Article Text

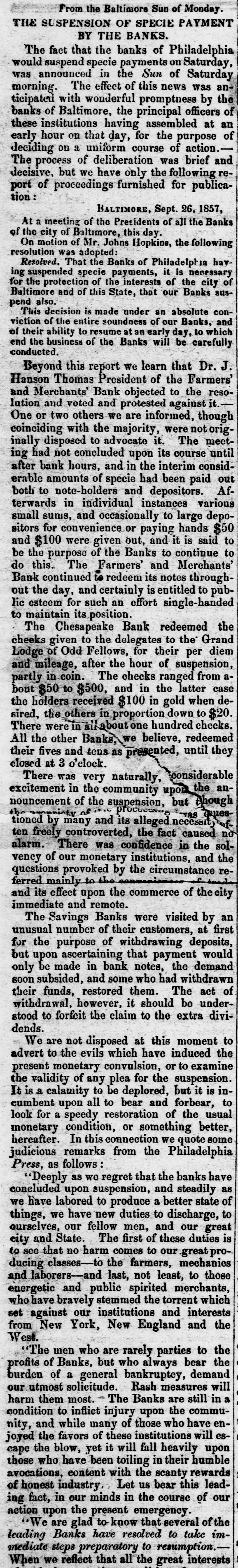

From the Baltimore Sun of Monday. THE SUSPENSION OF SPECIE PAYMENT BY THE BANKS. The fact that the banks of Philadelphia would suspend specie payments on Saturday, was announced in the Sun of Saturday morning. The effect of this news was anticipated with wonderful promptness by the banks of Baltimore, the principal officers of these institutions having assembled at an early hour on that day, for the purpose of deciding on a uniform course of action. The process of deliberation was brief and decisive, but we have only the following report of proceedings furnished for publication BALTIMORE, Sept. 26, 1857, At a meeting of the Presidents of all the Banks of the city of Baltimore, this day. On motion of Mr. Johns Hopkins, the following resolution was adopted: Resolved. That the Banks of Philadelph a having suspended specie payments, it is necessary for the protection of the interests of the city of Baltimore and of this State, that our Banks suspend also. This decision is made under an absolute conviction of the entire soundness of our Banks, and of their ability to resume at an early day, to which end the business of the Banks will be carefully conducted. Beyond this report We learn that Dr. J. Hanson Thomas President of the Farmers' and Merchants' Bank objected to the resolution and voted and protested against it.One or two others we are informed, though coinciding with the majority, were not originally disposed to advocate it. The meeting had not concluded upon its course until after bank hours, and in the interim considerable amounts of specie had been paid out both to note-holders and depositors. Afterwards in individual instances various small sums, and occasionally to large depositors for convenience or paying hands $50 and $100 were given out, and it is said to be the purpose of the Banks to continue to do this. The Farmers' and Merchants' Bank continued to redeem its notes throughout the day, and certainly is entitled to public esteem for such an effort single-handed to maintain its position. The Chesapeake Bank redeemed the cheeks given to the delegates to the Grand Lodge of Odd Fellows, for their per diem and mileage, after the hour of suspension, partly in coin. The checks ranged from about $50 to $500, and in the latter case the holders received $100 in gold when desired, the others in proportion down to $20. There were in air about one hundred checks. All the other Banks. we believe, redeemed their fives and tens as presented, until they closed at 3 o'clock. There was very naturally, considerable excitement in the community upon the announcement of the suspension, but though the of processing -728 questioned by many and its alleged necessity often freely controverted, the fact caused no alarm. There was confidence in the solvency of our monetary institutions, and the questions provoked by the circumstance referred mainly to the and its effect upon the commerce of the city immediate and remote. The Savings Banks were visited by an unusual number of their customers, at first for the purpose of withdrawing deposits, but upon ascertaining that payment would only be made in bank notes, the demand soon subsided, and some who had withdrawn their funds, restored them. The act of withdrawal, however, it should be understood to forfeit the claim to the extra dividends. We are not disposed at this moment to advert to the evils which have induced the present monetary convulsion, or to examine the validity of any plea for the suspension. It is a calamity to be deplored, but it is incumbent upon all to bear and forbear, to look for a speedy restoration of the usual monetary condition, or something better, hereafter. In this connection we quote some judicious remarks from the Philadelphia Press, as follows "Deeply as we regret that the banks have concluded upon suspension, and steadily as we have labored to produce a better state of things, we have new duties to discharge, to ourselves, our fellow men, and our great city and State. The first of these duties is to see that no harm comes to our great producing classes-to the farmers, mechanics and laborers-and last, not least, to those energetic and public spirited merchants, who have bravely stemmed the torrent which set against our institutions and interests from New York, New England and the West. "The men who are rarely parties to the profits of Banks, but who always bear the burden of a general bankruptcy, demand our utmost solicitude. Rash measures will harm them most. - The Banks are still in a condition to inflict injury upon the community, and while many of those who have enjoyed the favors of these institutions will escape the blow, yet it will fall heavily upon those who have been toiling in their humble avocations, content with the scanty rewards of honest industry. Let us bear this leading fact, in our minds in the course of our action upon the present emergency. "We are glad to know that several of the leading Banks have resolved to take im-