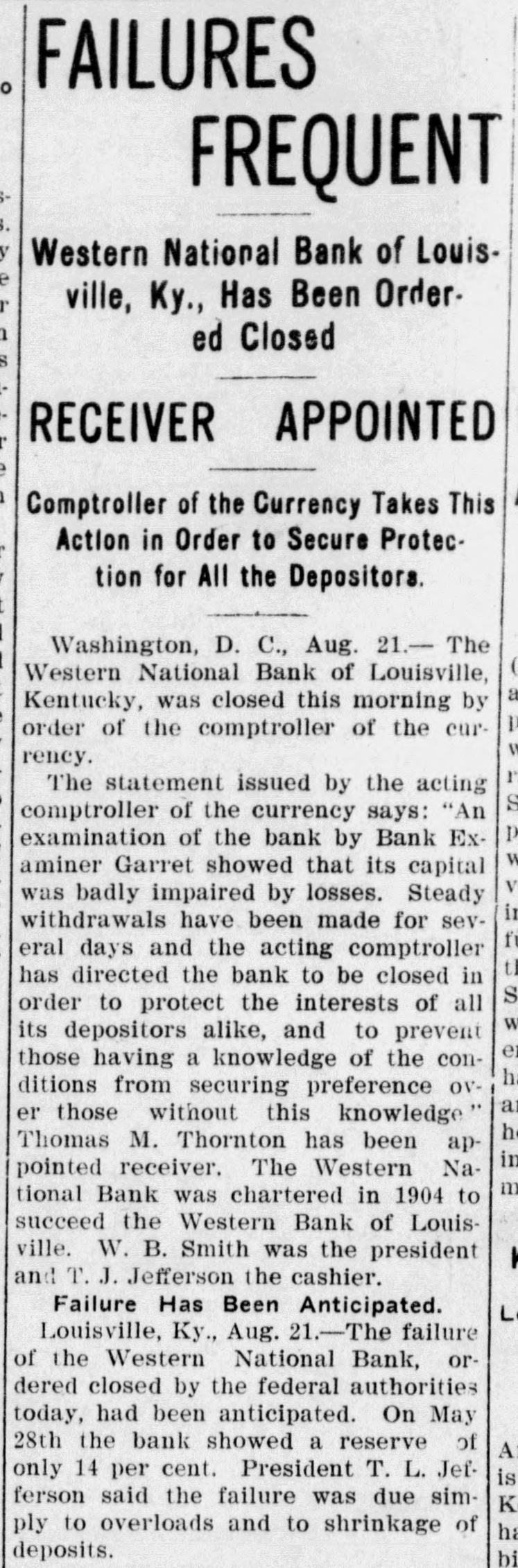

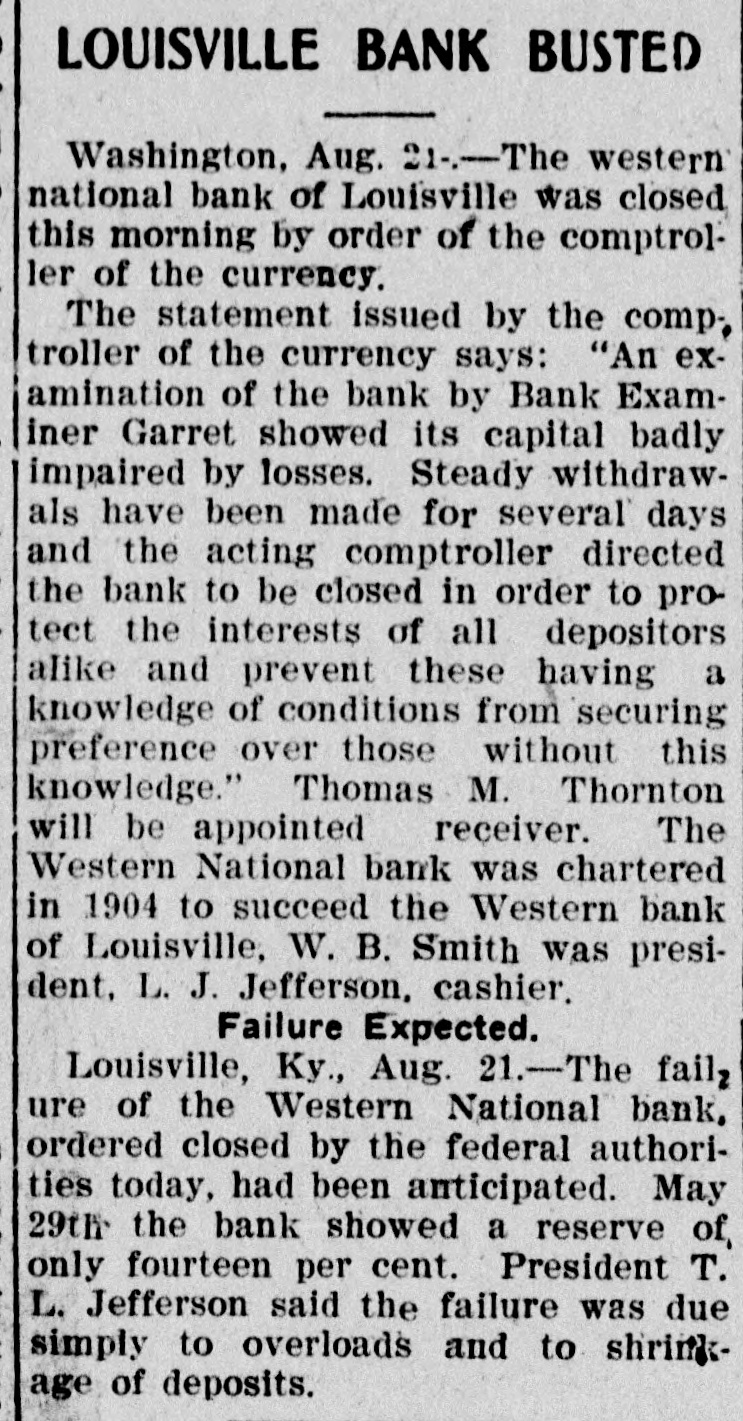

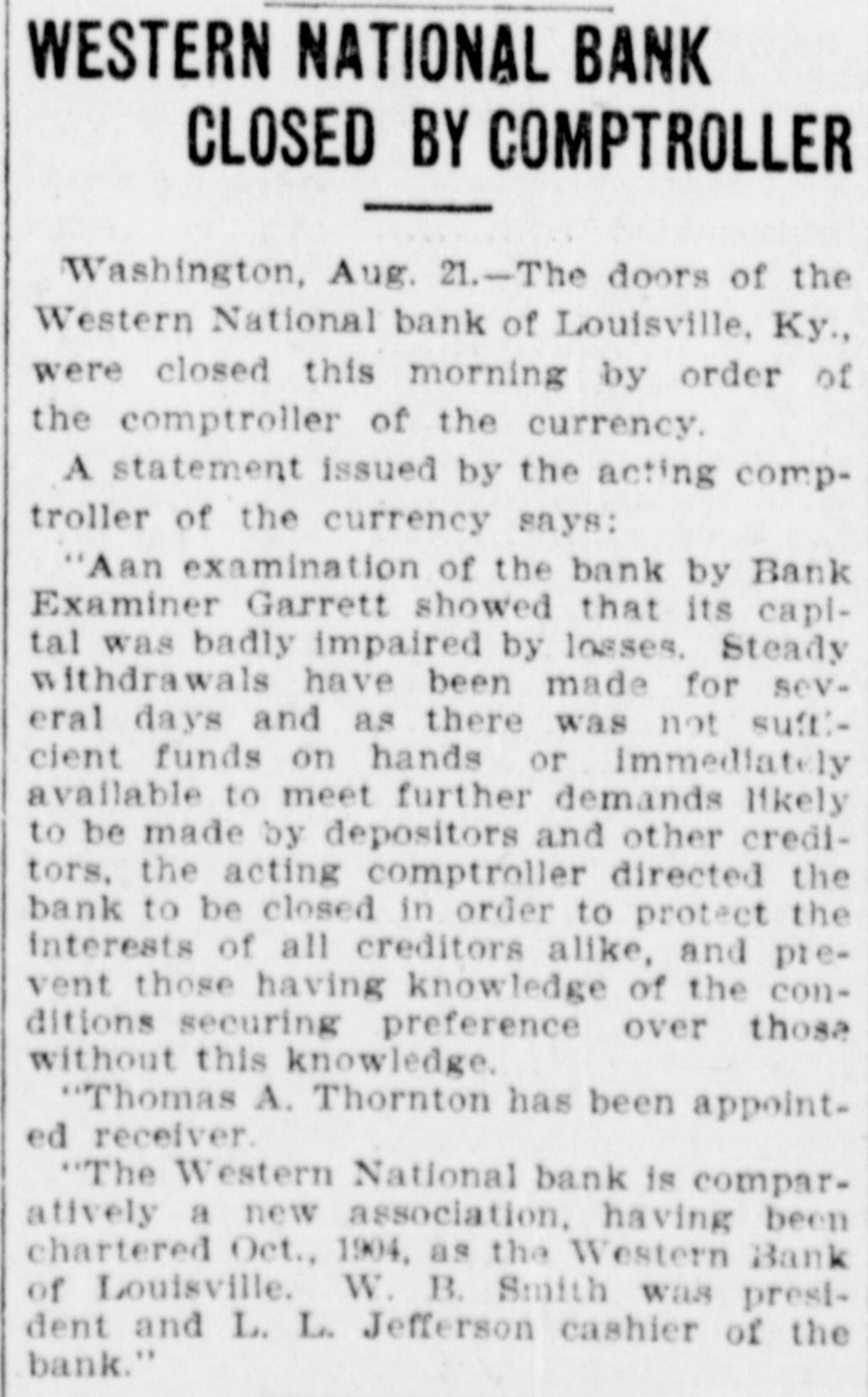

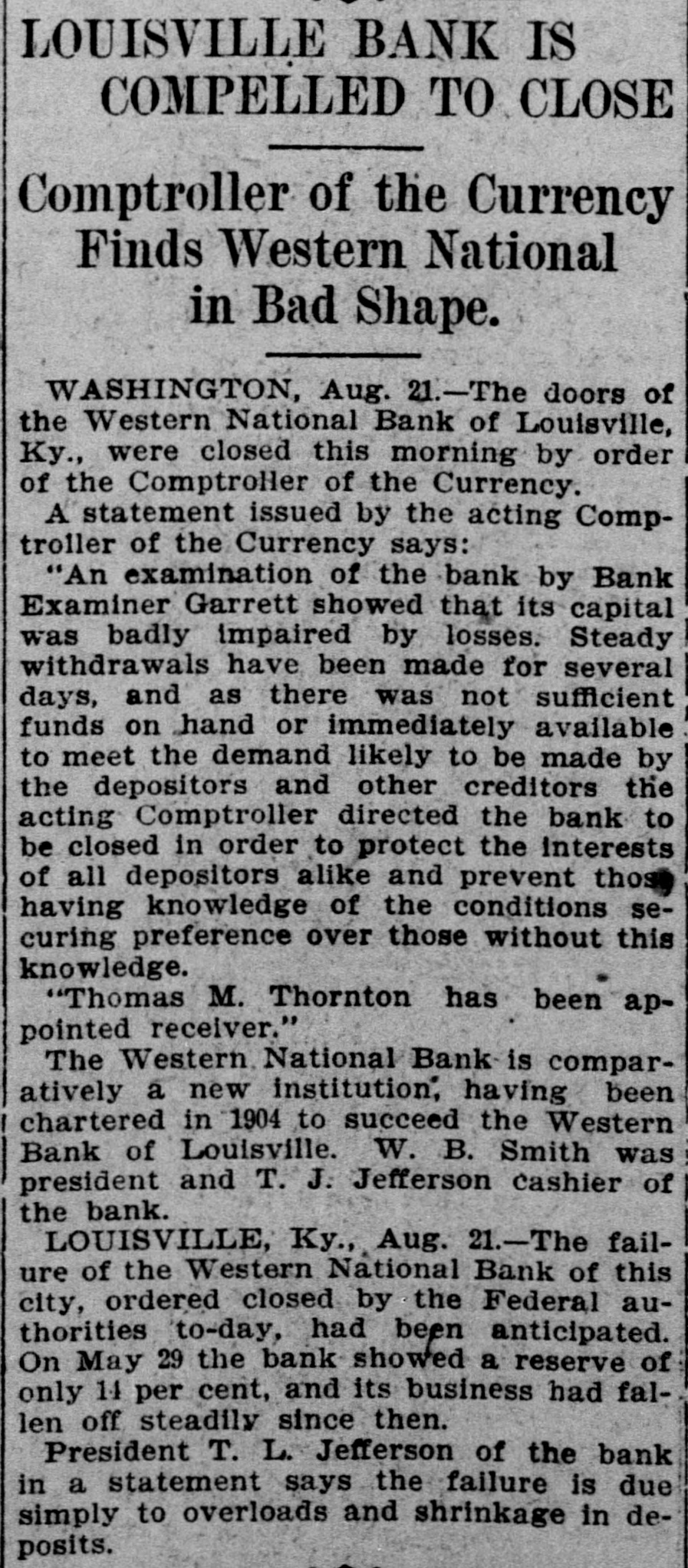

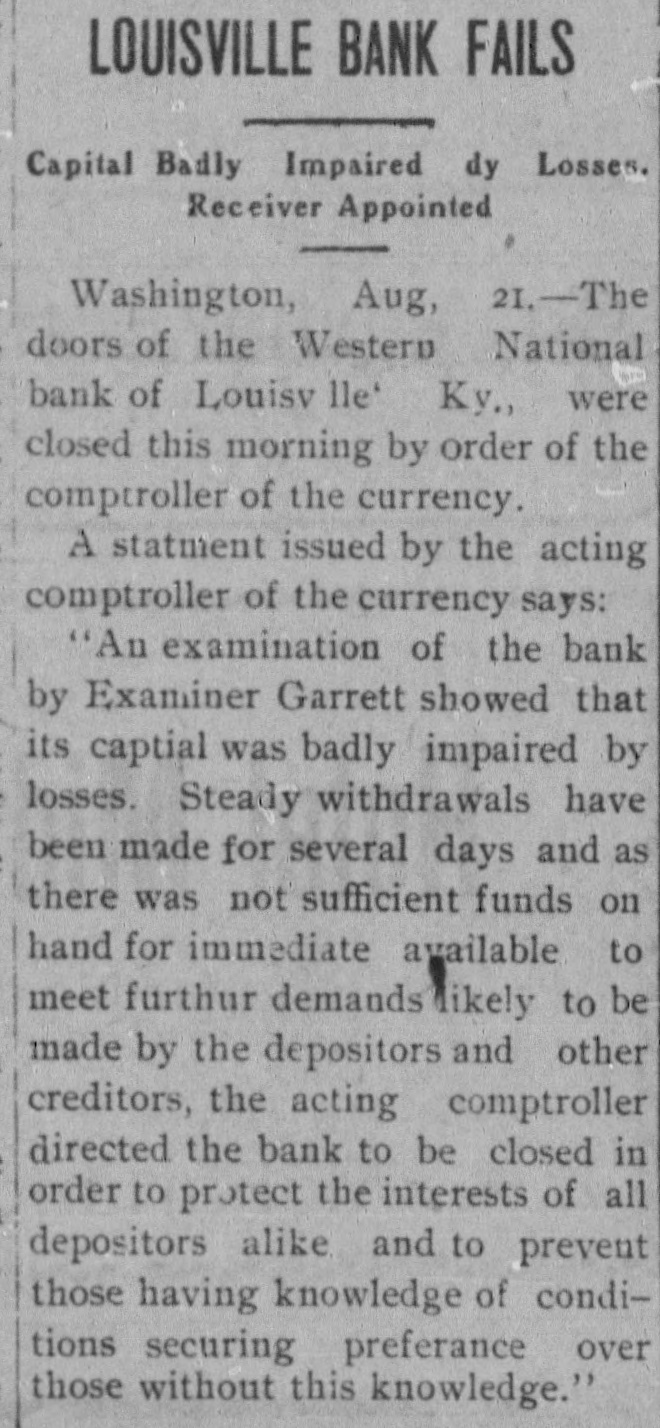

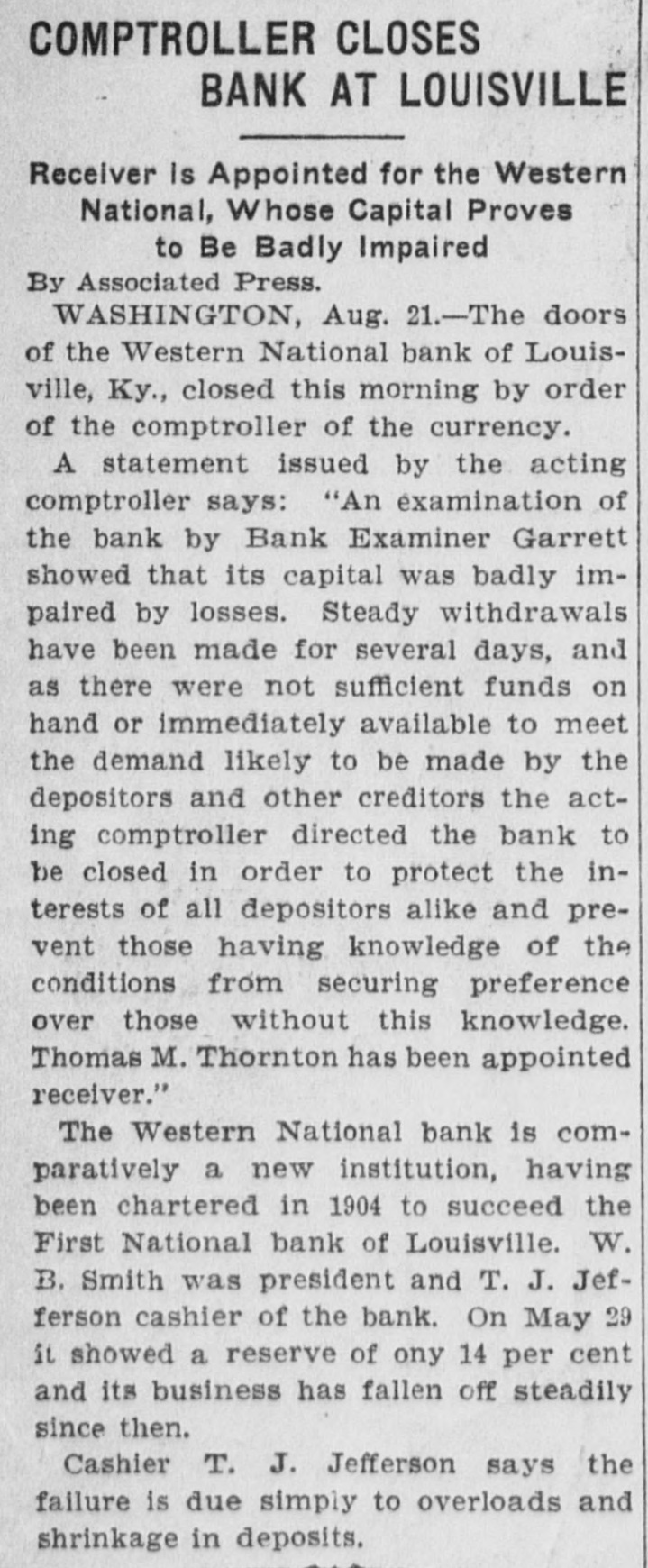

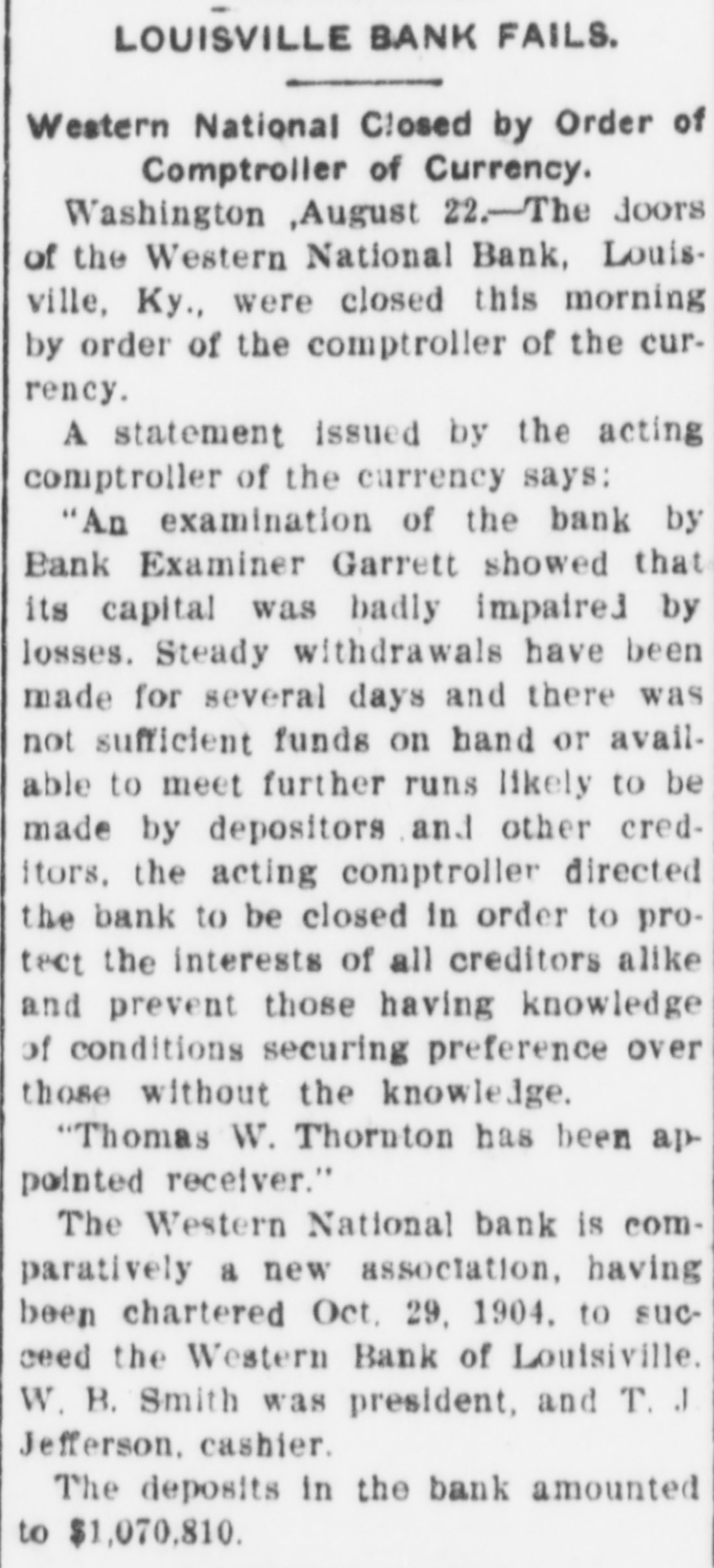

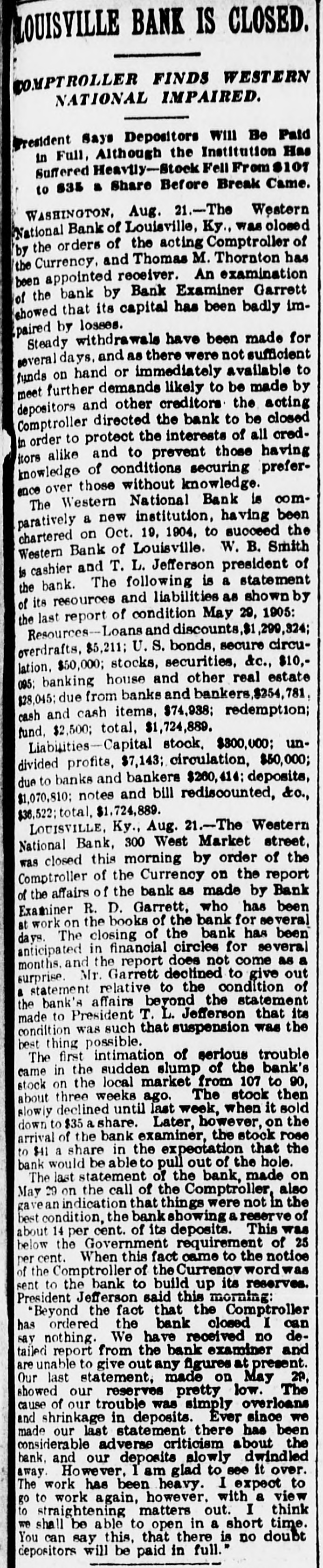

LOUISVILLE BANK IS CLOSED. COMPTROLLER FINDS WESTERN NATIONAL IMPAIRED. President Says Depositors will Be Paid in Full, Although the Institution Has Suffered Heavtly-Stock Fell From $107 to 835 a Share Before Break Came. WASHINGTON, Aug. 21.