Article Text

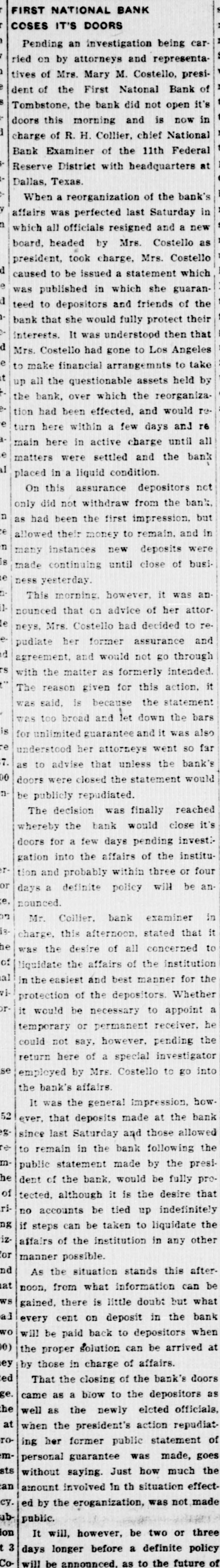

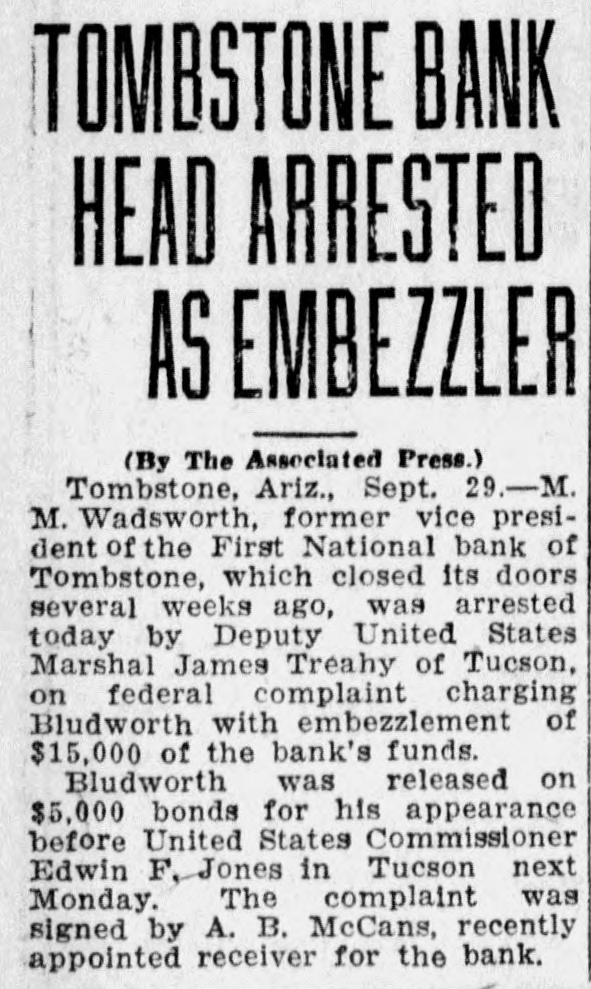

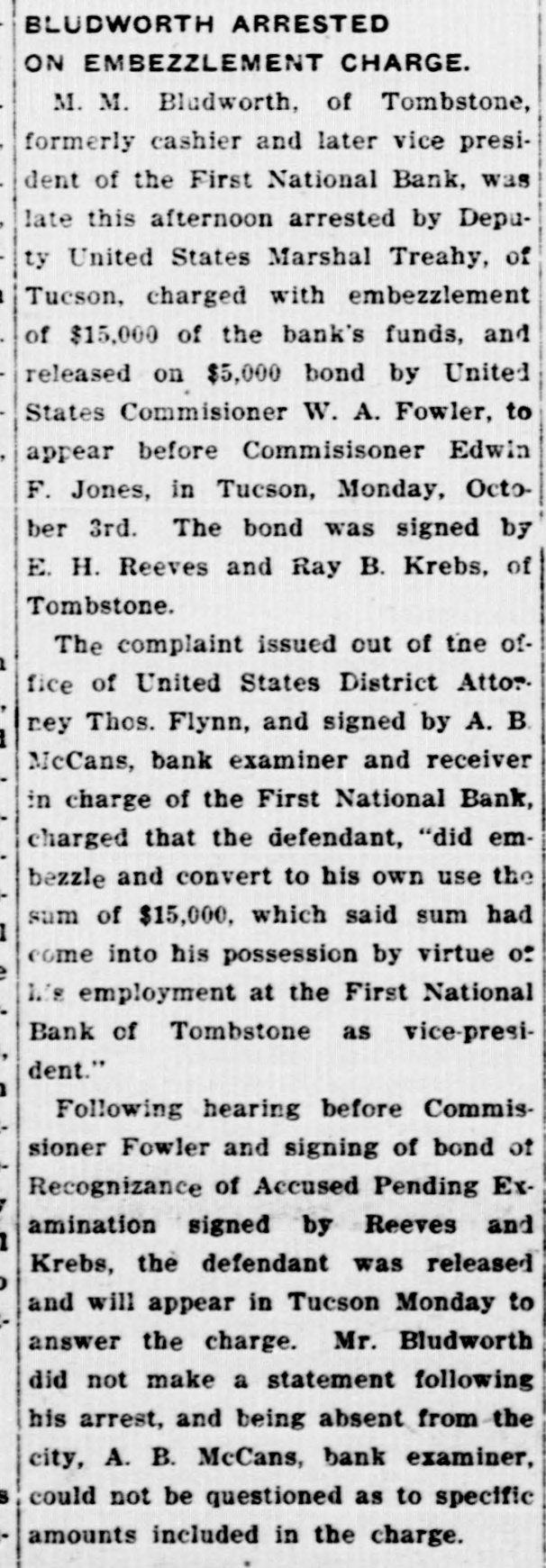

FIRST NATIONAL BANK COSES IT'S DOORS Pending an investigation being carried on by attorneys and representatives of Mrs. Mary M. Costello, president of the First Natonal Bank of Tombstone, the bank did not open it's doors this morning and is now in charge of R. H. Collier, chief National Bank Examiner of the 11th Federal Reserve District with headquarters at Dallas, Texas. When a reorganization of the bank's affairs was perfected last Saturday in which all officials resigned and a new board, headed by Mrs. Costello as president, took charge. Mrs. Costello d caused to be issued a statement which e was published in which she guarand teed to depositors and friends of the bank that she would fully protect their interests. It was understood then that d Mrs. Costello had gone to Los Angeles e to make financial arrangemnts to take t up all the questionable assets held by the bank, over which the reorganization had been effected, and would ree turn here within a few days and r6 main here in active charge until all e matters were settled and the bank il placed in a liquid condition. On this assurance depositors not only did not withdraw from the bank n as had been the first impression, but e allowed their money to remain. and in n many instances new deposits were 8 made continuing until close of busie ness yesterday 0 This morning. however, it was an1nounced that on advice of her attorle neys, Mrs. Costello had decided to repudiate her former assurance and d agreement, and would not go through rs with the matter as formerly intended. The reason given for this action. it was said, is because the statement was too broad and let down the bars is for unlimited guarantee and it was also re understood her attorneys went SO far 7. as to advise that unless the