Article Text

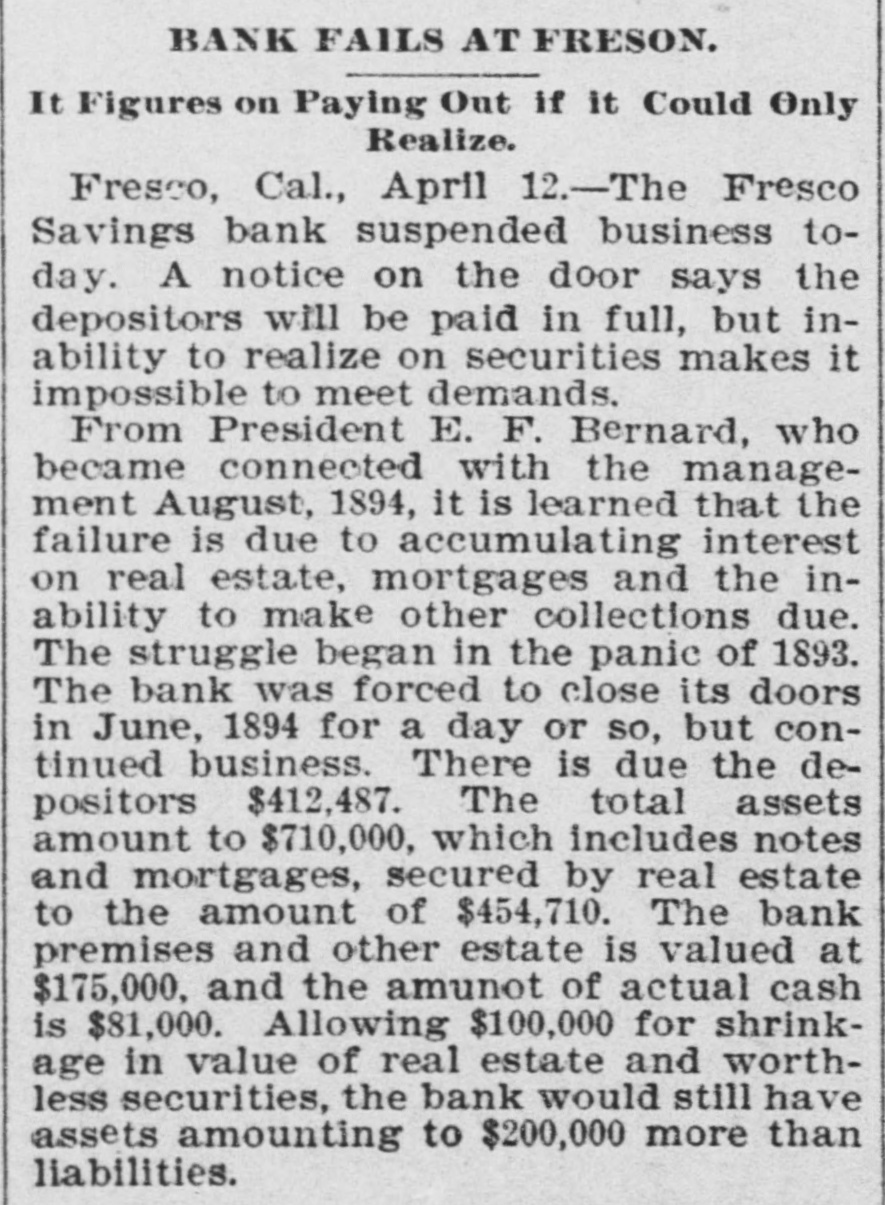

BANK FAILS AT FRESON. It Figures on Paying Out if it Could Only Realize. Fresco, Cal., April 12.-The Fresco Savings bank suspended business today. A notice on the door says the depositors will be paid in full, but inability to realize on securities makes it impossible to meet demands. From President E. F. Bernard, who became connected with the management August, 1894, it is learned that the failure is due to accumulating interest on real estate, mortgages and the inability to make other collections due. The struggle began in the panic of 1893. The bank was forced to close its doors in June, 1894 for a day or so, but continued business. There is due the depositors $412,487. The total assets amount to $710,000, which includes notes and mortgages, secured by real estate to the amount of $454,710. The bank premises and other estate is valued at $175,000, and the amunot of actual cash is $81,000. Allowing $100,000 for shrinkage in value of real estate and worthless securities, the bank would still have assets amounting to $200,000 more than liabilities.