Article Text

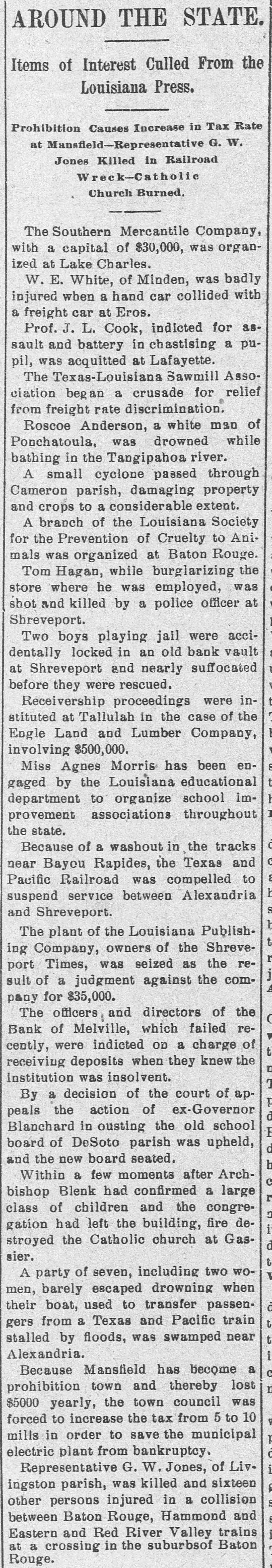

AROUND THE STATE. Items of Interest Culled From the Louisiana Press. Prohibition Causes Increase in Tax Rate at Mansfield-Representative G. W. Jones Killed in Railroad Wreck-Catholic Church Burned, The Southern Mercantile Company, with a capital of $30,000, was organized at Lake Charles. W. E. White, of Minden, was badly injured when a hand car collided with a freight car at Eros. Prof. J. L. Cook, indicted for assault and battery in chastising a pupil, was acquitted at Lafayette. The Texas-Louisiana Sawmill Association began a crusade for relief from freight rate discrimination. Roscoe Anderson, a white man of Ponchatoula, was drowned while bathing in the Tangipahoa river. A small cyclone passed through Cameron parish, damaging property and crops to a considerable extent. A branch of the Louisiana Society for the Prevention of Cruelty to Animals was organized at Baton Rouge. Tom Hagan, while burglarizing the store where he was employed, was shot and killed by a police officer at Shreveport. Two boys playing jail were accidentally locked in an old bank vault at Shreveport and nearly suffocated before they were rescued. Receivership proceedings were instituted at Tallulah in the case of the Engle Land and Lumber Company, involving $500,000. Miss Agnes Morris has been engaged by the Louisiana educational department to organize school improvement associations throughout the state. d Because of a washout in the tracks C near Bayou Rapides, the Texas and a Pacific Railroad was compelled to h suspend service between Alexandria S and Shreveport. The plant of the Louisiana Publishing Company, owners of the Shreveport Times, was seized as the result of a judgment against the company for $35,000. The officers and directors of the ( Bank of Melville, which failed recently, were indicted OD a charge of t receiving deposits when they knew the institution was insolvent. By a decision of the court of appeals the action of ex-Governor d Blanchard in ousting the old school E board of DeSoto parish was upheld, and the new board seated. b Within a few moments after Archbishop Blenk had confirmed a large class of children and the congregation had left the building, fire destroyed the Catholic church at Gassier. A party of seven, including two women, barely escaped drowning when their boat, used to transfer passent gers from a Texas and Pacific train stalled by floods, was swamped near Alexandria. Because Mansfield has become a c prohibition town and thereby lost $5000 yearly, the town council was forced to increase the tax from 5 to 10 mills in order to save the municipal electric plant from bankruptcy. Representative G. W. Jones, of Livingston parish, was killed and sixteen other persons injured in a collision between Baton Rouge, Hammond and Eastern and Red River Valley trains at a crossing in the suburbsof Baton Rouge.