Article Text

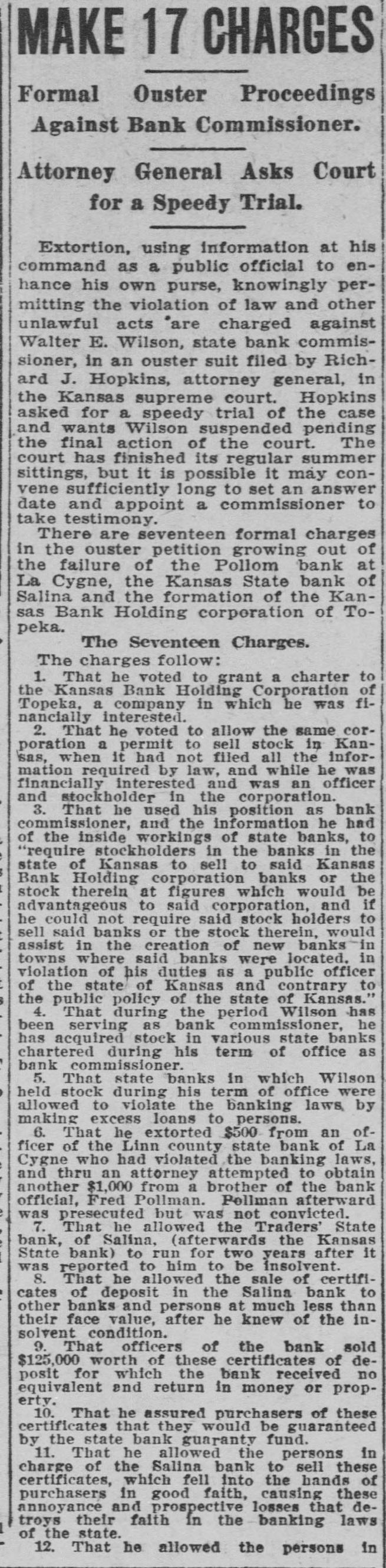

MAKE 17 CHARGES Formal Ouster Proceedings Against Bank Commissioner. Attorney General Asks Court for a Speedy Trial. Extortion, using information at his command as a public official to enhance his own purse, knowingly permitting the violation of law and other unlawful acts "are charged against Walter E. Wilson, state bank commissioner, in an ouster suit filed by Richard J. Hopkins, attorney general, in the Kansas supreme court. Hopkins asked for a speedy trial of the case and wants Wilson suspended pending the final action of the court. The court has finished its regular summer sittings, but it is possible it may convene sufficiently long to set an answer date and appoint a commissioner to take testimony. There are seventeen formal charges in the ouster petition growing out of the failure of the Pollom bank at La Cygne, the Kansas State bank of Salina and the formation of the Kansas Bank Holding corporation of Topeka. The Seventeen Charges. The charges follow: 1. That he voted to grant a charter to the Kansas Bank Holding Corporation of Topeka, a company in which he was financially interested. 2. That he voted to allow the same corporation a permit to sell stock in Kansas, when it had not filed all the information required by law, and while he was financially interested and was an officer and stockholder in the corporation. 3. That he used his position as bank commissioner, and the information he had of the inside workings of state banks, to "require stockholders in the banks in the state of Kansas to sell to said Kansas Bank Holding corporation banks or the stock therein at figures which would be advantageous to said corporation, and if he could not require said stock holders to sell said banks or the stock therein, would assist in the creation of new banks in towns where said banks were located. in violation of his duties as a public officer of the state of Kansas and contrary to the public policy of the state of Kansas." 4. That during the period Wilson has been serving as bank commissioner, he has acquired stock in various state banks chartered during his term of office as bank commissioner. 5. That state banks in which Wilson held stock during his term of office were allowed to violate the banking laws, by making excess loans to persons. 6. That he extorted $500 from an officer of the Linn county state bank of La Cygne who had violated the banking laws, and thru an attorney attempted to obtain another $1,000 from a brother of the bank official, Fred Pollman. Pollman afterward was presecuted but was not convicted. 7. That he allowed the Traders' State bank, of Salina, (afterwards the Kansas State bank) to run for two years after it was reported to him to be insolvent. 8. That he allowed the sale of certificates of deposit in the Salina bank to other banks and persons at much less than their face value, after he knew of the insolvent condition. 9. That officers of the bank sold $125,000 worth of these certificates of deposit for which the bank received no equivalent and return in money or property. 10. That he assured purchasers of these certificates that they would be guaranteed by the state bank guaranty fund. 11. That he allowed the persons in charge of the Salina bank to sell these certificates, which fell into the hands of purchasers in good faith, causing these annoyance and prospective losses that detroys their faith in the banking laws of the state. 12. That he allowed the persons in