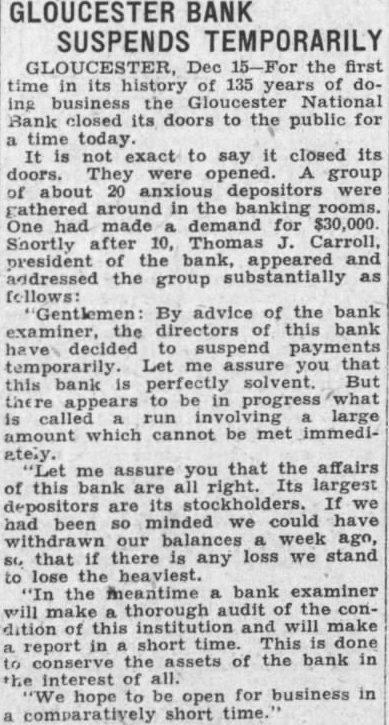

Article Text

GLOUCESTER BANK SUSPENDS TEMPORARILY GLOUCESTER, Dec the first time in its history of 135 of dobusiness the closed doors to the public for today exact to say it closed its were opened. group about depositors were gathered in the demand for Snortly Thomas Carroll, president of the appeared addressed the group substantially as follows: Gentlemen: By advice of the bank examiner, this bank temporarily. me you that But this solvent. be in progress called run large amount which cannot be immediately me that the affairs of this all largest are we depositors been minded we could had withdrawn our balances week ago, that there loss we stand the meantime bank examiner thorough of the condition this will make report in short time. done conserve of the bank in of hope be for business in