-The Western National Bank of Louisville, Ky., was closed by the orders of the acting Comptroller of the Currency, and Thomas M. Thornton has been appointed receiver. An examination of the bank by Bank Examiner Garrett showed that its capital has been badly impaired by losses. Steady withdrawals have been made for severaldays. and as there were not sufficient funds on hand or immediately available to meet further demands likely to be made by depositors and other creditors the acting Comptroller directed the bank to be closed in order to protect the interests of all creditors alike and to prevent those having knowledge of conditions securing preference over those without knowledge. The Western National Bank is comparatively a new institution, having been chartered on Oct. 19, 1904, to succeed the Western Bank of Louisville. W. B. Smith is cashier and T. L. Jefferson president of the bank. The following is a statement of its resources and liabilities as shown by the last report of condition May 29, 1905: Resources-Loans and discounts, 1,299,324; overdrafts, $5,211; U. S. bonds, secure circulation. $50,000; stocks, securities, &c., $10,095; banking house and other real estate $28,045; due from banks and bankers, cash and cash items, $74,938; redemption; fund, $2,500; total, $1,724,889. Liabilities-Capital stock. $800,000; undivided profits, $7,143; circulation, $50,000; due to banks and bankers $260,414: deposits, $1,070,810; notes and bill rediscounted, &o., $36,522; total, $1,724,889. LOUISVILLE, Ky., Aug. 21.-The Western National Bank, 300 West Market street, was closed this morning by order of the Comptroller of the Currency on the report of the affairs of the bank as made by Bank Examiner R. D. Garrett, who has been at work on the books of the bank for several days. The closing of the bank has been anticipated in financial circles for