Article Text

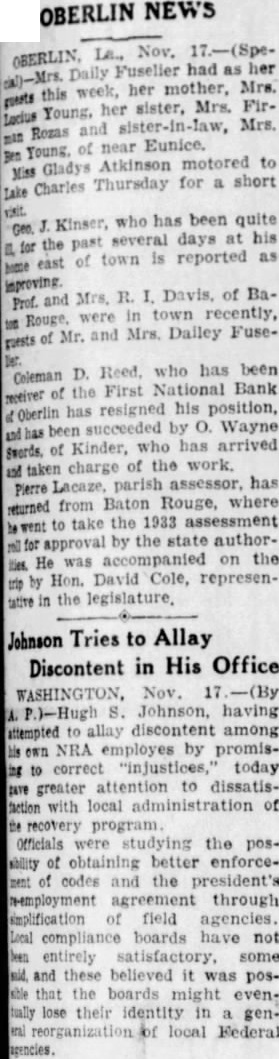

OBERLIN NEWS Nov. had as her Daily mother, Mrs. this her Mrs. FirMrs. and of Ben motored to Gladys Miss short Charles Lake been quite several days at his the reported as of improving. of BaProf. were town Mrs. Dailey of D. been Coleman First National Bank receiver of the his succeeded by O. Wayne arrived of of work. of taken assessor, has from Baton Rouge, where returned to take the 1933 assessment by the state authoraccompanied on the He was Hon. David Cole, represen- Johnson Tries to Allay Discontent in His Office WASHINGTON, Nov. 17 P.)-Hugh Johnson, having attempted allay discontent among NRA employes by promisto correct today greater attention to dissatisfaction with local administration of recovery program. Officials were the posability of obtaining better enforcecodes the president's of field agencies. Local compliance boards not entirely satisfactory, some and these believed was posthat the boards might evenlose their identity in genlocal Federal agencies.