Article Text

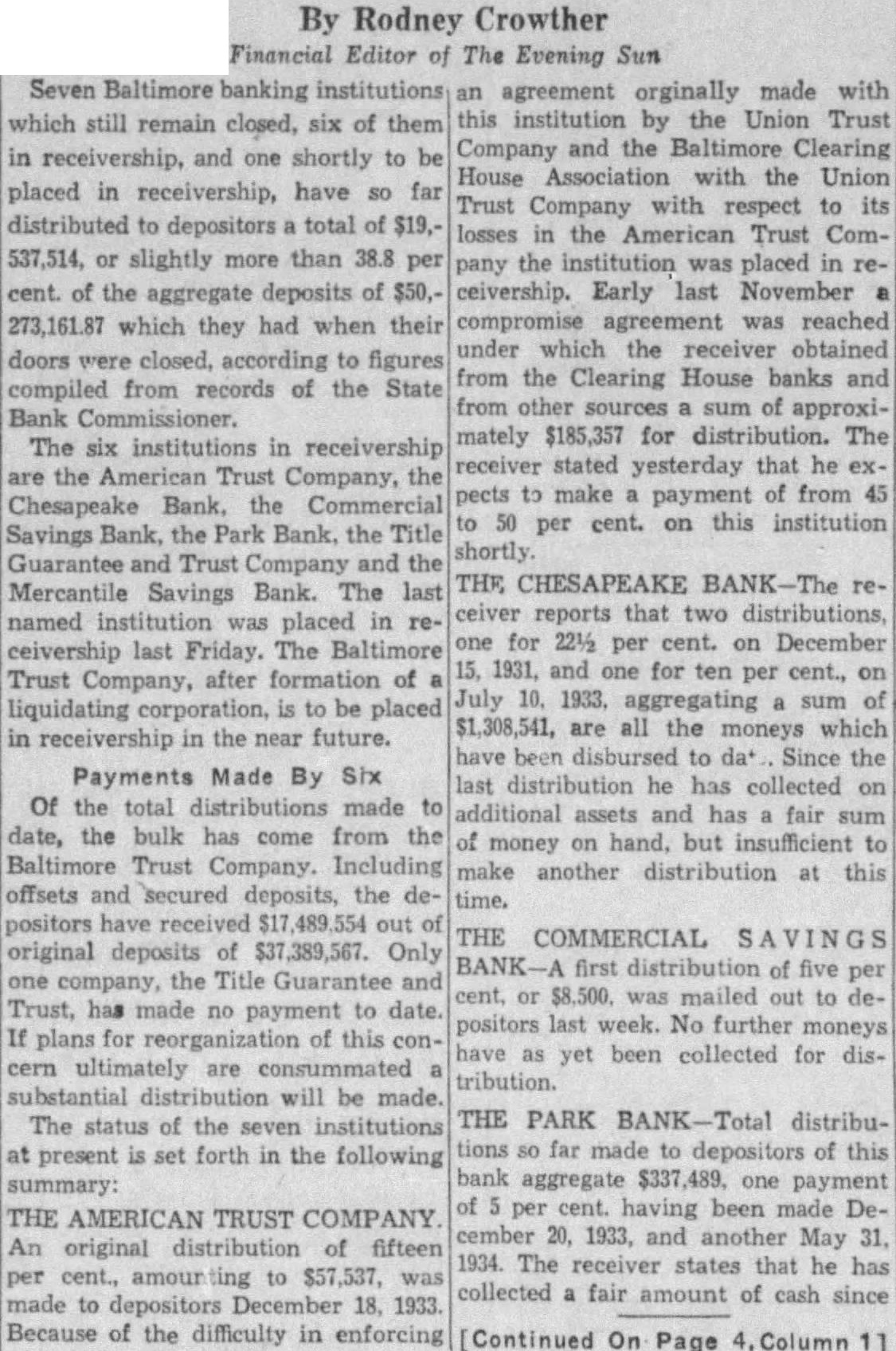

By Rodney Crowther Financial Editor The Evening Sun Seven Baltimore which remain closed, six of them in receivership, and one shortly to placed in receivership, have far distributed depositors total 537,514, slightly more than cent. of the aggregate deposits of 273,161.87 which they had when their doors to figures compiled from records the State The six institutions in receivership the American Trust Company, the Chesapeake the Commercial Savings Bank, the Park Bank. the Title Guarantee Trust Company and the Savings Bank. The last named placed in ceivership last Friday. The Baltimore Trust after of to be placed in in the near future. Payments Made By Six Of the total distributions made the bulk has come from the Baltimore Trust Company. Including offsets and secured deposits, the positors out original deposits $37,389,567. Only the Title Guarantee has If plans of this are will be made. The status of the seven institutions present set forth in the following summary: THE AMERICAN TRUST COMPANY An original distribution of fifteen amour to $57,537, 18, 1933. Because of the difficulty in enforcing agreement orginally made with institution the Union Trust Company and the Baltimore Clearing House Association with the Union Trust Company with respect to its losses in the American Trust Company the institution was placed in ceivership. Early last November compromise reached under which the receiver obtained from the Clearing House banks sources of approximately $185,357 for distribution. receiver stated yesterday that he pects make payment from per cent. on this institution shortly. THE CHESAPEAKE reports that distributions, for per cent. on December 1931, and one for ten cent., per aggregating are the moneys which have Since the distribution he has collected has fair money on hand, but another distribution this THE COMMERCIAL first distribution of five mailed out positors last week. No further yet been collected for tribution. THE PARK distribufar made depositors of this aggregate one payment per having been made 1933, and another May 1934. The receiver states that he collected fair amount of cash since [Continued On Page