Article Text

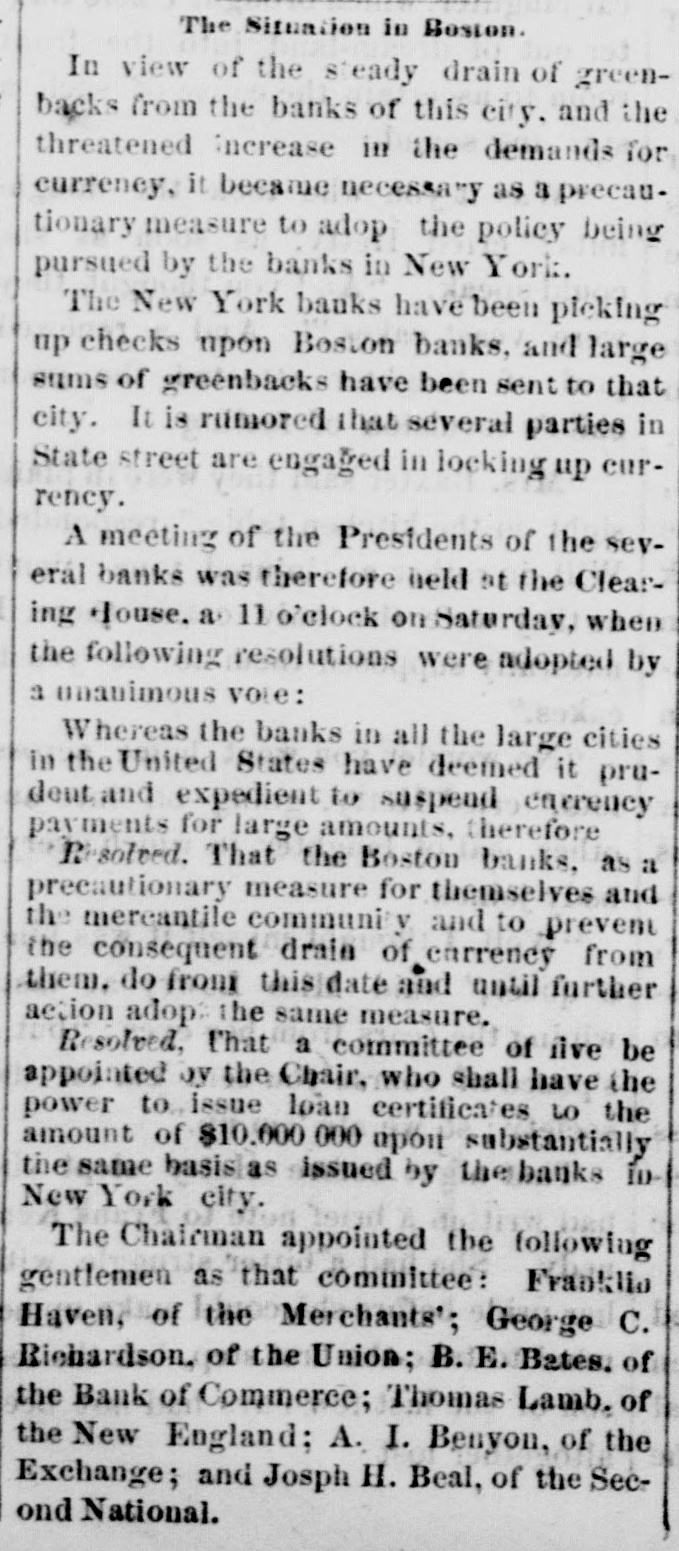

The Situation in Boston. In view of the steady drain of greenbacks from the banks of this city. and the threatened increase in the demands for currency, it became necessary as a precautionary measure to adop the policy being pursued by the banks in New York. The New York banks have been picking up checks upon Boston banks, and large sums of greenbacks have been sent to that city. It is rimored that séveral parties in State street are engaged in locking up currency. A meeting of the Presidents of the several banks was therefore held at the Clearing House. a 11 o'clock on Saturday, when the following resolutions were adopted by a unanimous vote: Whereas the banks in all the large cities in the United States have deemed it prudeut and expedient to suspend entrency payments for large amounts, therefore Resolved. That the Boston banks, as a precautionary measure for themselves and the mercantile community and to prevent the consequent drain of currency from them. do front this date and until further action adop: the same measure. Resolved, l'hat a committee of five be appointed oy the Chair, who shall have the power to issue loan certificates to the amount of $10.000 000 upon substantially the same basis as issued by the banks inNew York city. The Chairman appointed the following gentlement as that committee: Franklia Haven, of the Merchants'; George C. Richardson. of the Union; B. E. Bates. of the Bank of Commerce; Thomas Lamb. of the New England; A. I. Benyon, of the Exchange; and Josph H. Beal, of the Second National.