bank's 00 doors were closed the statement would nbe publicly repudiated. The decision was finally reached whereby the bank would close it's doors for a few days pending invest: gation into the affairs of the instituand probably within three or four or tion will be andays a definite policy e nounced. on Mr. Collier. bank examiner in 3. charge, this afternoon. stated that it he was the desire of all concerned to of liquidate the affairs of the institution al in the easiest and best manner for the viprotection of the depositors. Whether or a it would be necessary to appoint temporary or permanent receiver, he could not say, however, pending the se return here of a special investigator into employed by Mrs. Costello to go the bank's affairs. It was the general impression, how 52 ever, that deposits made at the bank g since last Saturday and those allowed reto remain in the bank following the m public statement made by the presihe dent of the bank. would be fully proof tected, although it is the desire that rino accounts be tied up indefinitely pg if steps can be taken to liquidate the izaffairs of the institution in any other for manner possible. nd As the situation stands this afterat noon, from what information can be ws gained, there is little doubt but what al every cent on deposit in the bank wo will be paid back to depositors when 0) the proper solution can be arrived at ey by those in charge of affairs. ed That the closing of the bank's doors ge. came as a blow to the depositors as the well as the newly eleted officials, at when the president's action repudiatro ing her former public statement of mpersonal guarantee was made, goes sts without saying. Just how much the an amount involved in th situation effectcy. ed by the eroganization, was not made ubpublic. ion It will, however, be two or three 3 days longer before a definite policy Cowill be announced. as to the future of