Click image to open full size in new tab

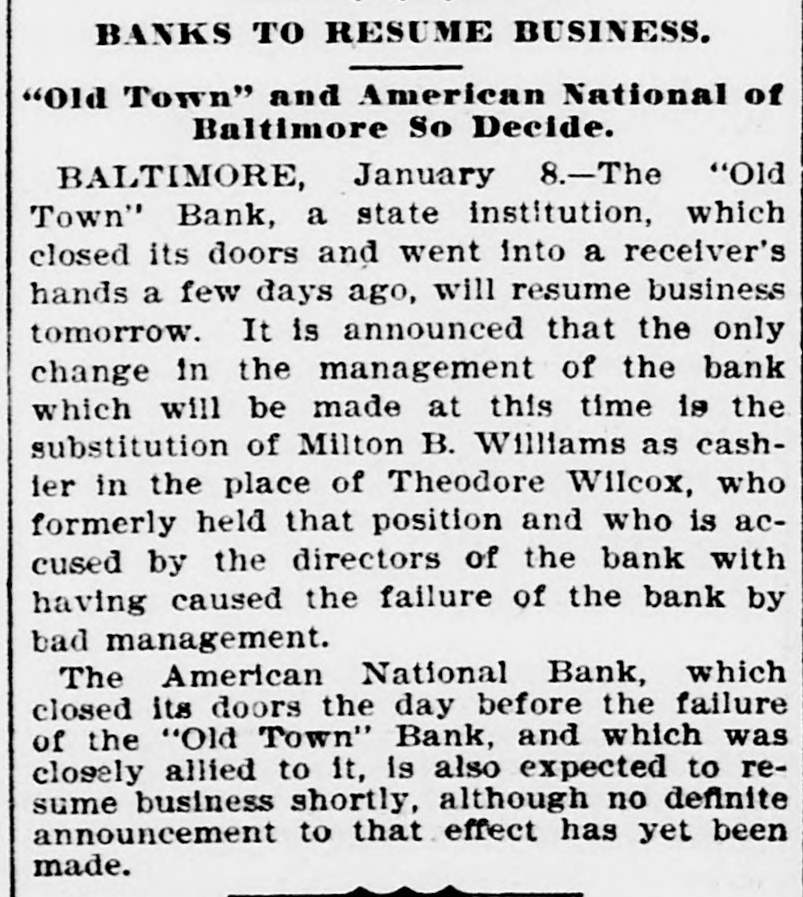

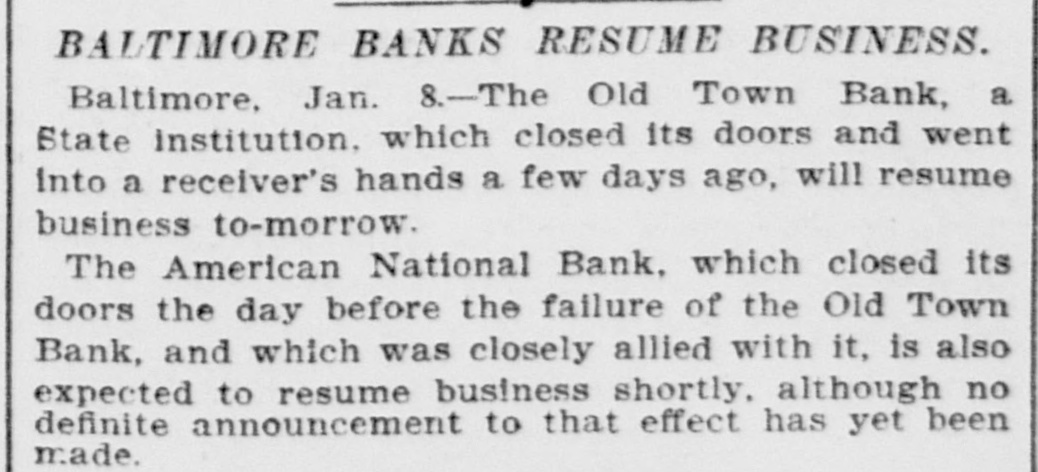

Article Text

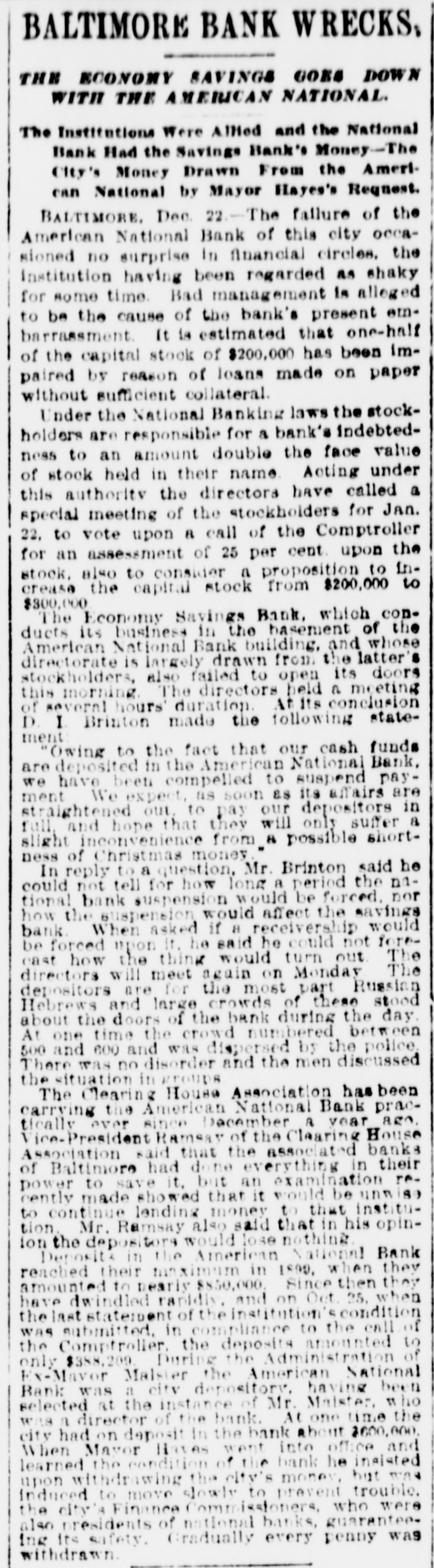

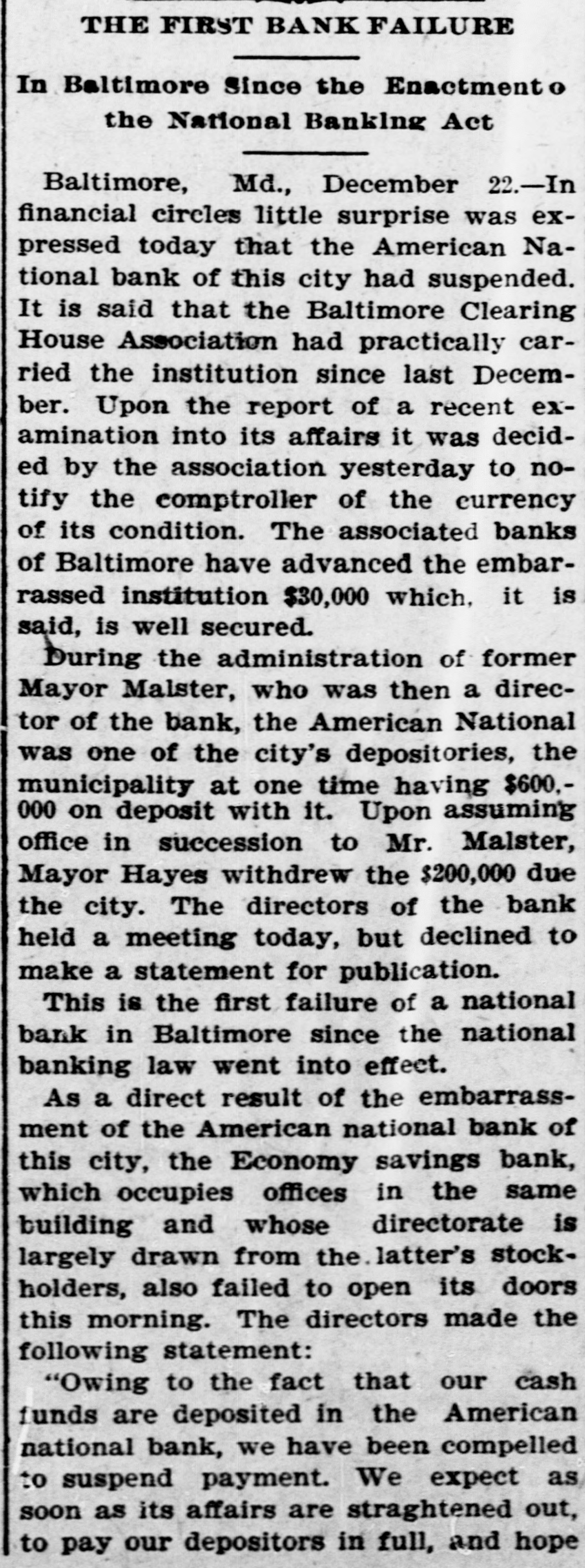

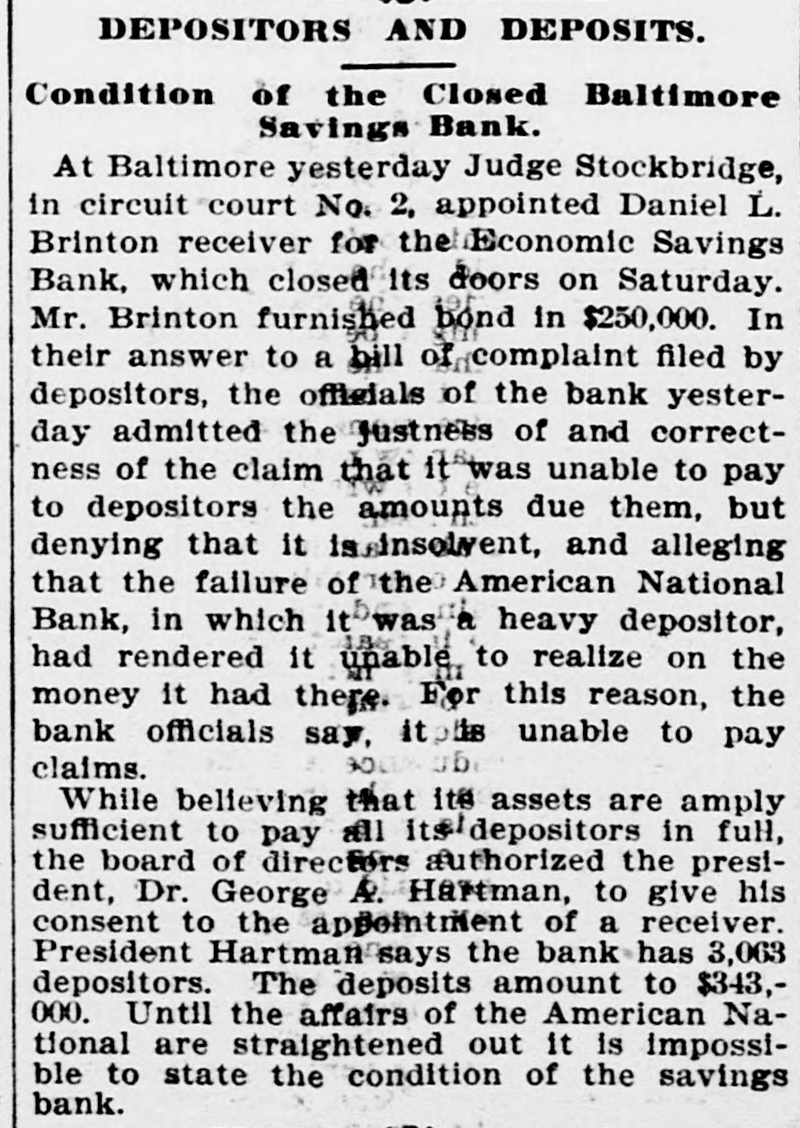

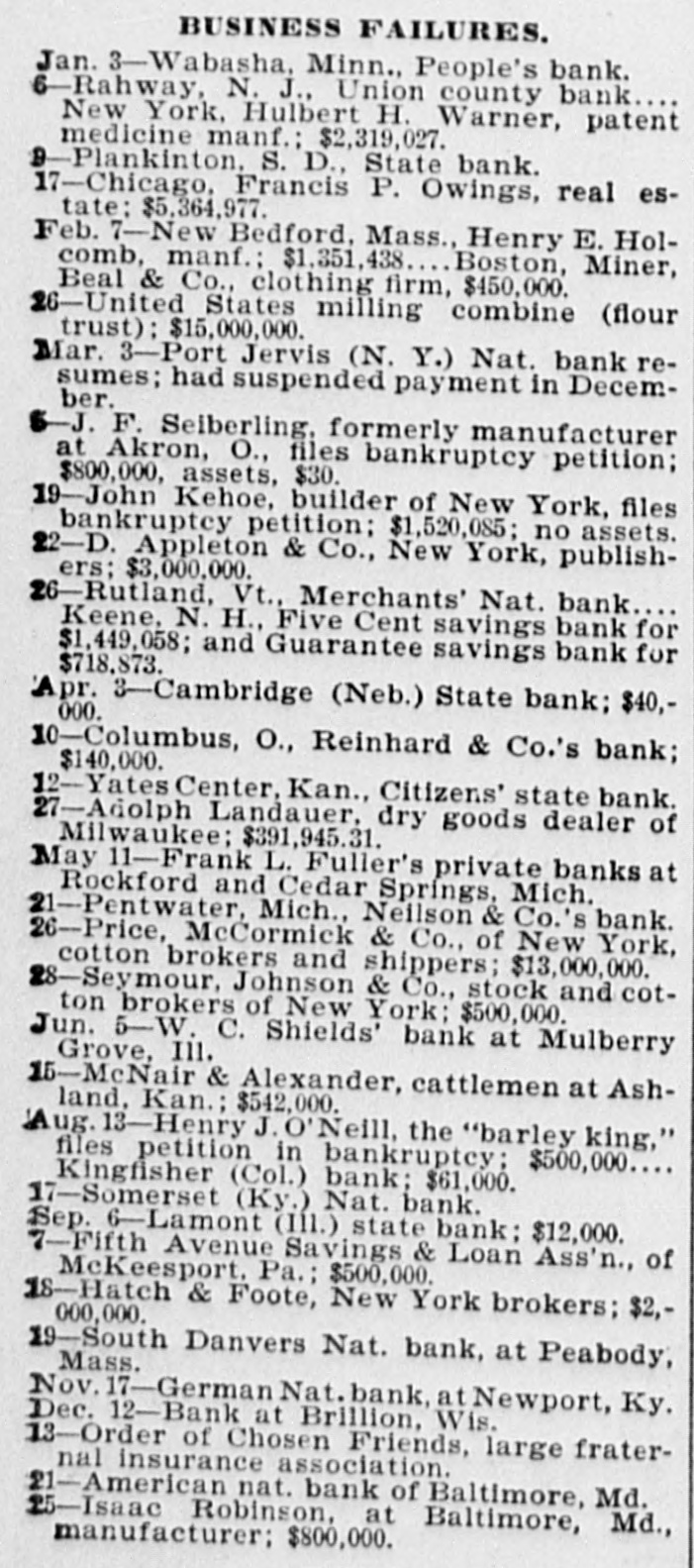

