Article Text

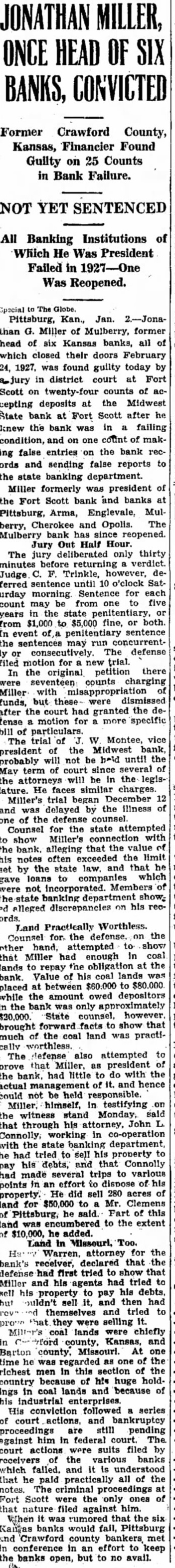

THE INDEPENDENT Published Weekly By The Independent Publishing & Printing Co. A newspaper devoted to the best commercial, industrial and social interests of the city of Mulberry and Crawford County. Subscription Rates In Crawford and Adjoining Counties, Per Year $1.50 Outside the Trade Territory Per Year $2.00 HOT ON THE TRAIL The Pittsburg Sun put Sheriff Turkington in a new role the other morning when it said, reporting the Croweburg killing, "a 'caldron' of sheriff's deputies was thrown around the house." Did The Sun mean that Turkington keeps them in a caldron so they will stay "hot," or did it intend to say, "cordon TOLD YA SO Last spring when the miners were "marhing" on the non-union shovels and mines in the district, attorneygeneral Griffith was enlisted to stop them on the theory that the union men were attempting to coerce and abuse the non-union coal diggers. As a matter of fact, the union miners were simply trying to convince their errant brothers that they were hurting themselves as well as the union cause generally. Late developments have shown the wisdom of those who warned the non-union miners. Not very far from Mulberry is one of the openshop shovels which hired teamsters for 50c a ton. By Herculean efforts a man with a good team could make about $5.00 a day. The union wage scale called for about $7.00 a day for this kind of work. If they had not worked at this small figure, the operator would of course, been foreed to pay the wage scale fixed by the union contract. So they, or some miner, lost a couple of dollars every day they worked. But to add insult to injury, the shovel in question has now purchase tractors and the erstwhile nonunion men are thrown out of even their 50c a ton job. The union won't reinstate them so they can't go to work at some union mine. But the union men have the satisfaction of saying, "We told you so." THE MINERS BANK Since the failure of the Mulberry State Bank, local citizens have come to realize the value to a community of a safe and sound financial institution such as the Miners State Bank. Merchants here have seen what one bank failure can do to a community; think what it would have mean't to Mulberry had the Miller bank also been forced to close its doors. The very fact that it withstood the unusual strain of caring for the financial needs of a community or dinarily served by two banks, gives an idea of its financial calibre. Following the Mulberry State failure, the resultant demands on the remaining bank amounted almost to a run, but the bank was never in any danger, and it has come through a hard summer and fall in as good shape as any bank in the state. And in it all is an example of the value of individuals. Without John Miller, the Miners State Bank might easily have gone the way of its neighbor. The financial and business size of Mr. Miller practically guarantees the security of any concern with which he is connected.