Article Text

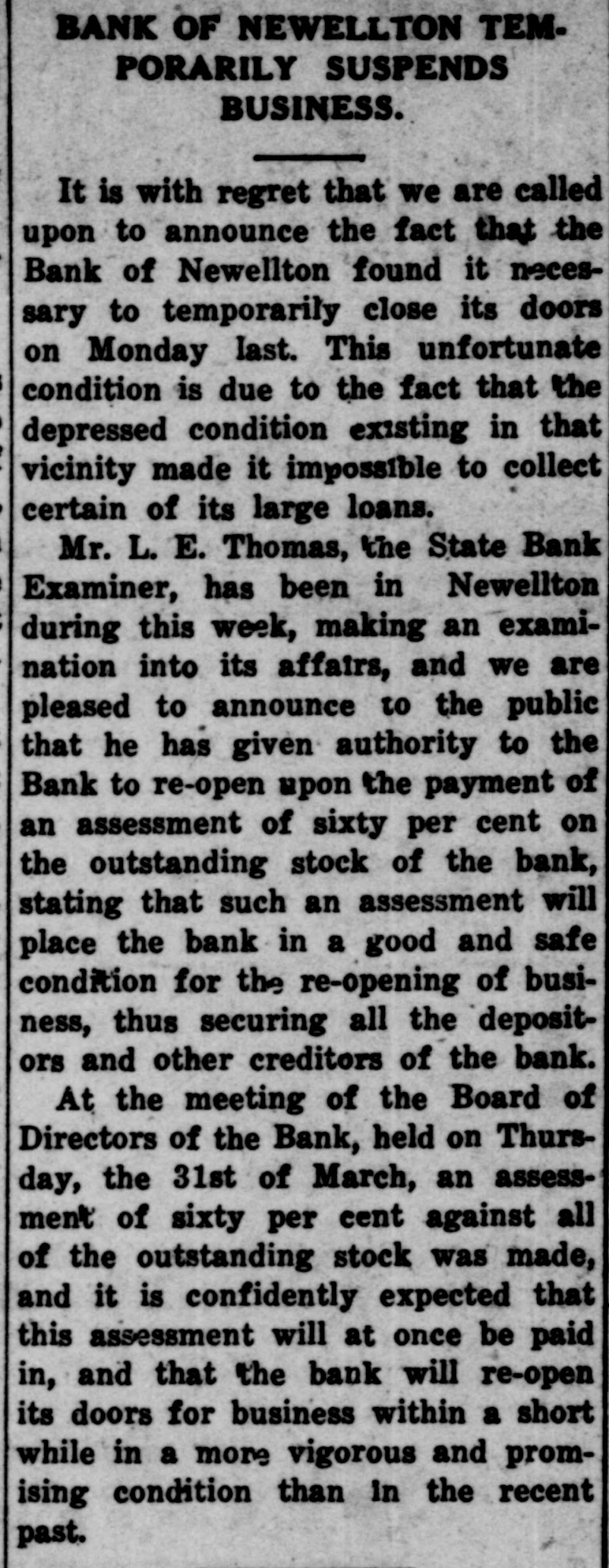

BANK OF NEWELLTON TEMPORARILY SUSPENDS BUSINESS. It is with regret that we are called upon to announce the fact that the Bank of Newellton found it necessary to temporarily close its doors on Monday last. This unfortunate condition is due to the fact that the depressed condition existing in that vicinity made it impossible to collect certain of its large loans. Mr. L. E. Thomas, the State Bank Examiner, has been in Newellton during this week, making an examination into its affairs, and we are pleased to announce to the public that he has given authority to the Bank to re-open upon the payment of an assessment of sixty per cent on the outstanding stock of the bank, stating that such an assessment will place the bank in a good and safe condition for the re-opening of business, thus securing all the depositors and other creditors of the bank. At the meeting of the Board of Directors of the Bank, held on Thursday, the 31st of March, an assessment of sixty per cent against all of the outstanding stock was made, and it is confidently expected that this assessment will at once be paid in, and that the bank will re-open its doors for business within a short while in a more vigorous and promising condition than in the recent past.