Article Text

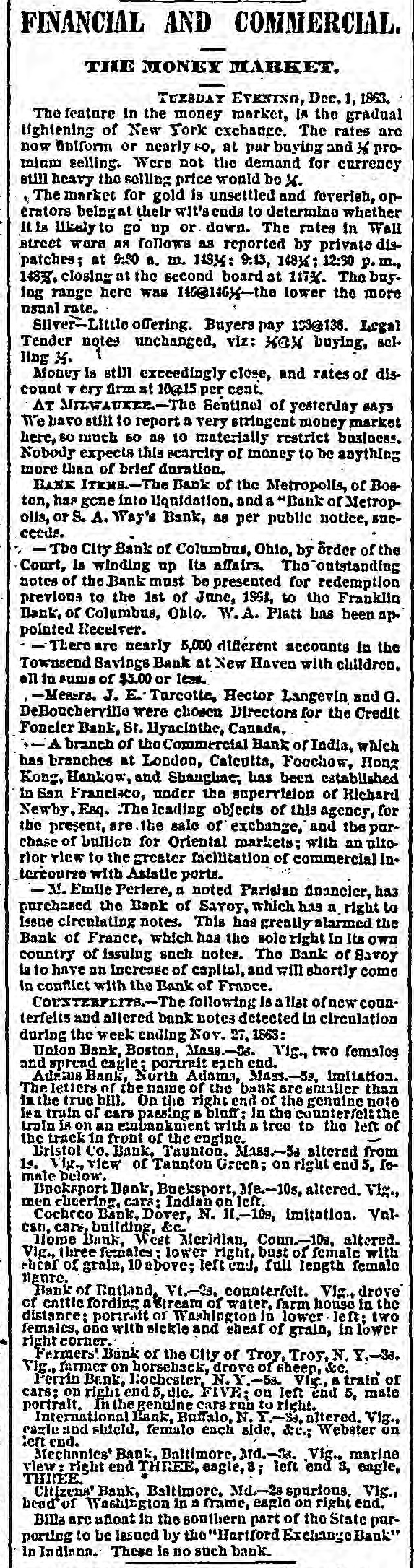

FINANCIAL AND COMMERCIAL. THE MONEY MARKET. TUESDAY EVENING, Dec. 1, 1863. The feature In the money market, is the gradual tightening of New York exchange. The rates are now uniform or nearly so, at par buying and ½ promium selling. Were not the demand for currency still heavy the selling price would be X. The market for gold is unsettled and feverish, operators being their wit's ends to determine whether It is likely to go up or down. The rates in Wall street were дя follows as reported by private dispatches; at 0:80 a. m. 14314: 9:13, 1481/1; 12:30 p. m., 148% closing at the second board at 117%. The buyIng range here was 146@146y-the lower the more usual rate. Silver-Little offering. Buyers pay 173@136. Legal Tender notes unchanged, viz: KOX buying, selling X. Money is still exceedingly close, and rates of discount V ery firm at 10@15 per cent. AT MILWAUKEE.-The Sentinel of yesterday says We have still to report a very stringent money market here, 80 much 80 as 10 materially restrict business. Nobody expects this scarcity of money to be anything more than of brief duration. BANK ITEMS-The Bank of the Metropolis, of Boston, has gcne into liquidation. and a "Bank of Metropolis, or S. A. Way's Bank, as per public notice, succeeds. - The City Bank of Columbus, Ohio, by order of the Court, is winding up Its affairs. The outstanding notes of the Bank must be presented for redemption previous to the 1st of June, 1551, to the Franklin Bank, or Columbus, Ohio. W.A. Platt has been appointed Receiver. There are nearly 5,000 different accounts in the Townsend Savings Bank at New Haven with children, all in sums of $5.00 or less. -Mesers. J. E. Turcotte, Hector Langevin and G. DeBoucherville were chosen Directors for the Credit Foncier Bank, St. Hyacinthe, Canada. branch of the Commercial Bank of India, which has branches at London, Calcutta, Foochow, Hong Kong, Hankow, and Shanghae, has been established in San Francisco, under the supervision of Richard Newby, Esq. The leading objects of this agency, for the present, are. the sale of exchange, and the purchase of bullion for Oriental markets; with an ultoflor view to the greater facilitation of commercial Intercourse with Asiatic ports. - M. Emile Periere, a noted Parislan financier, has purchased the Bank of Savoy, which has a. right to Issue circulating notes. This has greatly alarmed the Bank of France, which has the sole right in Its own country of issuing such notes. The Bank of Savoy is to have on Increase of capital, and will shortly come in confict with the Bank of France. COUNTERFEITS.-The following Is a Hat of new counterfeits and altered bank notes detected in circulation during the week ending Nov. 27, 1863: Union Bank, Boston, Mass.-3. Vig., two females and spread cagle; portrait each end. Adams Bank, North Adams, Mass.-53, imitation. The letters of the name of the bank are smaller than in the true bill. On the right end of the genuine note Ien train of cars passing a bluff: in the counterfelt the train is on an embankment with a tree to the left of the track in front of the engine. Cristol Co. Bank, Taunton. Mass.-5s altered from 1s. Vig., view of Taunton Green; on right end 5, female below. Bucksport Bank, Bucksport, Me.-10s, altered. Vig., men cheering, cars; Indian on left. Cocheco Bank, Dover, N. 11.-109, imitation. Valcan, care, building, &c. Home Bank, West Meridian, Conn.-10s, altered. Vig., three females: lower right, bust of female with -bcar of grain, 10 above; left end, full length female neure. Bank of Rutland, Vt.-3, counterfeit. Vig., drove of cattle fording a Stream of water, farm house in the distance; portrait of Washington In lower left: two females, one with sickle and sheaf of grain, in lower right corner. Fermers' Bank of the City of Troy, Troy, N. Y.-3d. Vig., farmer on horseback, drove of sheep, &c. Perrin Bank, Rochester, N. Y.-53. Vig., a train of cars; on right end 5, die. FIVE; on left end 5, male portrait. In the gennine cars run to right. International Bank, Buffalo, N. T.-3d, altered. Vig., cagle and shield, female each side, &e.; Webster on left end. Mechanics' Bank, Baltimore, Md.-3s. Vig., marine view: right end THREE, eagle, 8; left end 3, eagle, THREE. Citizens' Bank, Baltimore, Md.-2s spurious. Vig., head of Washington in a frame, eagle on right end. Billa are afloat in the southern part of the State purporting to be issued by the "Hartford Exchange Bank" in Indiana. These is no such bank.