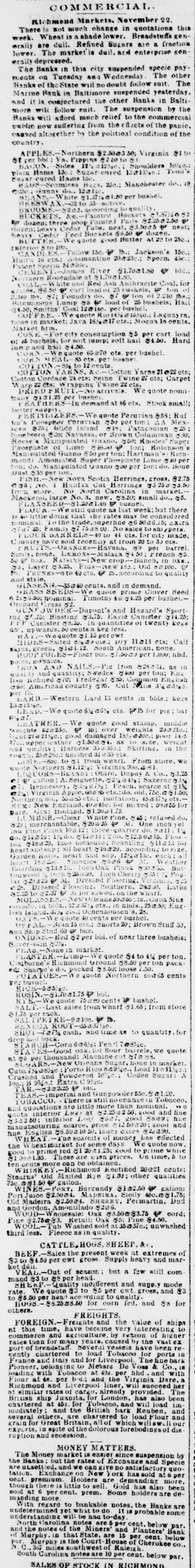

Article Text

erally are dull. Refined Sugars are a fraction lower. The marketis duil, and enterprise gen erally depressed. The Banks in this city suspended specie pay. ments on Tuesday and Wednesday The other Banks of the State will no doubt follow suit. The Marine Bank in Baltimore suspended yesterday. and it is conjectured the other Banks in Baltimore will follow suit. The suspension by the Banks will afford much relief to the commercial public now suffering from the flects of the panic, caused altogether by the political condition of the country. APPLES.- Northern $2.50@3.50 Virginia $1 to St per bbl: Va. Pippins $26010 01 BACON. Sides Shoulders 1040.: pisin Hams 13c.: Sugar cured Tood's Hams 100. cured Cover -Seamiess Bags. 25c.: Manchester do., 19 Gunny do.: 12alic. hite per bushel. BEESW -32 to 33- active. BROOMS S203. according toquality BUCKETS. &e.-Painted Buckets 87360 52 - dozen; three ROOP Painted Pails $2.25 a 2.50 W dozen: heavy Cedar Tubs, neat. 50 as * nest; heavy Cedar Feed Buckets $6.50 W dozen. BU CTER. We quote good Butter at zu to 25c.; inferier CANDL to Tallow 150 W 15.: Jackson's 15c.; Hull's 16 ets.: Adminantine 20a23c.: Sporm 45c 540000. Sperm Patent CEMENT -James River $1.70am1.80 V bbl.; N thern Rosendale at White and Red Ash Anthracite Coal. for as. 86 50 # eart load of bushels. # ton 2.240 IDS 87; Foundry do. 87 $ ton 240 168.; Bitominous Lump 20 W load of 25 bushels: Hail $4.00 Smiths Coal 12@14c. per bushel. COFFEE. W quote 16%0.; Laguay ra, none in market: Java ets.; Moena 10 cents. Market hrm. COKE city consumption $5 per cart load o: 25 bushels. for soit lump; soft hail $4.50. Hard $4.50. hail and lung CORN quote 65 a 70 ets per bashel CORN ЧЕЛЬ 85 ets per busher TON to 12 cents COTTON YARNS, Cotton Yarms 1022 cts; Cotton Cordage 24 cts: Neine Twine 27 ets; Carpet cts: rapping Twine 22 ets. DRIED arrivals. We quote nomi busher per $101.25 mally In demand at 46 ets. Stock small; TILIZE We quote Peruvian 858: Ruf has Phospher Perovian $50 per ton AA Mex1088 $25; blide Istand WIS: Patagonian 825 Nombrero $30 Navassa. or Brown Columbian $30; Recse's Manipalated Guano, you: Rhodes Super Phosphate of Lime 46.50 $ ton; Robinson's Manipulated Guano Stoper ton: Hartman Richmond) Amonia Super Phosphate Lane 10 per ton; do. Manipulated Quano DOU per ton: do. Bone Dust 535 per FISH.- New Nova Scotia Herrings, gross, 82.75 000 NO. Hanfax Cut Herrings 13 25 a $3.50 from store No North Carolina in market. Mackerel, large No. new $8.50; small do., $5. FLA 200 # busnet FLOU a We still quote as last week: but there is $0 little doing that the rates may be considered nominal Tothe trade, Superhae 06 exira STaT 25: Family 75a8.00 No sales to pers. FLOO R BARR to 44 cts. for city inade; C mutry have sold recently at from 20 to 35 ets. FRU Havana. #9 per barrel Sicity, none. LEMONS- Malaga 50; French 85 DU D.X. New erop Bunch in DXS $3, Layer $3.25. FIGS-1 183.; Old 80 V PRU ses-ate 40 ets. V 10. according to quality style. and cents. and in demand. GRASS quote prime Clover Seed $2,50.50; nominal. Tunothy 4" $4.25 per bushel.Orchard GUN Dupont's and Hazard's Sport 106 of .76; Blasting $3.75 Eakie Canister $14.25; FFF Canister $8.20 In quantities of twenty kess as upwards, DU cents keg less. Wequote 0 15 per cwt HIDES- Salted Dry 11a13 ets; Call SKINS, $101.12 South American, none. HOOP POL tour DDI. . .50 $ per 1,000; hhd. nosales. poles, RUN AND NAILS Pig Iron as in qual and quantity Swedes $400 per ton; Enz lish Rehned $70; Fredegar $80; English S60: Amc country $95. Cut Valis 03/13 per LARD Western Lard 13 cents in bbls.; kegs 13:21:40 LEAD. We quote ets. WA for PIX bar 6%07 ATHER We quote good stamp. middle weights F 10; over weights 200210.; Fight 21%c.; good damaged poor 140 upper teather as 10 size weight and Harness 35a Skirting. in the 31 018 timished 25m25c roug -850 to from worrt. From store, we Quote Northern $1.12 Virginia 90c.0 ORS- Otard, Dupuy & Co., $3.25 $ callon Seignette, Sazerac hennessey Peach scarce 02% Virginia Apple our old 75c. $1.00; 35455 4544 ets.RUM New England 40 a 45e for mixed 512555 for Holland. Date MBER -Clear White Pine. SW: refused do. S29 merchantable, $200.25 to M. One men yet low 100 three do. 9all 1% 814mlo; $12.50.a15. Floo $18420, 1200 measure 16 for heart sap all heart $16 620. according Garden Rans, heart and sap. each Shingles 2006 # Weather Boarding $13.10 OAK But teawood Cherr Pop at $21425 # M. Dressed Flooring, ex. Dressed Flooring, Southern. 