Article Text

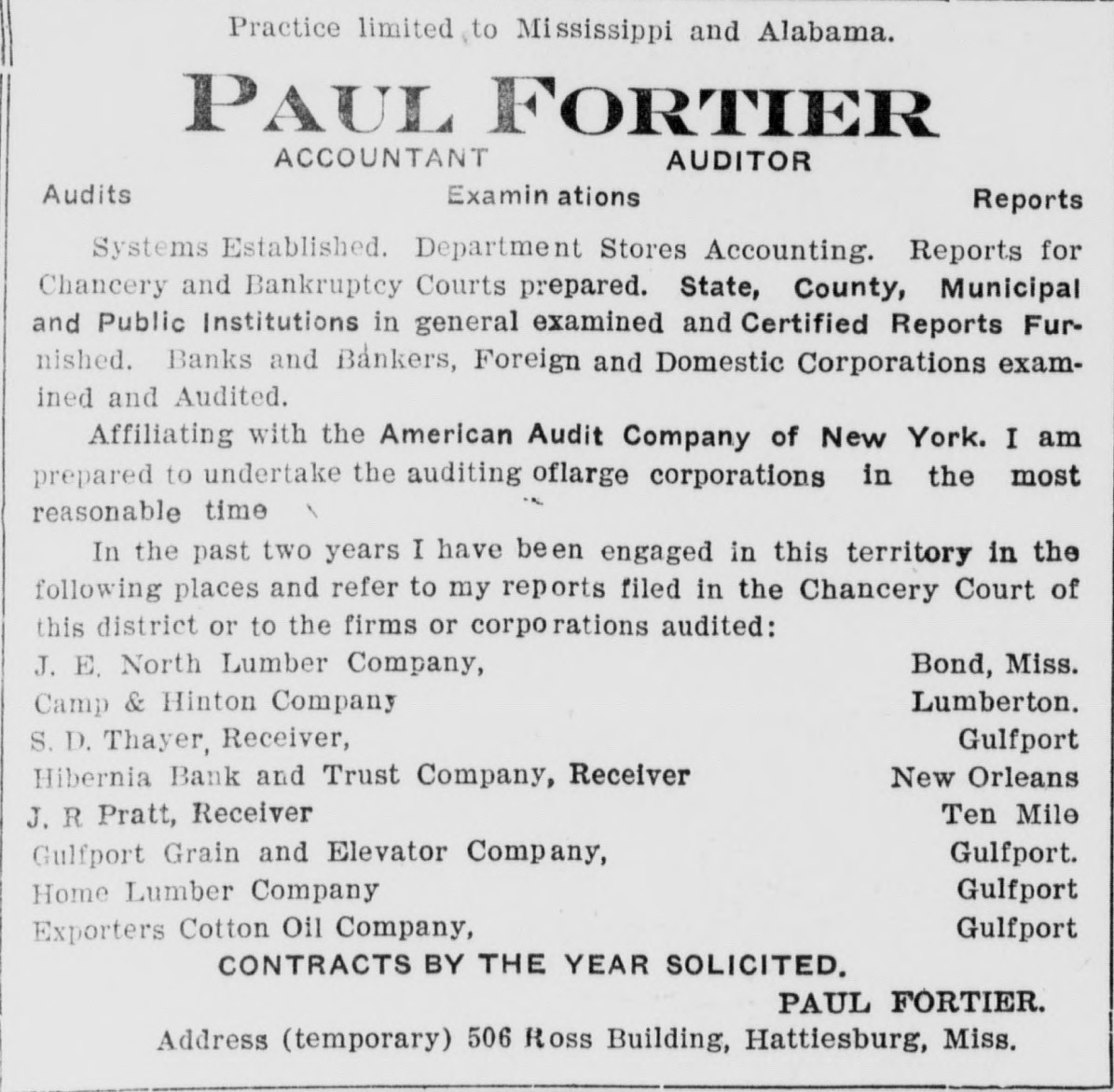

Practice limited to Mississippi and Alabama. # PAUL FORTIER ACCOUNTANT AUDITOR Audits Examinations Reports Systems Established. Department Stores Accounting. Reports for Chancery and Bankruptcy Courts prepared. State, County, Municipal and Public Institutions in general examined and Certified Reports Furnished. Banks and Bankers, Foreign and Domestic Corporations examined and Audited. Affiliating with the American Audit Company of New York. I am prepared to undertake the auditing of large corporations in the most reasonable time In the past two years I have been engaged in this territory in the following places and refer to my reports filed in the Chancery Court of this district or to the firms or corporations audited: J. E. North Lumber Company, Bond, Miss. Camp & Hinton Company Lumberton. S. D. Thayer, Receiver, Gulfport Hibernia Bank and Trust Company, Receiver New Orleans J. R Pratt, Receiver Ten Mile Gulfport Grain and Elevator Company, Gulfport. Home Lumber Company Gulfport Exporters Cotton Oil Company, Gulfport CONTRACTS BY THE YEAR SOLICITED. PAUL FORTIER. Address (temporary) 506 Ross Building, Hattiesburg, Miss.