Article Text

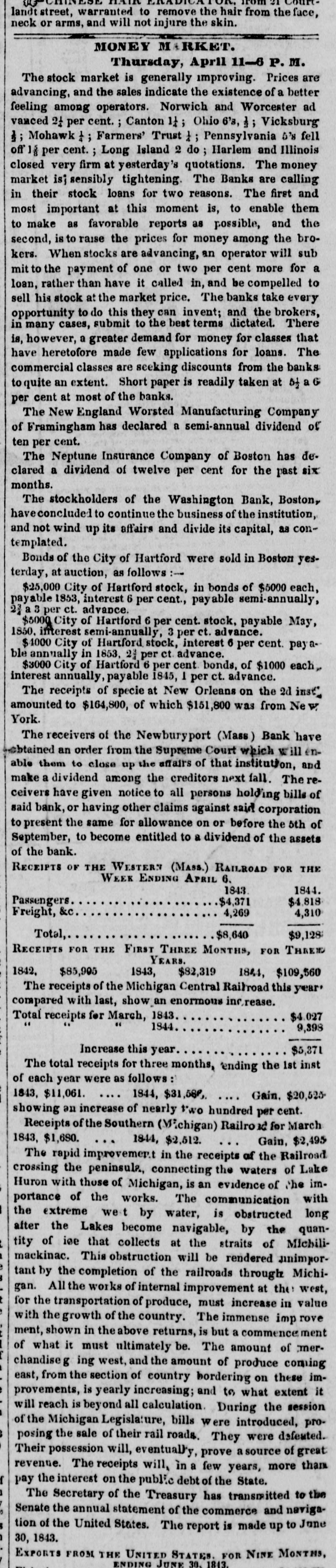

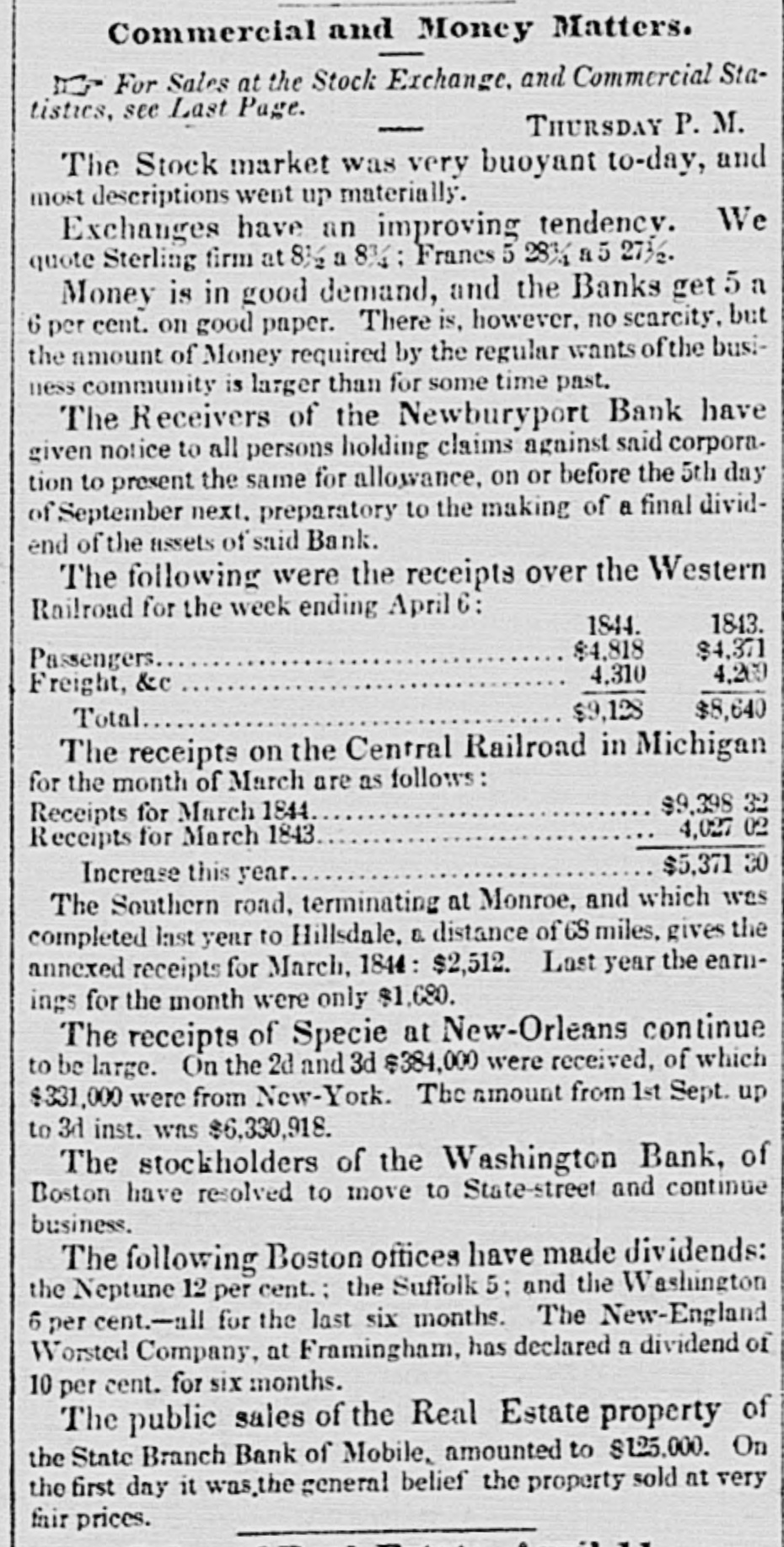

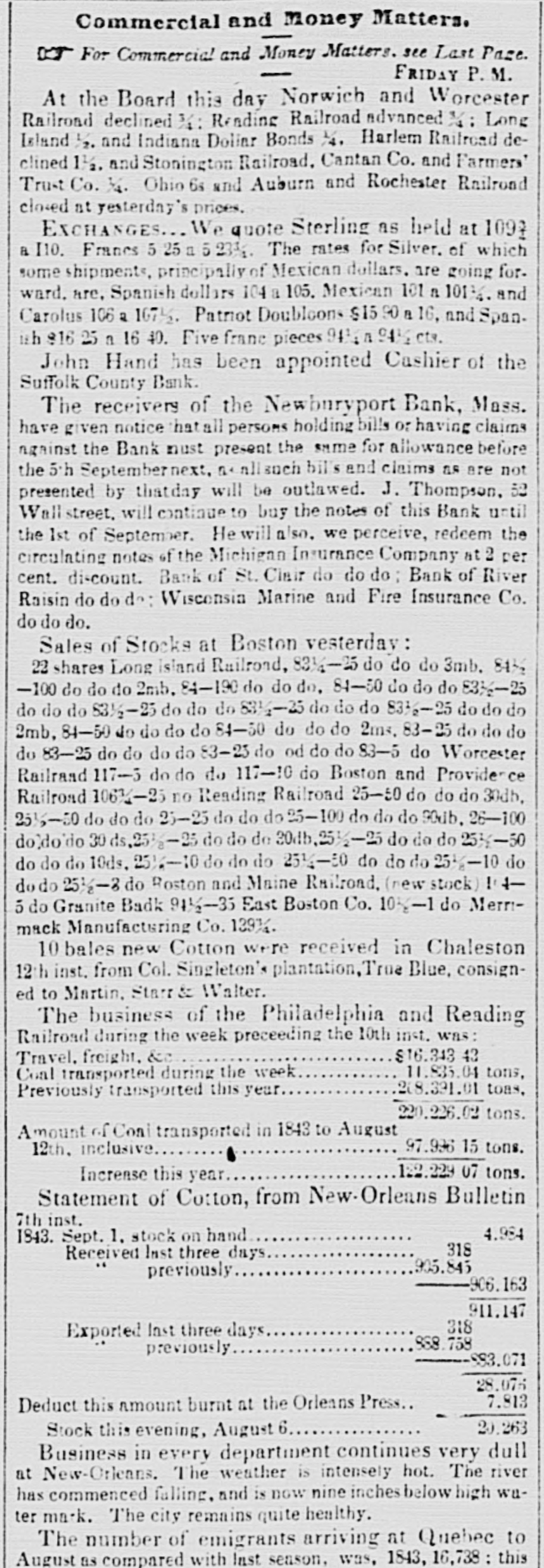

PURNESE From 21 Courtlandt treet, warranted to remove the hair from the face, neck or arms, and will not injure the skin. MONEY MARKET. Thursday, April 11-6 P. M. The stock market is generally improving Prices are advancing, and the sales indicate the existence of a better feeling among operators. Norwich and Worcester ad vanced 21 per cent. Canton 11 Ohio 6's, 1 ; Vicksburg ; Mohawk : : Farmers' Trust 1; Pennsylvania 5's fell off 16 per cent. Long Island 2 do; Harlem and Illinois closed very firm at yesterday's quotations. The money market isj sensibly tightening The Banks are calling in their stock loans for two reasons. The first and most important at this moment is, to enable them to make as favorable reports as possible, and the second, is to raise the prices for money among the brokers. When stocks are advancing, an operator will sub mit to the payment of one or two per cent more for a loan, rather than have it called in, and be compelled to sell his stock at the market price. The banks take every opportunity to do this they can invent; and the brokers, in many cases, submit to the best terms dictated. There is, however, a greater demand for money for classes that have heretofore made few applications for loans. The commercial classes are seeking discounts from the banks to quite an extent. Short paper is readily taken at of a G per cent at most of the banks. The New England Worsted Manufacturing Company of Framingham has declared a semi-annual dividend of ten per cent. The Neptune Insurance Company of Boston has declared a dividend of twelve per cent for the past