28.000. Laths to $2.37 P for sawed. on the whart. MOLASSES.- Mus eovado,in bids.. 32a375 ets., in hinds. 25 m 30; English ets.; Ochenne 28. quote 40 cents per bushel OF ets.: Shorts 20; Brown Stuff 30. bus. $ 60 Staff and ONIONS- Red $2 per bbl. of near three bushels; 8 skin 22% PEAS.-None in market PLASTER quote S4 to 4% per ton. Richmond Ground $8.50 per ton pack ed: Sharpe packed $8.50; loose 7.50. quote Northern cents per busnet. ROSIN. + bol. RYE.-We quote Surrements IF bushel. SALT.-- Last sales from wharf 81 60; from store $1.75 per sack. to. SAI SENECA ROOT SHOT Talk cash, and time is to quantity for drop 6064: Pearl 708%c. STA ES-Good OAK 101 Hour barrels, we quote at 00 per thousand: Machine cut STANS. Urieans Sugar, none in market. Cuba Porto Rico 84940. Load 10 Crushed and Powdered 10910.; Codee Sugar: A 100.; 9340.; Extra 9%0. R.-$2025 P DUL and Gunpowder5 TOBACCO. Thereis Tobacco, and quotations are little more than nominal. we quots interior Lugs at 50. good and fine $34350; inferior Soal. good 8809; has manufacturing scaree, price g and fine English 36.50 a 10 50. lane) cases $2,090. THEAT -The acaroity of money has effected the /heatmarket for some days We quotenow, good prime red 81 2021.25; good to time while These are ush prices. On time, 5 to ten more can be obtained. WHISKEY Richmond Rectified 20021 cents: Stearns' Old Maited Rye $1.00; other qualities 50 75c gallon. 3 WINES. Burgundy $102.50 # gallon: Juice $2.50m4. MADEIRA. 460.0$1.7 Old Madeira $2.50 04. SHERRY, Permartin, Duff and Gordon, Amontilado $206. Wholesale: Oak $3.50@$3.75 $ cord; Pine $2.75@83. Retail: Oak $5; Pine $4.50. WOOL.-1 Washed sold 35037c.; unwashed third less. Fleece as in quality. CATTLE,HOGS, SHEEP, &c. BEEF -Sales the present week at extremes of $4.50 per cwt gross Supply heavy and market EAL. dull. -Out of season but a few still com head. to per mand SH Quality indifferent and supply mode rate. We quote $3 to 80 per ewt gross, and $3 to $5.50 per head ace rding to quality HOGS $8.25.a8.50 for corn fed. and 88 for others. FREIGHTS and the value of ships at this time, have become very interesting to commerce and agriculture, by reason of higher rates than for many years, caused by the vast ex port of breadstuff Several vessels have been re cently chartered to load Tobacco for ports in France and Italy and for Liverpool. The finebark Pioneer belonging to Messrs De Voss & Co., 18 loading with Tobacco at 40a. per hhd. and with Flour at 48. per bot; and the Virginia Dare, a Richmond and Liverpool liner, will succeed her at similar rates of cargo, already provided. The British ship Juanita, for London, has also been chartered at 45s. for Tobacco, and will load un mediately and the British bark Reuben, and several others, are chartered to load Flour and grain Great Britain, allof which our exports, in spite dolorous forebodings of dis ruption and secession. MONEY MATTERS. The Money market easier since suspension by the Banks: but the rates of Exchange and Specie utsett and we no satisfactory quotation. Exchange New York has sold at per Gent. premium Holders are demanding more, though there little to sell. Gold has also been sold at 6 per cent. prem. Some holders are demanding more With regard to bankable notes, the Banks are undetermined yet what do 18 probable some understanding will be had to-day North Carolina notes are per cent. below par. the notes of the Miners' and Planters'