Article Text

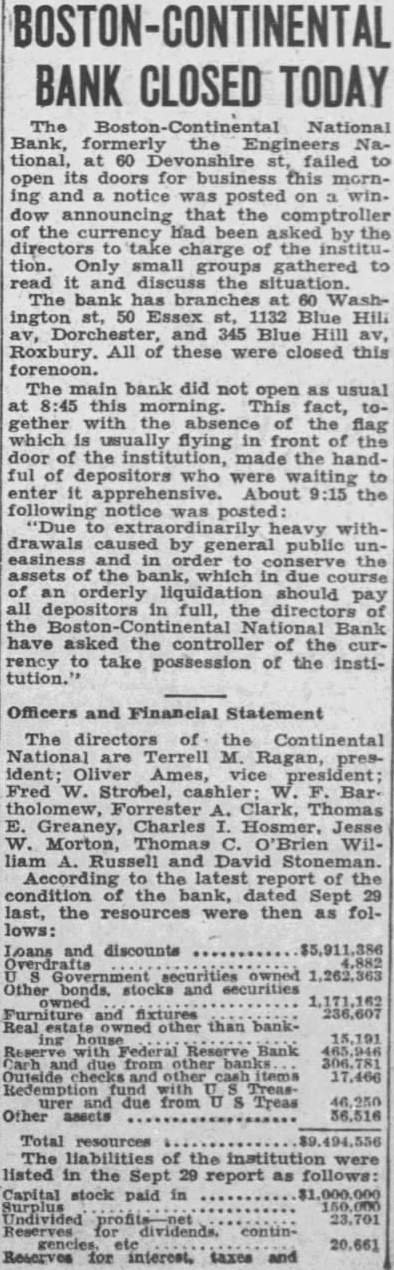

Boston, Dec 17.-(UP)-The Boston Continental National Bank, with deposits approximating $7.000,000, failed to open for business today. It was the second National bank to close in Boston this week. the much-larger Federal National Bank having closed Tuesday. According to President T. M. Ragan, the Continental National, with two in town and two suburban branches, was closed to protect the depositors in the face of unusually heavy withdrawals. A notice posted at the bank's entrance read: "Due to extraordinarily heavy withdrawals caused by general public uneasiness and in order to conserve the assets of the bank, which in the due course of an orderly liquidation should pay all depositors in full, directors of the Boston Continental National Bank have asked the controller of the currency to take possession of the institution." Boston, Dec 17.-(UP)-With deposits aggregating $61,701,238 tied up by the closing of 10 National banks and trust companies, efforts were made to-day to discourage runs on several savings banks. Reminded that never in history has a Massachusetts savings bank been obliged to close, depositors generally refused to become panicky over developments affecting the other types of banks. But in East Boston, South Boston and Lowell, runs had been reported on savings banks. "The banks in East Boston and South Boston, where the runs are being made, are two of the strongest banks in the state," said State Bank Commissioner Arthur Guy. "They are both in excellent shape and they can't possibly be tired out by a run." Deposits tied up bank closings surpassed the sixty million dollar mark yesterday afternoon when the Lowell Trust company of Lowell, with $3,961,000 on deposit, closed. This was the 10th Massachusetts bank to close within 48 hours, and the 15th New England bank to close since October 1. After the bank commissioner took charge of the Lowell Trust company at the behest of its officials, the seven savings banks in that important industrial center decided, as a precautionary measure, to invoke the 90-day privilege. Thus, during the next three months, depositors of these banks will be ableto withdraw not more than $100 each. Herbert Pearson, appointed by the controller of the currency as receiver for the Federal National Bank of Boston, to-day was directing the preliminaries to liquidation, with bank officers still asserting that depositors would be paid in full. All the closed banks except the Lowell Trust company were affiliates of the Federal National which, with its five Greater Boston branches, closed Tuesday. Hamden. Conn, Dec 17.-(UP)The Hamden Bank and Trust company was closed to-day on a restraining order issued by the state banking commissioner. The action was understood to have been taken to protect depositors. The bank's last statement listed general deposits of $570,000 and savings deposits of $688,000, capital of $200,000, surplus of $75,000 and undivided profits of $44,000. Examiner George Ogden of the state banking commission. who was examining the bank's books to-day, said the state intervened after continued withdrawals by letter had placed the institution in an unlilquid position. There was no "run" on the bank, he said. Heavy withdrawal of Christmas savings contributed to the bank's