six months. The stockholders of the Washington Bank, Boston, have concluded to continue the business of the institution, and not wind up its affairs and divide its capital, as contemplated. Bonds of the City of Hartford were sold in Boston yesterday, at auction, as follows :$25,000 City of Hartford stock, in bonds of $5000 each, payable 1853, interest 6 per cent., payable semi-annually, per ct. advance. $5000 City of Hartford 6 per cent. stock, payable May, 1850, interest semi-annually, 3 per ct. advance. $4000 City of Hartford stock, interest 6 per cent. payable annually in 1853, 23 per ct advance. $3000 City of Hartford 6 per cent bonds, of $1000 each, interest annually, payable 1845, 1 per ct. advance. The receipts of specie at New Orleans on the 2d inst* amounted to $164,800, of which $151,800 was from New York. The receivers of the Newburyport (Mass) Bank have obtained an order from the Supreme Court which will enable them to close up the affairs of that institution, and make a dividend among the creditors next fall. The receivers have given notice to all persons holding bills of said bank, or having other claims against said corporation to present the same for allowance on or before the 5th of September, to become entitled to a dividend of the assets of the bank. RECEIPTS OF THE WESTERN (Mass.) RAILROAD FOR THE WEEK ENDING APRIL 6. 1844. 1843 $4,371 Passengers $4,818 4,269 Freight, &c 4,310 Total $8,640 $9,128 RECEIPTS FOR THE FIRST THREE MONTHS, FOR THREND YEARS. 1842, $85,905 $82,319 1843, 1844, $109,560 The receipts of the Michigan Central Railroad this year' compared with last, show an enormous rease. $4.027 Total receipts for March, 1843 1844 9,398 Increase this year $5,371 The total receipts for three months, ending the 1st inst of each year were as follows 1843, $11,061. 