Click image to open full size in new tab

Article Text

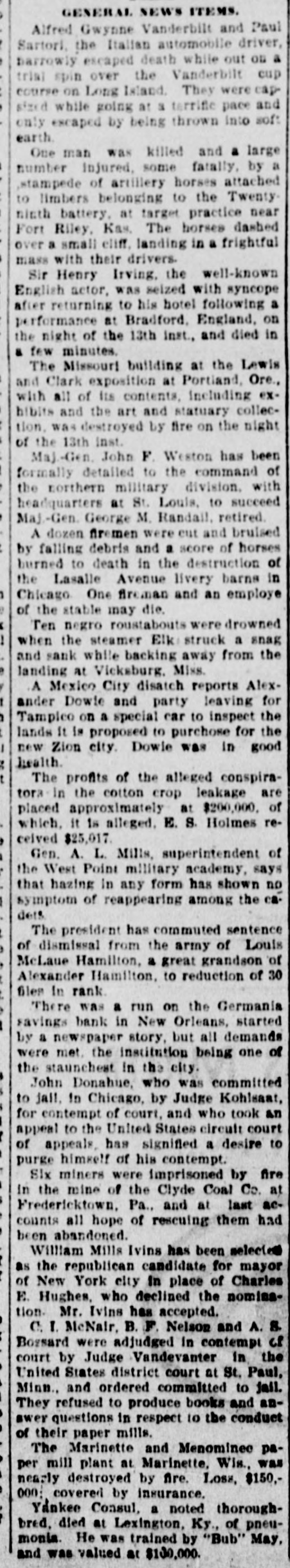

# GENERAL NEWS ITEMS.

Alfred Gwynne Vanderbilt and Paul Sartori, the Italian automobile driver, barrowly escaped death while out on a trial spin over the Vanderbilt cup course on Long Island. They were capsized while going at a terrific pace and only escaped by being thrown into soft earth.

One man was killed and a large number injured, some fatally, by a stampede of artillery horses attached to limbers belonging to the Twenty-ninth battery, at target practice near Fort Riley, Kas. The horses dashed over a small cliff, landing in a frightful mass with their drivers.

Sir Henry Irving, the well-known English actor, was seized with syncope after returning to his hotel following a performance at Bradford, England, on the night of the 13th inst., and died in a few minutes.

The Missouri building at the Lewis and Clark exposition at Portiand, Ore., with all of its contents, including exhibits and the art and statuary collection, was destroyed by fire on the night of the 13th inst.

Maj. Gen. John F. Weston has been formally detailed to the command of the northern military division, with headquarters at St. Louis, to succeed Maj-Gen. George M. Randail, retired.

A dozen firemen were cut and bruised by falling debris and a score of horses burned to death in the destruction of the Lasalle Avenue livery barns in Chicago. One fireman and an employe of the stable may die.

Ten negro roustabouts were drowned when the steamer Elk struck a snag and sank while backing away from the landing at Vicksburg. Miss.

A Mexico City disatch reports Alexander Dowie and party leaving for Tampico on a special car to inspect the lands it is proposed to purchose for the new Zion city. Dowie was in good health.

The profits of the alleged conspirators in the cotton crop leakage are placed approximately at $200,000, of which, it is alleged, E. S. Holmes received $25,017.

Gen. A. L. Mills, superintendent of the West Point military academy, says that hazing in any form has shown no symptom of reappearing among the cadets

The president has commuted sentence of dismissal from the army of Louis McLaue Hamilton, a great grandson of Alexander Hamilton, to reduction of 30 files in rank.

There was a run on the Germania savings bank in New Orleans, started by a newspaper story, but all demands were met, the institution being one of the staunchest in the city.

John Donahue, who was committed to jall, in Chicago, by Judge Kohlsaat, for contempt of court, and who took an appeal to the United States circuit court of appeals, has signified a desire to purge himself of his contempt.

Six miners were imprisoned by fire in the mine of the Clyde Coal Co. at Fredericktown, Pa., and at last accounts all hope of rescuing them had been abandoned.

William Mills Ivins has been selected as the republican candidate for mayor of New York elty in place of Charles E. Hughes, who declined the nomination. Mr. Ivins has accepted.

C. I. McNair, B. F. Nelson and A. 8. Bossard were adjudged in contempt of court by Judge Vandevanter in the United States district court at St. Paul, Minn., and ordered committed to jail. They refused to produce books and answer questions in respect to the conduct of their paper mills.

The Marinette and Menominee paper mill plant at Marinette, Wis., was nearly destroyed by fire. Loss, $150,000 covered by insurance.

Yankee Consul, a noted thoroughbred, died at Lexington, Ky., of pneumonia. He was trained by "Bub" May, and was valued at $100,000.