Article Text

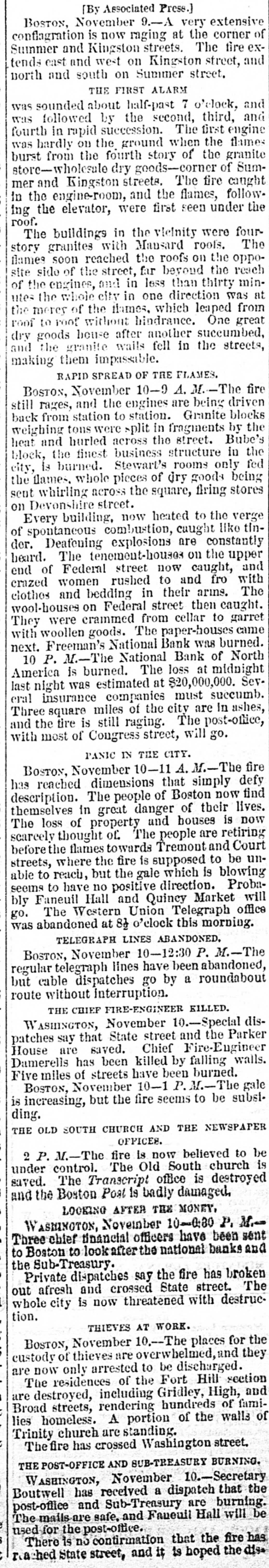

[By Associated Press.] BOSTON, November 9.-A very extensive conflagration is now raging at the corner of Summer and Kingston streets. The fire extends east and west on Kingston street, and north and south on Summer street. THE FIRST ALARM was sounded about half-past 7 o'clock, and followed by the second, fourth in succession. engine was rapid The third, first and was hardly on the ground when the flames burst from the fourth story of the granite store-wholesule dry goods-corner of Sumstreets. caught in and the mer the and engine-room, Kingston The flames, fire under follow- the ing the elevator, were first seen roof. buildings in the vieinity were fourwith Mausard story The granites roofs. the The flames reached the roofs on oppoof the far of and in less site the side engines, soon street, beyoud direction than thirty the reach minutes whole city in one was at the of the names, which mercy the hindrance. leaped One great from roof to roof without dry goods house after another succumbed, and the granite wails fell in the streets, making them impassable. RAPID SPREAD OF THE FLAMES. BOSTON, November 10-9 A. M.-The fire still rages, and the engines are being driven back from station to station. Granite blocks weighing tons were split in fragments by the heat and hurled across the street. Bube's block, the finest business structure in the city, is burned. Stewart's rooms only fed the flames. whole pieces of dry goods being sent whirling across the square, firing stores on Devonshire street. Every building, now heated to the verge of spontaneous combustion, caught like tinder. explosions are constantly The tenement-houses on upper end Federal street now heard. of Deafening caught, the and crazed women rushed to and fro with The clothes and bedding in their arins. on Federal street then caught. crammed from The They with wool-houses woollen were goods. paper-houses cellar to burned. garret came next. Freeman's National Bank was 10 P. M.-The National Bank of North America is burned. The loss at midnight last night was estimated at $20,000,000. Several insurance companies must succumb. Three square miles of the city are In ashes, and the tire is still raging. The post-office, with most of Congress street, will go. PANIC IN THE CITY. BOSTON, November 10-11 M.-The defy reached dimensions that simply has The people of Boston now find in great danger of loss of property and description. The themselves houses their is lives. now scareely thought of. The people are retiring before the flames towards Tremont and Court where the fire is supposed to be unbut the gale which to have no positive streets, able seems to reach, direction. is blowing Proba- will bly Faneuil Hall and Quincy Market office The Western Union Telegraph go. was abandoned at 81 o'clock this morning. TELEGRAPH LINES ABANDONED. November 10-12:30 P. M.-The regular BOSTON, telegraph lines have been abandoned, but cable dispatches go by a roundabout route without interruption. THE CHIEF FIRE-ENGINEER KILLED. WASHINGTON, November 10.-Special dispatches say that State street and the Parker House are saved. Chief Fire-Engineer walls. Damerells has been killed by falling Five miles of streets have been burned. BOSTON, November 10-1 P.M.-The subsi- gale is increasing, but the fire seems to be ding. THE OLD SOUTH CHURCH AND THE NEWSPAPER OFFICES. 2 P. M.-The fire is now believed to be is control. The Old South church saved. under The Transcript office is destroyed and the Boston Post is badly damaged. LOOKING AFTER THE MONEY, WASHINGTON, November 10-0:30 P. M. Three chief financial officers have been sent and to Boston to look after the national banks the Private Sub-Treasury. dispatches say the fire has broken The afresh and crossed State street. out whole city is now threatened with destruction. THIEVES AT WORK. BOSTON, November ).--The places for they the custody of thieves are overwhelmed, and are now only arrested to be discharged. residences of the Fort Hill section and The destroyed, including Gridley, High, of famiare Broad streets, rendering hundreds walls of lies homeless. A portion of the Trinity church are standing. The fire has crossed Washington street. THE POST-OFFICE AND SUB-TREASURY BURNING. WASHINGTON, November 10.-Secretary the has received a dispatch that post-office Boutwell and Sub-Treasury are burning. will be The mails are safe. and Faueuil Hall used for is the no post-office. continuation that the fire has There hed State street, and it is hoped the dise