Article Text

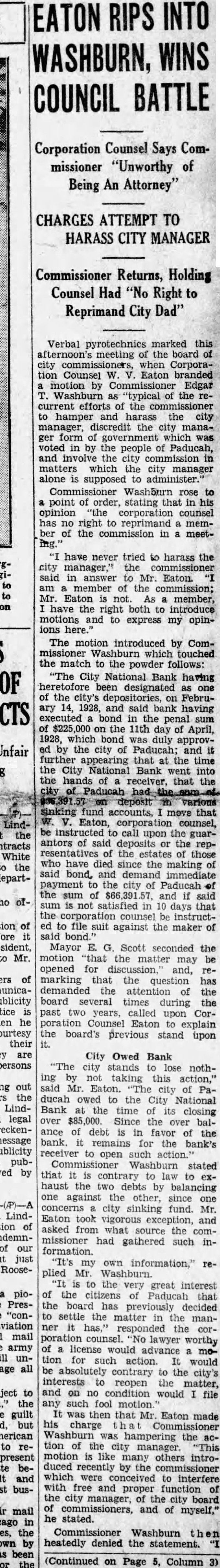

WASHBURN, WINS COUNCIL BATTLE Corporation Counsel Says Commissioner "Unworthy of Being An Attorney" CHARGES ATTEMPT TO HARASS CITY MANAGER Commissioner Returns, Holding Counsel Had Right Reprimand City Verbal pyrotechnics marked this afternoon's meeting of the board city when Corporation Counsel Eaton branded motion Commissioner Edgar the efforts of the hamper and the city manager, discredit the city manager form government voted by the people of Paducah, and the city which the city manager alone supposed Commissioner Washburn point of order, stating that in his opinion corporation counsel no right to reprimand member of the commission in meet- have never tried to harass the city manager," the said in answer Mr. Eaton am member the commission; Eaton member, have the right both to introduce motions and to express my opinions The motion introduced by Commissioner Washburn which touched the match to the powder follows: City National Bank having of the city's February 1928, and said bank having bond the the 11th day of April, 1928, which bond duly approvby the city Paducah: and further appearing that the time the City National Bank went into the hands receiver, that the various sinking accounts, that Eaton, counsel, be the upon antors of the repof the those who have died since the making said bond, and demand immediate payment the city of Paducah the sum and not satisfied in that the instructed to file suit against the maker of Mayor E. Scott seconded the motion "that the matter may be opened for and, marking that the question has attention the board several times during the past two years, called upon CorCounsel Eaton to explain the board's previous stand upon City Owed Bank "The stands nothing not taking this action." said Mr. Eaton. city Paducah owed the City National Bank the time closing over $85,000. Since over ance of debt favor of the bank. remains for the bank's open such action.' Commissioner Washburn stated that contrary to law to exhaust the by balancing against other, since one concerns sinking fund. Mr. Eaton took vigorous exception, and asked from what source the missioner had gathered such information. my own information," plied Mr. Washburn. great interest of the citizens Paducah the board previously decided to settle the matter the manner it responded the corporation counsel. lawyer worthy license would advance such action. would be absolutely contrary the interests reopen the matter, and no condition would file such fool then that Eaton made his charge Washburn hampering the tion the "This manager. motion others introduced by the which were interfere with free and proper function of the city manager, of the city board commissioners, and of myself," he stated. Commissioner Washburn heatedly denied the statement. on Page Column