Article Text

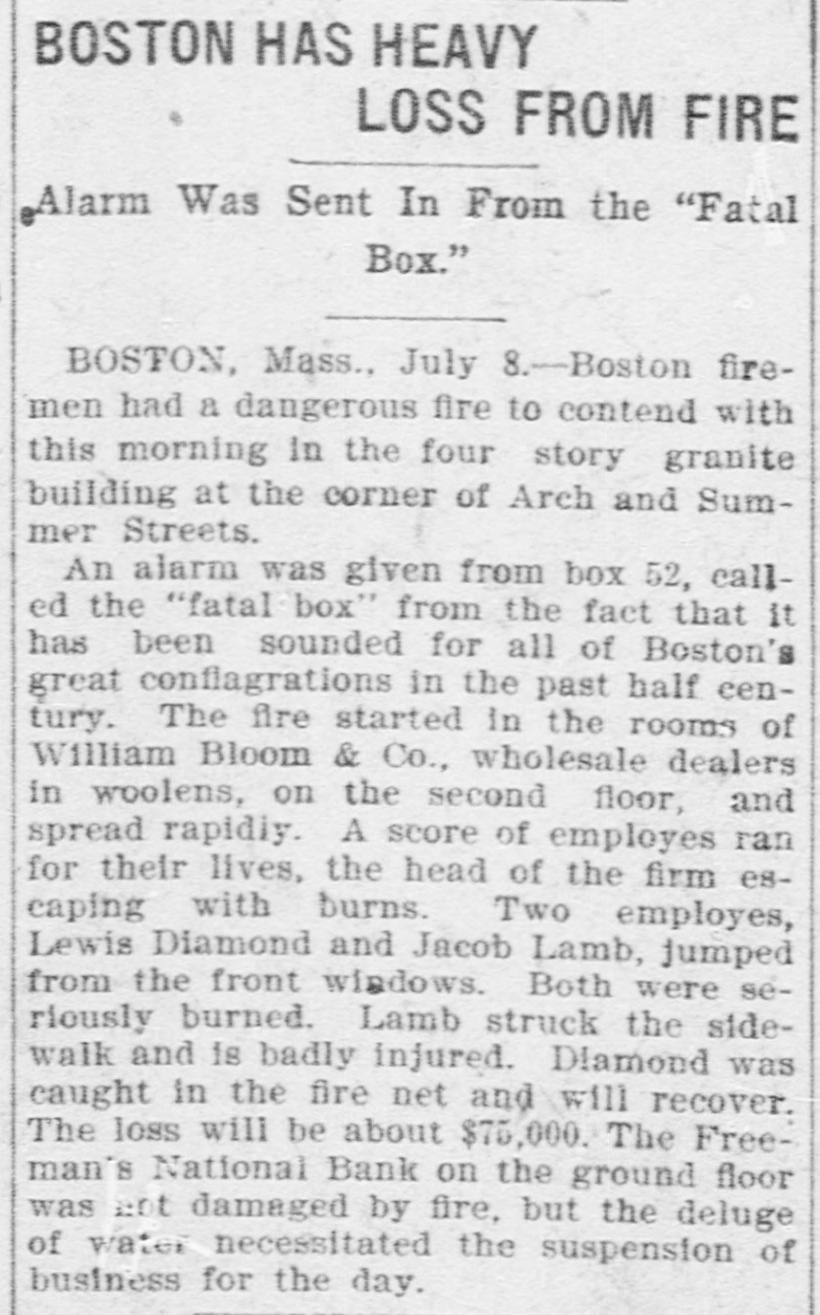

BOSTON HAS HEAVY LOSS FROM FIRE Alarm Was Sent In From the "Fatal Box." BOSTON, Mass.. July 8.-Boston firemen had a dangerous fire to contend with this morning in the four story granite building at the corner of Arch and Summer Streets. An alarm was given from box 52, called the "fatal box" from the fact that It has been sounded for all of Boston's great conflagrations in the past half century. The fire started in the rooms of William Bloom & Co., wholesale dealers in woolens, on the second floor, and spread rapidly. A score of employes ran for their lives, the head of the firm escaping with burns. Two employes, Lewis Diamond and Jacob Lamb, jumped from the front windows. Both were seriously burned. Lamb struck the sidewalk and is badly injured. Dlamond was caught in the fire net and will recover. The loss will be about $75,000. The Freeman's National Bank on the ground floor was ant damaged by fire, but the deluge of water necessitated the suspension of business for the day.