Article Text

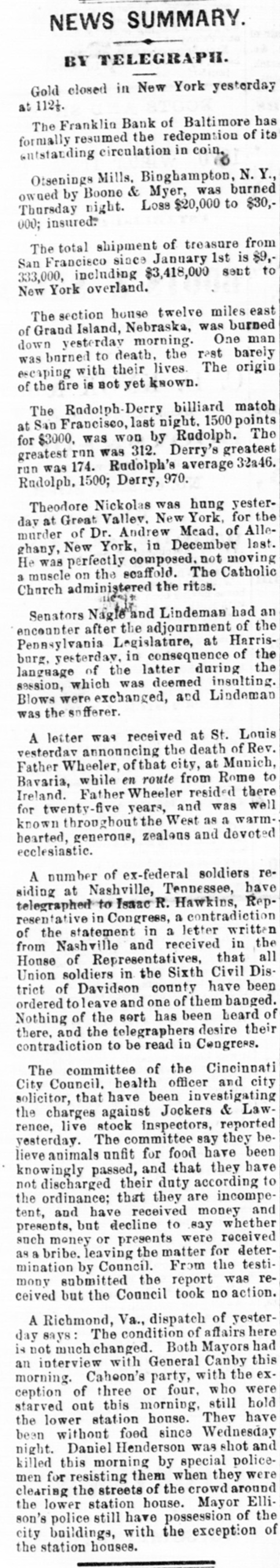

NEWS SUMMARY. BY TELEGRAPH. Gold closed in New York yesterday at 112t. The Franklin Bank of Baltimore has formally resumed the redepintion of its untstanding circulation in coin. 6 Otsenings Mills, Bioghampton, N.Y., owned by Boone & Myer, was burned Thursday night. Loss $20,000 to $30,000; insured: The total shipment of treasure from San Francisco since January 1st is $9,333,000, including $3,418,000 sent to New York overland. The section house twelve miles east Island, Nebraska, was burned morning. man down of Grand yesterday One barely to death, the rest with their escaping was borned lives. The origin of the fire is not yet known. The Radolph-Derry billiard match at last night. 1500 points for was won by San $3000, Francisco, Rudolph. greatest The greatest ron was 312. Derry's run was 174. Rudolph's average 32a46. Rudolph. 1500; Derry, 970. Theodore Nickolas was hung yesterGreat Vallev. of Dr. Andrew day murder at New December Mead, York, of for Alle- last. the New York, in He was ghany, perfectly composed. The not Catholic moving a muscle on the scaffold. Church administered the rites. and Lindeman had an the encounter Senators after Nagle adjournment Harris- of the Legislature, at in consequence the burg, Penasylvania yesterday. of the language of the latter during which was Blows session, were exchanged, deemed and Lindeman insulting. was the sufferer. received at St. Louis the vesterdav A letter announcing was death of Rev. Wheeler, of that city, at Manich, while en route to Father Bavaria, from Rome Ireland. Father Wheeler resided there for twenty-five years, and was well known throughout the West as a warmhearted, generone, zealeus and devoted ecclesiastic. A number of ex-federal soldiers reat Nashville, Tennessee, have to Isaac R. siding telegraphed Hawkins, contradiction Rep. resentative in Congress, a in a and of from the Nashville statement received letter written in the all in the Dis Union House soldiers of Representatives, Sixth Civil that trict of Davidson county have been ordered toleave and one of them banged. Nothing of the sert has been heard of there, and the telegraphers desire their contradiction to be read in Congress. The committee of the Cincinnati City Council. health officer and city solicitor, that have been investigating the against Jockers & Lawlive stock inspectors, rence, charges reported they be. yesterday. The committee say unfit for and knowingly leve animals passed, food that have they have been to their duty the that are not discharged ordinance; they according incompe- and tent, have money but decline to say presents, and received received whether or presents were as the matter such bribe. money leaving for the deter- testimination by Council. From the remony submitted report took was action. ceived but the Council no A Richmond, Va., dispatch of yesterday says: The condition of affairs here is not much changed. Both Mayors had with General Canby this Caheon's party, exmorning. an interview four, with who the of three or were out this morning, station house. starved ception the lower They still have hold been without food since Wednesday night. Daniel Henderson was shot and by policethem were killed men for this resisting morning when special crowd they around the streets of the the station house. son's still have clearing lower police possession Mayor of Elli- the city buildings, with the exception of the station houses.