Article Text

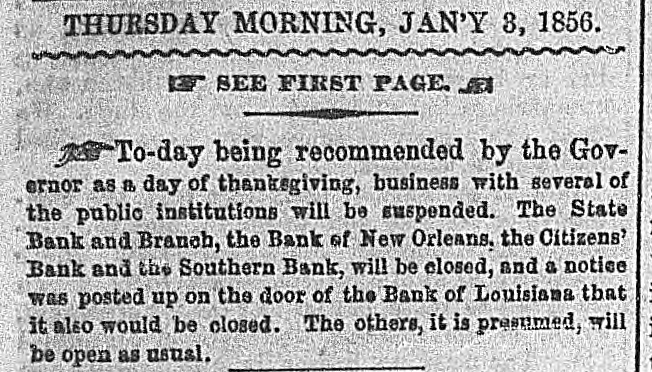

THURSDAY MORNING, JAN'Y 3, 1856. SEE FIRST PAGE. To-day being recommended by the Governor as B day of thanksgiving, business with several of the public institutions will be suspended. The State Bank and Branch, the Bank of New Orleans, the Citizens' Bank and the Southern Bank, will be closed, and & notice was posted up on the door of the Bank of Louisiana that it also would be closed. The others, it is presumed, will be open as usual. i 1