several months. and the report does not come as a surprise. Mr. Garrett declined to give out a statement relative to the condition of the bank's affairs beyond the statement made to President T. L. Jefferson that its condition was such that suspension was the best thing possible. The first intimation of serious trouble came in the sudden slump of the bank's stock on the local market from 107 to 90, about three weeks ago. The stock then slowly declined until last week, when it sold down to $35 a share. Later, however, on the arrival of the bank examiner, the stock rose to $41 a share in the expectation that the bank would be able to pull out of the hole. The last statement of the bank, made on May 29 on the call of the Comptroller, also gave an indication that things were not in the best condition, the bank showing a reserve of about 14 per cent. of its deposits. This was below the Government requirement of 25 per cent. When this fact came to the notice of the Comptroller of the Currenov word was sent to the bank to build up its reserves. President Jefferson said this morning: "Beyond the fact that the Comptroller has ordered the bank closed I can say nothing. We have received no detailed report from the bank examiner and are unable to give out any figures at present. Our last statement, made on May 29, showed our reserves pretty low. The cause of our trouble was simply overloans and shrinkage in deposits. Ever since we made our last statement there has been considerable adverse criticism about the bank, and our deposits slowly dwindled away. However, 1 am glad to see it over. The work has been heavy. I expect to go to work again, however. with a view to straightening matters out. I think we shall be able to open in a short time. You can say this, that there is no doubt depositors will be paid in full.'