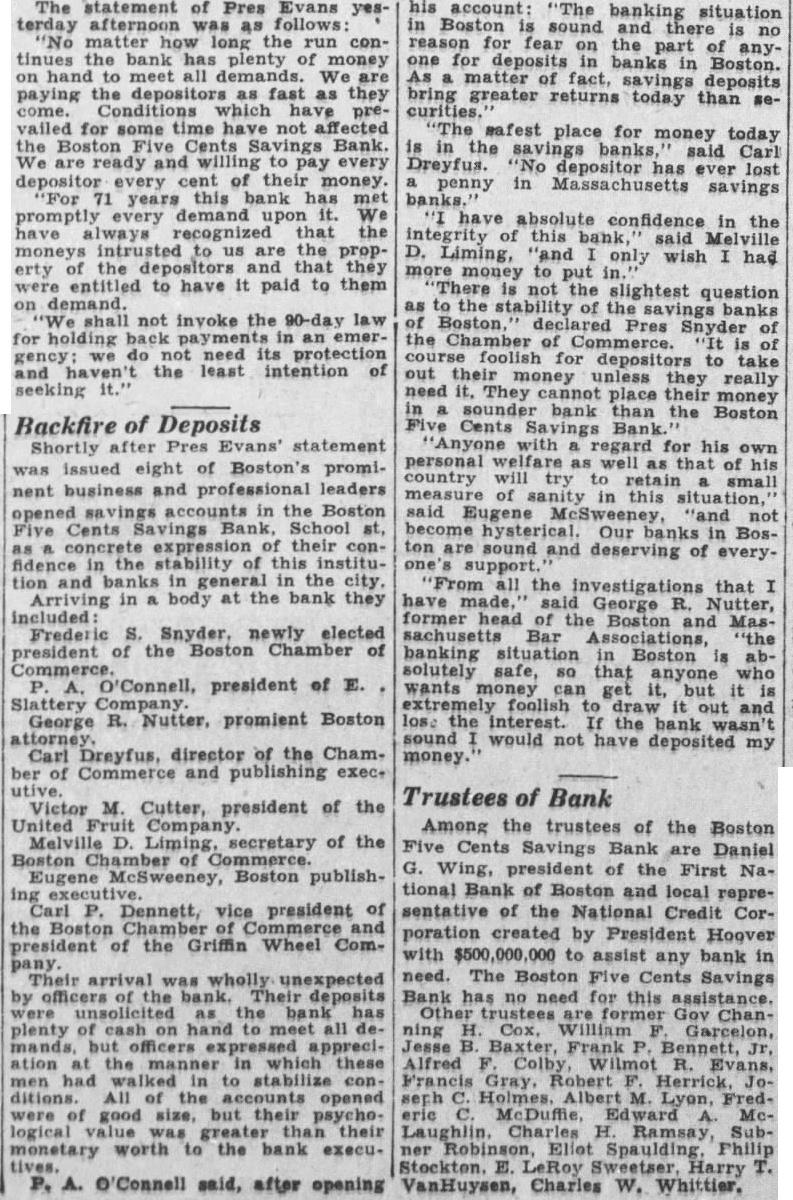

Article Text

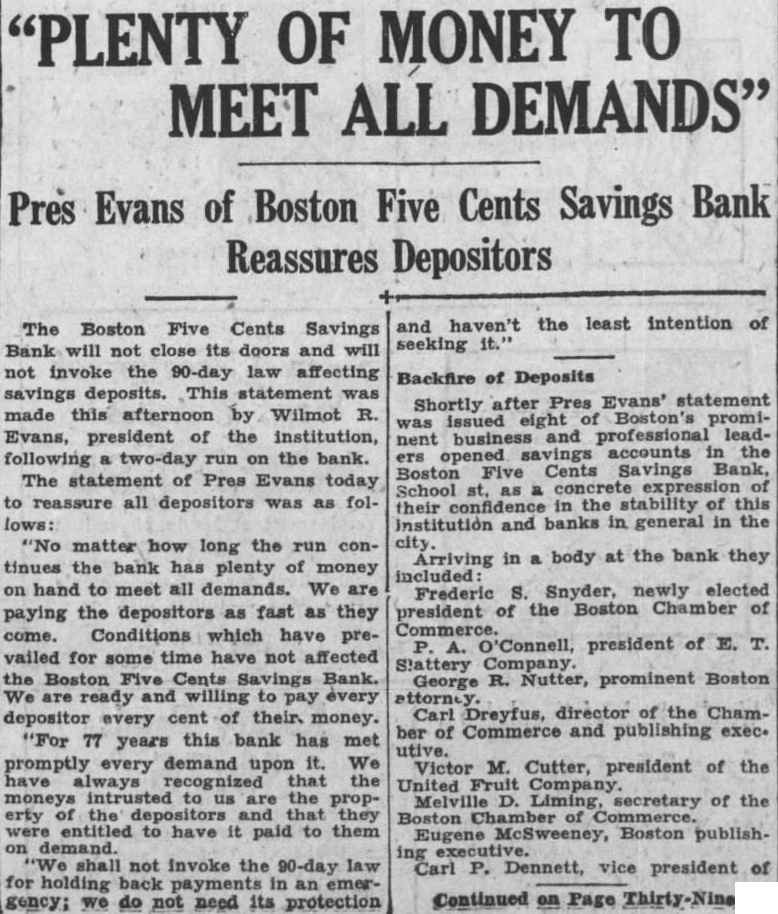

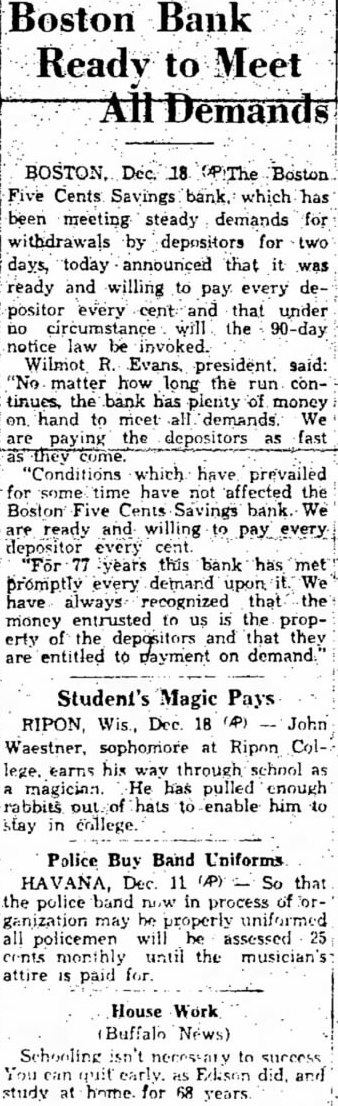

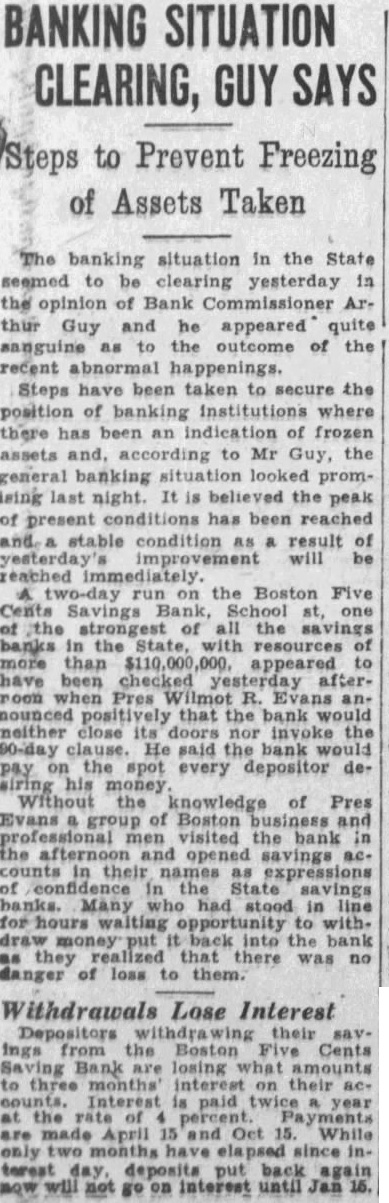

'PLENTY OF MONEY TO MEET ALL DEMANDS" Pres Evans of Boston Five Cents Savings Bank Reassures Depositors The Boston Five Cents Savings Bank will not close its doors and will not invoke the 90-day law affecting savings deposits. This statement was made this afternoon by Wilmot R. Evans, president of the institution, following two-day run on the bank. The statement of Pres Evans today to reassure all depositors was as follows: "No matter how long the run continues the bank has plenty of money on hand to meet all demands. We are paying the depositors as fast as they come. Conditions which have prevailed for some time have not affected the Boston Five Cents Savings Bank. We are ready and willing to pay every depositor every cent of their. money. "For 77 years this bank has met promptly every demand upon it. We have always recognized that the moneys intrusted to us are the property of the depositors and that they were entitled to have it paid to them on demand. "We shall not invoke the 90-day law for holding back in an emergency; we do not need its protection and haven't the least intention of seeking it." Backfire of Deposits Shortly after Pres Evans' statement was issued eight of Boston's prominent business and professional leaders opened savings accounts in the Boston Five Cents Savings Bank, School st, as a concrete expression of their confidence in the stability of this institution and banks in general in the city Arriving in a body at the bank they included: Frederic S. Snyder, newly elected president of the Boston Chamber of Commerce. P. A. O'Connell, president of E. T. George R. Nutter, prominent Boston attorney Carl Dreyfus, director of the Chamber of Commerce and publishing exec. utive. Victor M. Cutter, president of the United Fruit Company Melville D. Liming, secretary of the Boston Chamber of Commerce. Eugene McSweeney, Boston publishing Carl P. Dennett, vice president of Continued on Page Thirty-Nine