Article Text

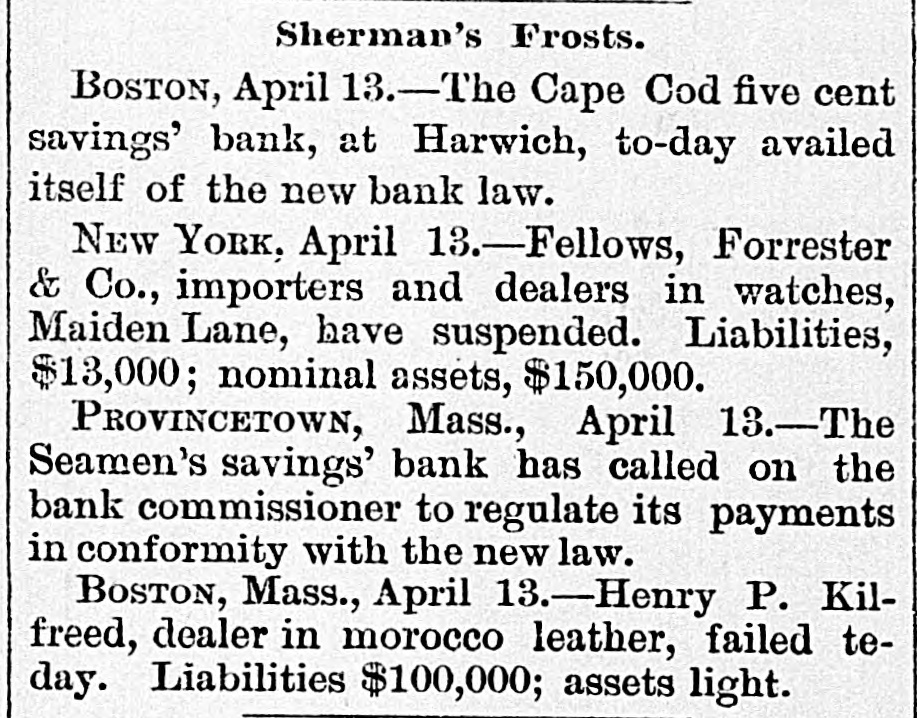

Sherman's Frosts. BOSTON, April 13.-The Cape Cod five cent savings' bank, at Harwich, to-day availed itself of the new bank law. NEW YORK, April 13.-Fellows, Forrester & Co., importers and dealers in watches, Maiden Lane, have suspended. Liabilities, $13,000; nominal assets, $150,000. PROVINCETOWN, Mass., April 13.-The Seamen's savings' bank has called on the bank commissioner to regulate its payments in conformity with the new law. BOSTON, Mass., April 13.-Henry P. Kilfreed, dealer in morocco leather, failed teday. Liabilities $100,000; assets light.