Click image to open full size in new tab

Article Text

into the rear end of a gravel train that was standing on the main track.

THE southbound express on the East Tennessee, Virginia & Georgia railroad was held up on the 3d ard robbed by two masked men three miles east of Rome, Ga. The robbers secured $1,000 from the express car and escaped.

FIRE started in a coal and lumber yard at Plainfield. N. J., on the 3d, and all the stock was destroyed, involving a loss of $100.000; insurance about $60,000. A dozen houses took fire and were more or less damaged by the flames. The total loss will probably foot up $150,000.

LOUIS HARRIOr, the slayer of Mrs. Charles T. Leonard, who is now incarcerated in the county jail at Freehold, N. J., for the foul crime he committed near Atlantic Highlands a few days sgo, has at last confessed his guilt.

Surr was entered against ex-Mayor Richard Pearson, of Allegheny, Pa., on the 3d for embezzlement. He is charged with retaining $794 of jail and workhouse commitments.

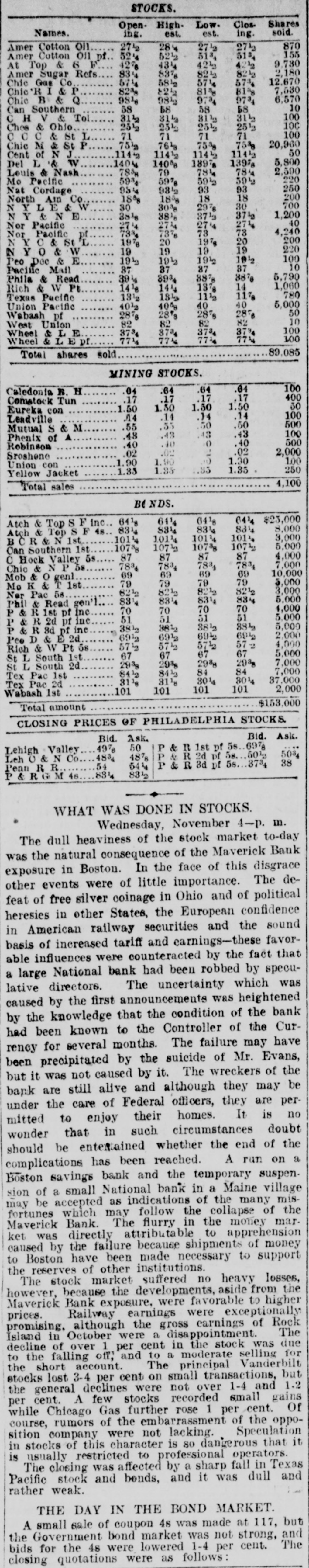

THE 551 claims proved at the Maverick bank, Boston, aggregate about $1,800,000. The receiver has deposited with the United States sub-treasury $90,000, making a total of $2,300,000 now standing to the credit of the bank's creditors.

JOHN T. STAPLER, a wealthy cracker manufacturer of Trenton, N. J suicided on the 3d by shooting himself, while making preparations to go on a pleasure trip to Bermuda with his wife.

J. M. BENSON, treasurer of Bladen county, N. C., has absconded with $6,000 of the county's money and about $10,000 belonging to farmers in the county, which they had placed with him on deposit.

BENSON C. HAZLETON, treasurer of the Order of the Royal Ark, which recently failed, and L. G. Powers, secretary of the same concern, were fined $200 and $400 respectively at Boston on the 3d for violating the insurance laws. Judge Sherman said he regretted that the law did not allow him to send them to prison.

THE principal business block in Argyle, Mich., was destroyed by fire on the 4th. The loss was $100,000; insurance light.

At St. Paul, Minn., on the 14th, the wall of a burned building fell upon fifteen workmen who were engaged in removing the debris from the scene. Seven of the laborers were killed and the remainder were terribly injured.

THE strike among the miners at the Colorado Coal & Iron Company's mines at Crested Butte, Col., is still on, with no prospect of their going to work. Everything is shut down and the coke ovens are closed. Two hundred and fifty men are idle by the strike.

EIGHT buildings were destroyed by fire at Blair, Neb., on the 4th, causing a loss of $100,000.

AT Johnson, Neb., on the night of the 3d. a mob of masked men called at the office of Dr. P. H. Welfiey and after blindfolding and binding him, took him to an unused house and liberally laid on a coat of tar and feathers and gave him twenty-four hours to leave the town. He left.

TWELVE barges loaded with brick, in tow of the tug Townsend, of the Cornell Towing Company, were upset when opposite Croton Point, N. Y., on the 4th and thirty persons are supposed to have been drowned.

A TERRIFIC explosion occurred on the 4th in the Union Trust building in New York City. It was caused by a dynamite bomb exploding in the office of Russell Sage, the well-known financier. Mr. Sage was badly hurt, but will live. The man who threw the bomb, one of Mr. Sage's clerks, and two others were killed and many persons injured. The explosion was the work of a fiend who went to Russell Sage's office and demanded $1,300,000 from Sage and on being refused threw the bomb.

THE business failures during the week ended December 3 number for the United States 304 and Canada 26, a total of 330, as compared with totals of 295 the previous week. For the corresponding week of last year the figures were 312.

By an accident on the New England road near Boston on the 4th caused by a passenger train running into a freight train at a crossing, five persons were killed outright and another burned to death in the smoker, which took fire and was consumed. The passenger train on the Long Island road was passing on a track alongside at the time of the accident and it too crashed into the wreck, piling up three trains together.

THE annual report of W. W. Farnam. treasurer of Yale university for the year ended July 31, 1891, shows that the university had received $343,734 in gifts during the past year.

HARRY TAYLOR, a saloonkeeper, and Chris Yager, a farmer, were arrested at Port Huron, Mich, charged with counterfeiting. A quantity of the spurious coin, together with the metals used in its manufacture, were found on Taylor's premises. After the arrest Taylor confessed, implicating a number of others.

MRS. CHARLES P. JOHNSON, of Wyandotte, Kan., has organized a band of adventists who have fixed Christmas day as the end of the world. She has about 800 followers already and has fitted up a residence magnificently, where she receives her friends and holds seances.

An attempt was made on the 4th to