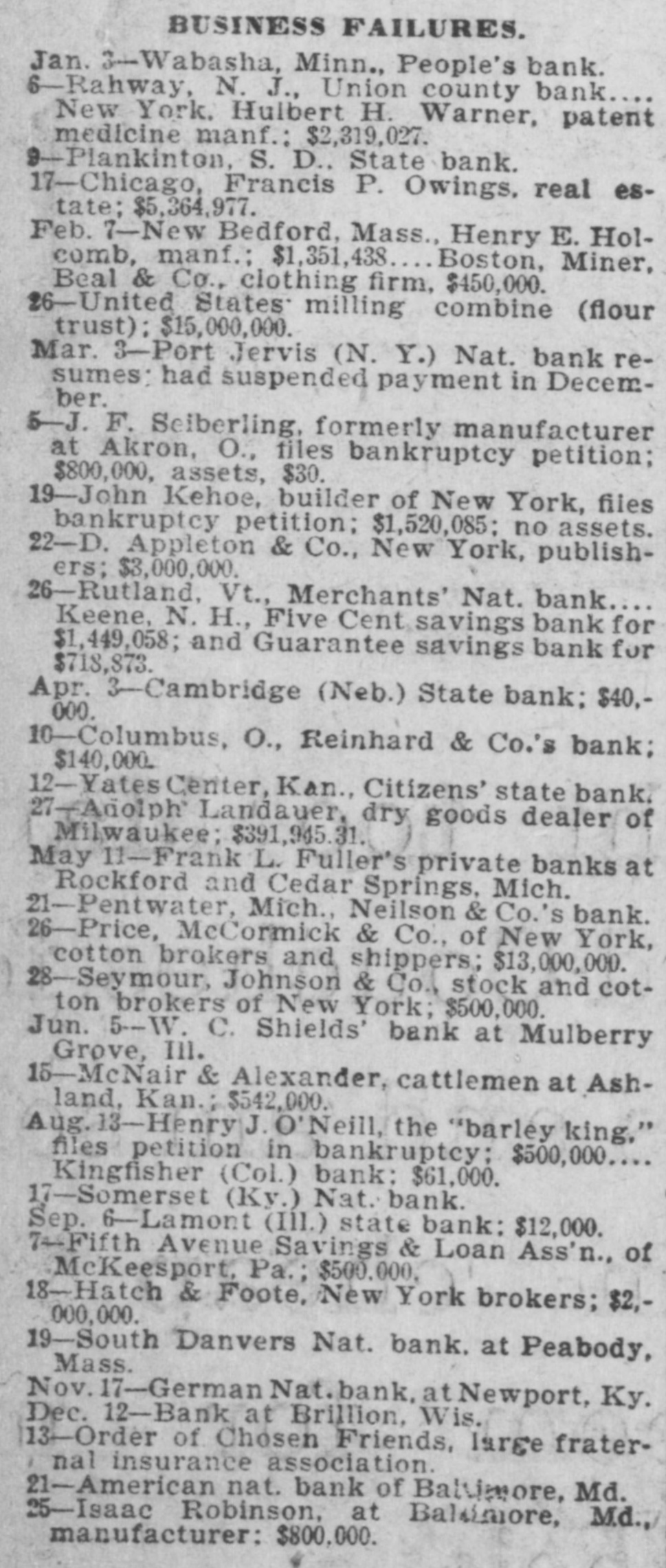

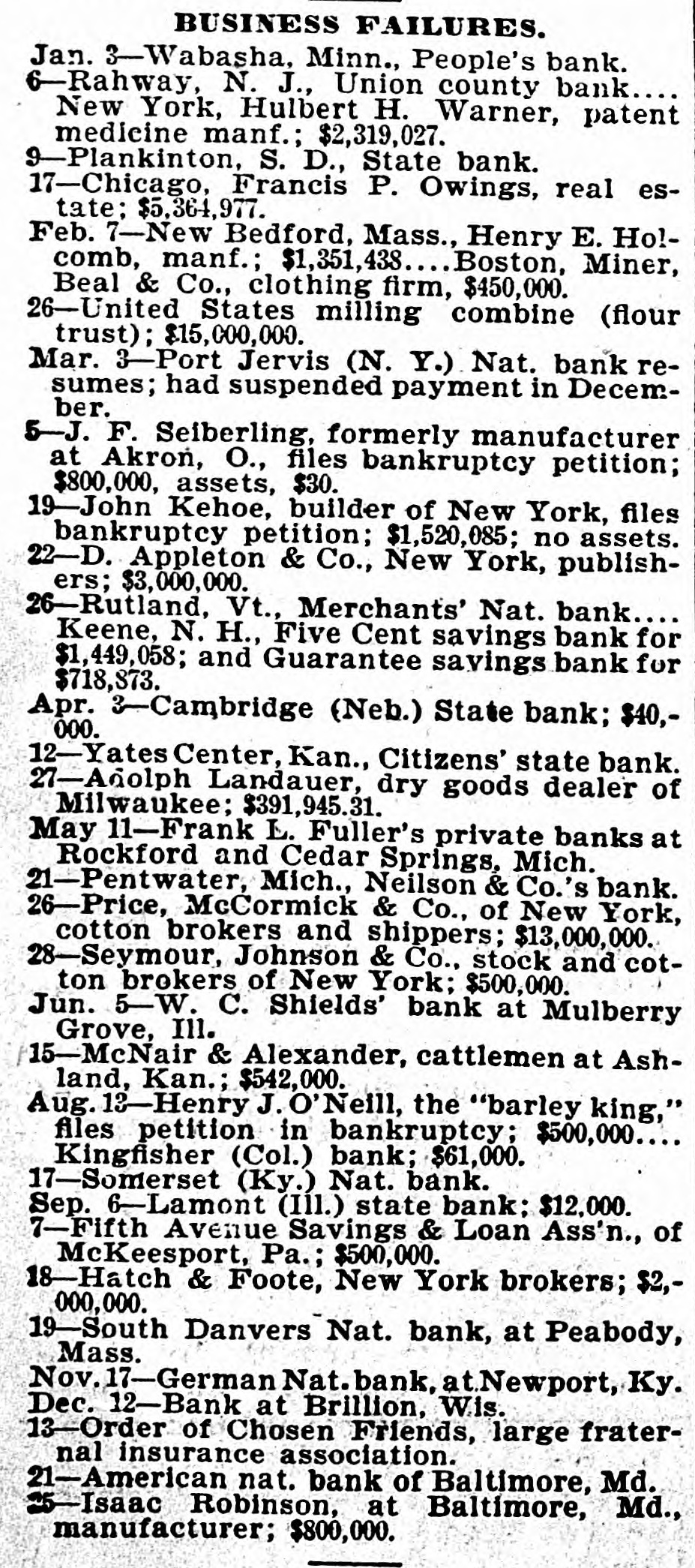

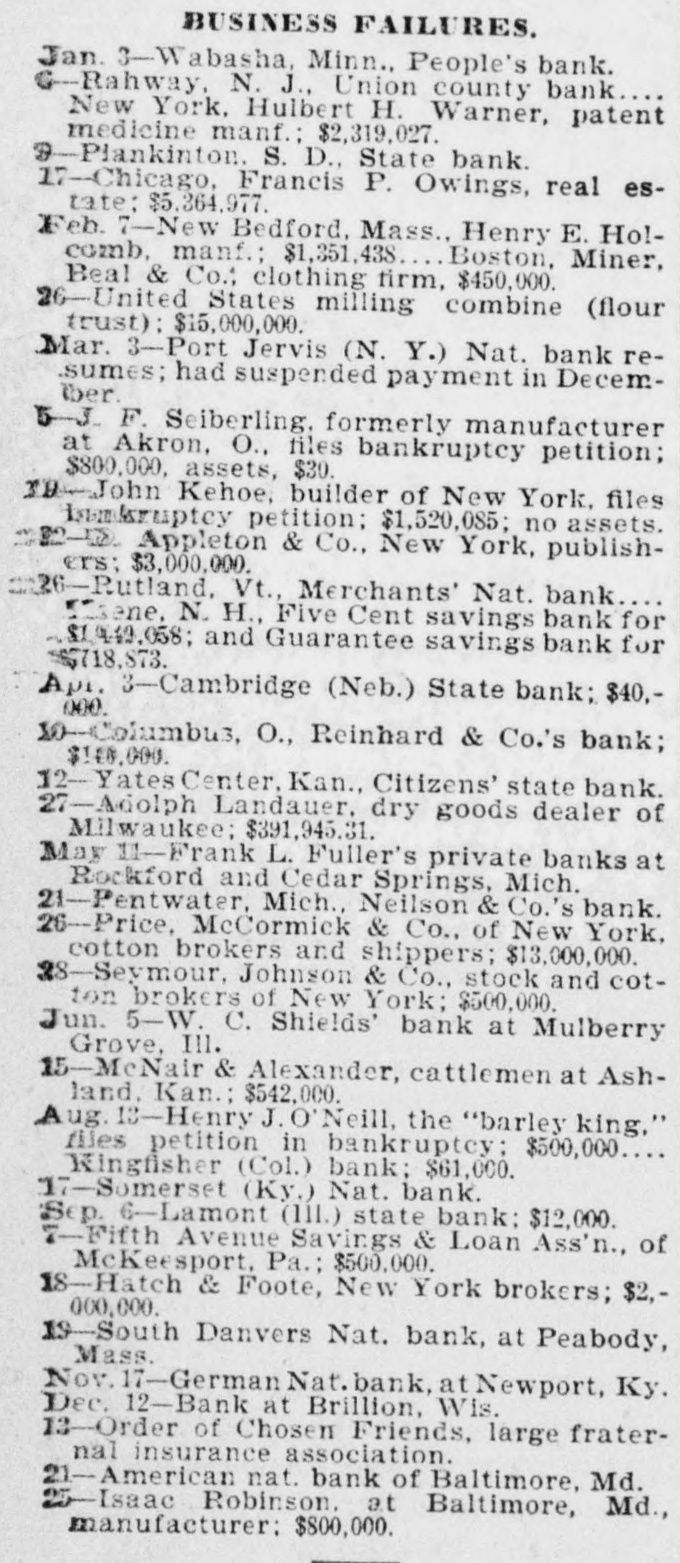

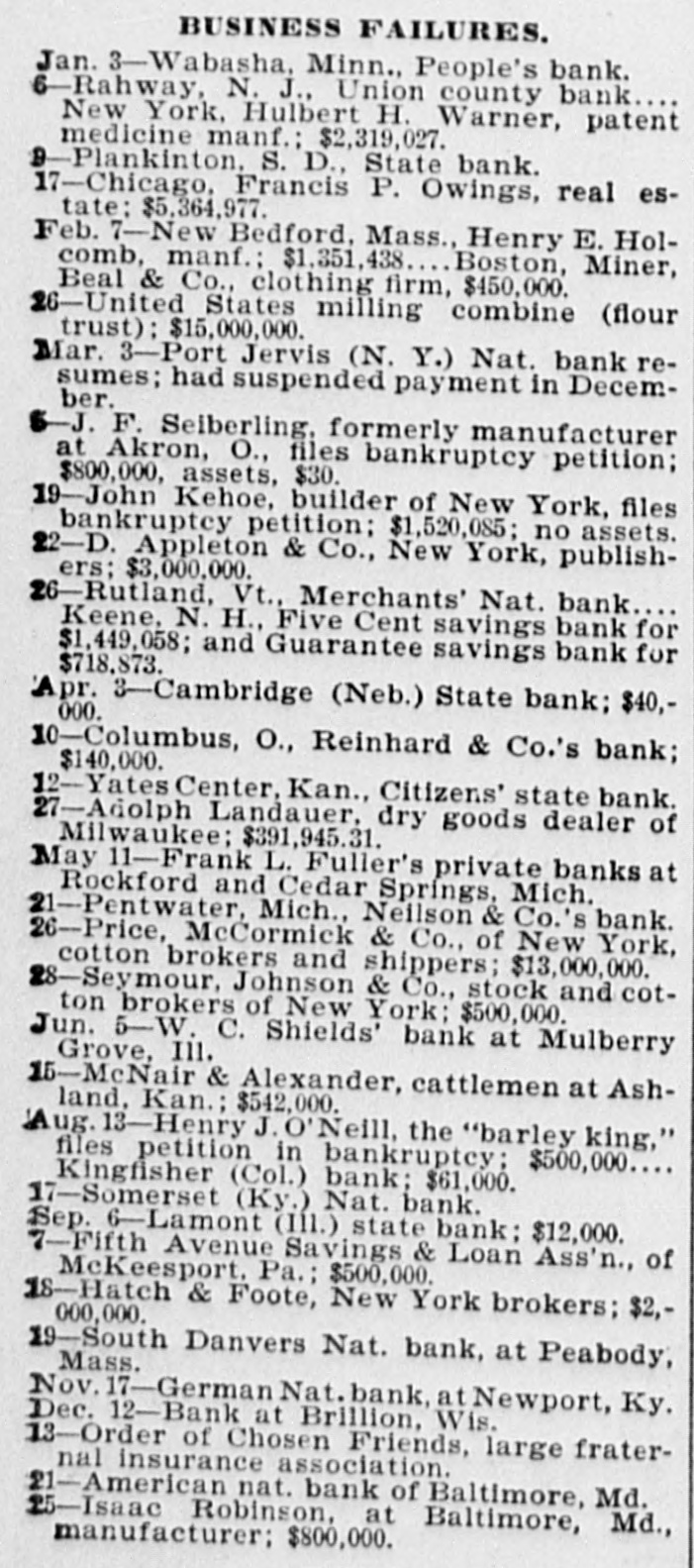

BUSINESS FAILURES. Jan. 3-Wabasha, Minn., People's bank. 6-Rahway, N. J., Union county bank New York, Hulbert H. Warner, patent medicine manf.; $2,319,027. 