1844, $31,58P, Gain. $20,525 showing an increase of nearly two hundred per cent. Receipts of the Southern (Vichigan) Railroad for March 1843, $1,680. 1844, $2,512. Gain, $2,495 The rapid improvement in the receipts of the Railroad crossing the peninsula. connecting the waters of Lake Huron with those of Michigan, is an evidence of the importance of the works. The communication with the extreme we t by water, is obstructed long after the Lakes become navigable, by the quantity of ioe that collects at the straits of Michilimackinac. This obstruction will be rendered junimportant by the completion of the railroads through Michigan. All the works of internal improvement at the west, for the transportation of produce, must increase in value with the growth of the country. The immense imp rove ment, shown in the above returns, is but a commence ment of what it must ultimately be. The amount of merchandiseg ing west, and the amount of produce coming east, from the section of country bordering on these improvements, is yearly increasing; and to what extent it will reach is beyond all calculation. During the session of the Michigan Legislature, bills Were introduced, pro: posing the sale of their rail roads. They were defeated. Their possession will, eventually, prove a source of great revenue. The receipts will, in a few years, more than f pay the interest on the public debt of the State. ) The Secretary of the Treasury has transmitted to the / Senate the annual statement of the commerce and navigas tion of the United States. The report is made up to June ) 30, 1843. EXPORTS FROM THE UNITED STATES. FOR NINE MONTHS, ENDING JUNE 30. 1813