9-Plankinton, S. D., State bank. 17-Chicago, Francis P. Owings, real estate: $5,364,977. Feb. 7-New Bedford, Mass., Henry E. Holcomb, manf.; $1,351,438 Boston, Miner, Beal & Co., clothing firm, $450,000. 26-United States milling combine (flour trust); $15,000,000. Mar. 3-Port Jervis (N. Y.) Nat. bank resumes; had suspended payment in December. 6-J. F. Seiberling, formerly manufacturer at Akron, O., files bankruptcy petition; $800,000, assets, $30. 19-John Kehoe, builder of New York, files bankruptcy petition; $1,520,085; no assets. 22-D. Appleton & Co., New York, publishers; $3,000,000. 26-Rutland, Vt., Merchants' Nat. bank Keene, N. H., Five Cent savings bank for $1,449,058; $718,873. and Guarantee savings bank for Apr. 000. 3-Cambridge (Neb.) State bank; $40,10-Columbus, $140,000. O., Reinhard & Co.'s bank; 12-Yates Center, Kan., Citizens' state bank. 27-Adolph Landauer, dry goods dealer of Milwaukee; $391,945.31. May 11-Frank L. Fuller's private banks at Rockford and Cedar Springs, Mich. 21-Pentwater, Mich., Neilson & Co.'s bank. 26-Price, McCormick & Co., of New York, cotton brokers and shippers; $13,000,000. 28-Seymour, Johnson & Co., stock and cotton brokers of New York; $500,000. Jun. 5-W. C. Shields' bank at Mulberry Grove, Ill. 15-McNair & Alexander, cattlemen at Ashland, Kan.; $542,000. ug. 13-Henry J. "Neill, the "barley king," files petition in bankruptcy; $500,000.... Kingfisher (Col.) bank: $61,000. 17-Somerset (Ky.) Nat. bank. Sep. 6-Lamont (III.) state bank; $12,000. 7-Fifth Avenue Savings & Loan Ass'n., of McKeesport, Pa.; $500,000. 18-Hatch 000,000. & Foote, New York brokers; $2,19-South Mass. Danvers Nat. bank, at Peabody, Nov. 17-German Nat. bank, at Newport, Ky. Dec. 12-Bank at Brillion, Wis. 13-Order of Chosen Friends, large fraternal insurance association. 21-American nat. bank of Baltimore, Md. 25-Isaac Robinson, at Baltimore, Md., manufacturer; $800,000.